|

| Source: Wikipedia |

A consumer invested P42,000 in 2 education policies. He later defaulted on some premiums because he had resigned from his job to start own business. Given his new situation he decided to cancel the policies and attempted to withdraw the money he'd invested so far.

The surprise was how much was returned to him.

P1,440.

He was told that the reason was “the money was used for admin.”

He commented:

“Morally that is wrong. One would expect they should pay me some interest for the money I invested with them.”This was an example of “front-loading”. Long-term investment products, such as education policies are meant to last for many years, maybe 10 or 20 years. But the agents and brokers selling these products don't want to wait that long to get their commission. If you read the small print you'll see that the admin expenses and commissions are often taken in the first year or two of the policy. It's only after a few years that your money starts to grow.

BUT, do consumers understand this? Did the agent or broker that sold them the policy explain this? Did the insurance company do enough to ensure that their customers understand?

2. Insurance vs investments

There is a lot of confusion about investments and insurance policies.

Investments and savings schemes are about putting money somewhere safe. With luck you might even earn some interest on the money you contribute but remember "front-loading".

Insurance is about transferring risk, or at least the financial cost of risk. Whether it's your vehicle, your house or its contents, your health or your life, an insurance policy will cover the cost of something bad happening.

3. CBN - a pyramid scheme

[A number of people asked us to repeat this warning, so here goes.]

(See also our press release about CBN here.)

“P100 can change your financial situation. CBN is a way to go. Join me today and let me take you through the journey of that financial change. You won't regret taking that decision. Drop your number now. Remember your P100 is a once off.”Apparently you can join for just R100 and recruit 6 people, “You earn R10 per downline” and then get P60. And then so on, through several levels:

- Level 1 Worker

- Level 2 Supervisor

- Level 3 Manager

- Level 4 General Manager (at which you apparently get a laptop worth R4,000, groceries R2,000 and a Marketing allowance of R500.)

- Level 5 Assistant Director (at which you get a Sun City holiday)

- Level 6 Director (now you get a car worth R200,000)

- Level 7 Acting CEO (another car, this time worth R500k)

- Level 8 CEO (yet another car, now worth R1,200,000, a house valued at R2,500,000 along with furniture worth R500,000).

CBN claim that:

“It’s simple to work with us: Recruitment only, no selling products, no products maintaining.”Section 9 of the 2018 Consumer Protection Act defines a pyramid scheme as a scheme:

“where participants in the scheme receive compensation derived primarily from their respective recruitment of other persons as participants”It goes on to warn that:

“A person shall not directly or indirectly promote, or knowingly join, enter or participate, or cause any other person to promote, join, enter or participate in… A pyramid scheme”and that:

“A person who participates in an arrangement, agreement, practice or scheme under subsection 2 commits an offence and shall be liable, upon conviction, to a fine not exceeding P100,000 or to imprisonment for a term not exceeding five years, or to both.”CBN is a blatant pyramid scheme. Please don't risk your money, effort and time. And your liberty.

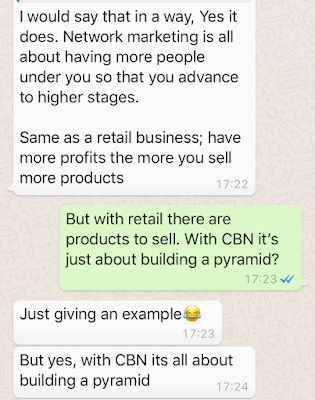

And some more. Some screenshots of conversations with people marketing CBN in Botswana.

4. The broken tablet

“I bought my son a tablet for P399 and its still under warranty. After two weeks my son tells me the screen broke and I decided to check with the store for repairs. They called me after few days and explained that they can help me provided I pay P300 for screen, I then told her that am not happy because the price is worth buying a new one. I am not impressed at all with this because I even pleaded with manager to say they can’t charge me almost the same amount as new tablet and I even offered to at list pay P200.”Section 13 (1) (a) of the Consumer Protection Regulations requires suppliers to offer commodities and services that are "of merchantable quality". It doesn't say they must prevent you or your children from breaking things.

In this case the store hasn't done anything wrong. Your child broke the device and it's your responsibility to either pay for it to be fixed or to buy a new one.

No comments:

Post a Comment