Luckily, a few people were stopped from losing so much by Good Samaritans who intervened. An acquaintance who works for a large financial institution told me that she was approached by several clients who asked to cash in policies and she flatly refused. No, she told them, you can NOT have you money now that you’ve told me what you’re planning to do with it. Strictly speaking she was probably breaking the rules by denying them access to their savings but she had sufficient care for her fellow human beings that she took the risk. Hopefully they now realise how grateful they should be to her.

Some people lost significant amounts investing in the other Ponzi schemes like Felmina Alliance and “Oil of Asia”, clones of Eurextrade. Ironically we even heard of victims of Eurextrade that then jumped to the next scam and lost even more. Some people don’t seen capable of learning form experience.

Many others have lost smaller amounts, but nevertheless have still lost significantly, by joining a variety of pyramid schemes that promised wealth and prosperity but in fact only existed to benefit the founders, the people at the top of the pyramid.

However not all losses are as high. Many of the problems we hear about are of a much smaller value. For instance we received a message recently saying this:

“Can one report someone to small claims if they owe you P150. I sold this guy a second hand wardrobe at P450, he gave me P300. Now he is refusing to pay me because he says the truck damaged it!”This is a dispute over a mere P150. Is it really worth the bother? Isn’t it simpler just to forget about it?

Another recent problem followed a wedding in Mahalapye. A reader hired various items from a wedding organiser and paid a refundable deposit of P300 to cover any damage to the items while she had them. No damage was done and the owner picked them up after the wedding, promising to repay the P300 as soon as possible. That was in March. To date she still doesn’t have her P300 back.

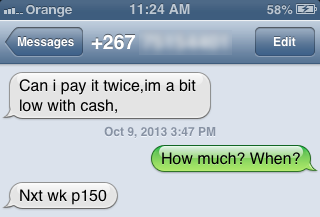

To make this worse, the owner of the company has made endless promises both to the reader and to me that the payment will be made but these appear to have been no more than lies. She’s come up with various excuses including one about being “a bit low with cash”.

Despite this they continue to advertise their services on Facebook, posting comments about other large weddings they’ve organised and even comments from happy customers. Unless they’ve made all of these comments up, then they are clearly still operating and taking money from other customers. I simply don’t believe that they don’t have P300 to repay our reader.

But it’s only P300. Is it really worth the bother? Isn’t it simpler just to forget about it?

We heard from another reader who entered into an informal saving scheme last year. Ten women all apparently contributed P1,000 per month for several months to one who held the money on their behalf. Some of them have now taken out their contributions but one apparently has not. Despite asking repeatedly she tells me that she’s not received a single thebe back. This is made more awkward because she now lives overseas and even worse, none of this was put in writing. No contract, no receipts and no records of anything at all.

I’ve had various conversations with the woman holding the money and she’s being remarkably evasive. Her last comment to me was that she’s talking to her lawyer because she thinks I’m going to name her, despite never threatening to do this. Meanwhile she’s ignoring the debt she owes this woman. Maybe I SHOULD name her.

But it’s only P9,000 to a woman who can afford to save P1,000 a month and who can afford to live in the UK. Is it really worth the bother? Isn’t it simpler just to forget about it?

No, as I’m sure you agree, it’s not simpler to forget about it. There’s a principle at stake. People should honour their obligations. If necessary they should be MADE to honour them. Just because it’s not as much as “two houses and a Range Rover” that doesn’t make it acceptable.

Luckily we have the Small Claims Court now that covers the smaller end of the market, covers the problems that most of us face. If you have a dispute valued up to P15,000 they can intervene on your behalf, No lawyers so no legal bills, no suspicious legal insurance schemes, just you and your story along with any evidence you have and they’ll step in and give you some rapid justice.

However the Small Claims Court is only useful if people use it. Only if people take the time and make the effort to go there will it be as useful as it can be. Only if we take the time to go there over issues that some might think are trivial will it be really useful.

Who knows, if we don’t stop these crooks from stealing P150 or P300, sooner or later they’ll graduate to the P9,000 level scams. Later they might even be running a multi-million Pula scam like Eurextrade. Let’s stop them now while we have the chance.