There’s a saying in the legal world: “Justice delayed is justice denied”. The idea behind it is that the execution of justice should be done as swiftly as decently possible. But how swiftly is that?

Unlike a depressingly significant proportion of our community, I think justice shouldn’t be done too swiftly. Instead it should be done at a measured, perhaps even sedate pace. It certainly shouldn’t be done by a rampaging mob, thirsty for blood. Even when the guilt of someone seems beyond doubt, when pictures of an alleged murdering rapist, standing in a pool of blood, are published on Facebook, the legal process must be followed. Mob justice is no form of justice at all. One thing that separates us from other animals is that we restrain ourselves and allow the authorities to act on our behalf.

But how fast should justice proceed? There obviously isn’t a standard answer. Unlike science, which relies on rules, theories and scientific “laws”, our judicial system welcomes anecdotal evidence. Every case before the courts must be treated differently, because every case is different. Even the most serious crimes vary. Not every murder is the same, nor every rape, assault, theft or even speeding. The details vary and therefore the penalties vary. Of course some crimes, like murder and rape, rightly attract the most severe punishments and minor crimes are treated more leniently but every case is slightly different from the others.

It’s not just in the legal world where justice should be swiftly executed. Even in customer service, speed can be critical.

A few weeks ago we heard from a reader who had suffered, and who continues to suffer, from delayed justice.

This reader is a customer of Bank A, a major bank in Botswana. For whatever reason he wasn’t near an ATM belonging to Bank A so was forced to use an ATM belonging to Bank B. So far, so good. Until he tried to withdraw some money. That’s when Bank B’s ATM decided to go wrong and not actually give him his money despite sending a signal to Bank A that the money had been withdrawn. His money had disappeared.

Any reader who works in a bank will confirm that this happens occasionally. Not often, but it does still happen and the banks have a procedure to follow in these cases. They need to check their records that show whether he did really stick his card into the slot and how much money he asked for and then, most importantly, whether the amount he requested appears still to be in the machine. Once they total up all the withdrawals for the day, they should be able to tell whether his disputed amount is still there or not. They can even check the CCTV recording to confirm whether any cash was dispensed.

So it SHOULD have been fixed fairly quickly, don’t you think, particularly when he complained to his bank that the money he tried to withdraw, P2,000, was his month’s salary and he needed to pay his rent that day? You’d think they would have acted swiftly? Even though it wasn’t actually Bank A’s fault, you’d think they would show some care for their customer?

No, not even a hint. Since this disaster, which occurred over three weeks ago, he’s had virtually no help from his bank. When we got involved they started to make the right noises but that hasn’t changed his situation. He still doesn’t have last month’s wages. And the rent he owed his landlord? He couldn’t pay it and his landlord evicted him. He’s now poor and homeless, all because his bank couldn’t get their act together. The solution would have been simple. Once they’d checked with Bank B that he wasn’t lying, and that shouldn’t have taken too long, they could have given him an emergency overdraft. Bank B could have paid the costs. Maybe even the reader would have been prepared to pay the cost himself given how desperate he was?

But none of that is the key issue. Bank A’s customer has been financially ruined and if they really cared about him the bank would have done something to help him. But they didn’t.

Let’s be brutally frank, it’s probably because he wasn’t a “high value” customer. The bank didn’t see him as a prestige customer, someone worth fussing over. The sad thing is that the customers who get the worst service in these situations are the ones who can least afford to get treated so badly. The sort of customer who can survive for a few weeks without P2,000 is likely to be treated like royalty when problems occur. The irony for the bank is that almost all of their high-value customers were once not high-value customers. The politicians, CEOs and business leaders of today were once the sort of customers who needed their wages to pay their rent that month. The reader they’ve just abused might one day be the sort of customer they need to suck up to. And how is he likely to react when Bank A tries sucking up to him?

Organisations like banks, but also insurance companies, supermarkets, furniture stores, power and water suppliers often forget that for most of us, the ordinary customers whose money is important, can’t afford to hang around and wait for a solution. We need it now or at least very soon and if the supplier delays us we suffer. Some of us might even end up homeless as a result.

I’m a big believer in companies having strict procedures but an organisation that cared for it’s customers would have the right procedures for fixing problems but would also recognise that sometimes those procedures have to be fast-tracked. Maybe the rules even have to be bent, not broken, just bent a little to help a customer avoid ending up homeless.

Like justice, service delayed is service denied.

Consumer Watchdog is a (fiercely) independent consumer rights and advocacy organisation campaigning on behalf of the consumers of Botswana, helping them to know their rights and to stand up against abuse. Contact us at consumerwatchdog@bes.bw or find us on Facebook by searching for Consumer Watchdog Botswana. Everything we do for the consumers of Botswana has always been and always will be entirely free.

Saturday, 22 December 2012

The Voice - Consumer's Voice

Dear Consumer’s Voice #1

Hope you will be able to help me with this one. In May 2012 we engaged a supplier based at the LEA factory shells in Gaborone to fix our sofas. We made a down payment of P3,600 upfront (cost being P5,600) and selected the material we preferred and expected the sofas to be delivered within 10 days.

He bought wrong materials which we did not accept and since then when we approach him about our sofas he tells us he does not have enough money to buy our materials and yet his business is still in operation? What is this, and what’s your advice on this? It’s been seven months without our sofas!

It sounds to me like you’ve been very patient but it’s now time to end your patience. I suggest that you write the guy a letter expressing your dissatisfaction and give him 7 days to resolve the situation. Make it clear that you hold him responsible for buying the wrong materials and that you expect him to either refund you all of the money you’ve paid him, or you expect your fully repaired sofa back.

Make it perfectly clear in your letter that if he fails to respond suitably you’ll be seeking an order from the Small Claims Court against him. Make sure he understands that you mean it!

Let me know how he responds.

Meanwhile, send me his cellphone number!

Dear Consumer’s Voice #2

I want to know how to lodge a complaint at consumer watchdog and if I have to pay for the services?

I approached a hair salon on the 21st September this year and I met a guy who promised to reconnect my dreadlocks. I was to attend a wedding on the 30th September but on the 21st he told me that my hair was too short to be reconnected and that I should wait for the hair to grow.

Since I was going for a wedding he said he will tint the hair and asked me to come the following day but when I came he was not there. When I called he told me that he is busy and set another appointment but he never came. I went for the wedding after that I came to him again he twisted my hair and on that he took the money and said he is going to finish the work on that day.

When we were about to join the hair he said my hair is too soft and I should go and wait for some days. I did that but after that he called me for twisting and when I arrived he told me he is held up somewhere. I waited and he never showed up and I asked for refund and he said he will refund on the 31st November and he never did that.

Firstly let me make this clear. Everything Consumer Watchdog does for individual consumers is, has always been, and always will be, entirely free.

You’re another person who’s been patient enough. It’s time to get demanding. Your demand should be for a full refund. Write him a letter explaining that he’s failed to honor the contract between the two of you and that he’s breached Section 15 (1) (a) of the Consumer Protection Regulations by not offering a service with “reasonable care and skill”.

Make it clear that you’ll be seeking an order from the Small Claims Court for a full refund.

Meanwhile, send me his cellphone number!

Celebrations

A reader got in touch to celebrate Antoinette at Choppies Fairgrounds for being cheerful and helpful. Another reader celebrated Pearl at Water Utilities for actually being helpful and explaining something clearly.

I’m not the only person who wants to celebrate NBFIRA, the Non-Bank Financial Institutions Regulatory Authority, for issuing a public notice to alert consumers about “high yield” investment schemes like EurexTrade which we should all know by now is a Ponzi scheme. Good for them!

Keep the celebrations coming in!

Hope you will be able to help me with this one. In May 2012 we engaged a supplier based at the LEA factory shells in Gaborone to fix our sofas. We made a down payment of P3,600 upfront (cost being P5,600) and selected the material we preferred and expected the sofas to be delivered within 10 days.

He bought wrong materials which we did not accept and since then when we approach him about our sofas he tells us he does not have enough money to buy our materials and yet his business is still in operation? What is this, and what’s your advice on this? It’s been seven months without our sofas!

It sounds to me like you’ve been very patient but it’s now time to end your patience. I suggest that you write the guy a letter expressing your dissatisfaction and give him 7 days to resolve the situation. Make it clear that you hold him responsible for buying the wrong materials and that you expect him to either refund you all of the money you’ve paid him, or you expect your fully repaired sofa back.

Make it perfectly clear in your letter that if he fails to respond suitably you’ll be seeking an order from the Small Claims Court against him. Make sure he understands that you mean it!

Let me know how he responds.

Meanwhile, send me his cellphone number!

Dear Consumer’s Voice #2

I want to know how to lodge a complaint at consumer watchdog and if I have to pay for the services?

I approached a hair salon on the 21st September this year and I met a guy who promised to reconnect my dreadlocks. I was to attend a wedding on the 30th September but on the 21st he told me that my hair was too short to be reconnected and that I should wait for the hair to grow.

Since I was going for a wedding he said he will tint the hair and asked me to come the following day but when I came he was not there. When I called he told me that he is busy and set another appointment but he never came. I went for the wedding after that I came to him again he twisted my hair and on that he took the money and said he is going to finish the work on that day.

When we were about to join the hair he said my hair is too soft and I should go and wait for some days. I did that but after that he called me for twisting and when I arrived he told me he is held up somewhere. I waited and he never showed up and I asked for refund and he said he will refund on the 31st November and he never did that.

Firstly let me make this clear. Everything Consumer Watchdog does for individual consumers is, has always been, and always will be, entirely free.

You’re another person who’s been patient enough. It’s time to get demanding. Your demand should be for a full refund. Write him a letter explaining that he’s failed to honor the contract between the two of you and that he’s breached Section 15 (1) (a) of the Consumer Protection Regulations by not offering a service with “reasonable care and skill”.

Make it clear that you’ll be seeking an order from the Small Claims Court for a full refund.

Meanwhile, send me his cellphone number!

Celebrations

A reader got in touch to celebrate Antoinette at Choppies Fairgrounds for being cheerful and helpful. Another reader celebrated Pearl at Water Utilities for actually being helpful and explaining something clearly.

I’m not the only person who wants to celebrate NBFIRA, the Non-Bank Financial Institutions Regulatory Authority, for issuing a public notice to alert consumers about “high yield” investment schemes like EurexTrade which we should all know by now is a Ponzi scheme. Good for them!

Keep the celebrations coming in!

Saturday, 15 December 2012

Core business

I have a theory that the success of every business can be reduced to a single key measurement. For every organisation there should be, if my theory is correct, one way of telling whether they are a success or not.

The first one I ever thought of was about bars. I was a regular at a particular bar in Gaborone that was renowned for being a bit of a disgrace. They occasionally allowed some of their thirstier patrons to get out of control, the décor was shockingly bad and the service was often slow. However they always, without fail, got one thing right. The beer was always cold. That’s why we regulars were there al the time.

If a bar can’t do that, then surely nothing else can work properly. Serving cold beer is the fundamental purpose of a bar and if they can’t get that right then it’s not a functional bar.

The challenge of my theory is to find the core measurement in other organisations. What’s the ONE thing that judges whether your company is functional?

A few years ago we heard from a reader who had visited one of the major spicy chicken outlets in Gaborone. She’d gone there hungry for spicy chicken, one of those cravings we all sometimes get. But she was to be disappointed. The spicy chicken joint had no chicken. That presumably is a textbook case of a failed organisation. I know they probably had a delivery of chicken, their core product, shortly afterwards but I don’t think that’s a forgivable offence.

It’s probably easier in a conventional restaurant. Spicy chicken outlets serve, despite minor variations, just one product. Restaurants usually have a broad menu with a vast range of choices. It’s more acceptable to be told in a restaurant that they have no chicken today because you can always choose beef, fish or pork. There are alternatives.

What a restaurant has to do, the ONE thing they have to focus on cooking food hygienically. Anyone who’s watched the Ramsay’s Kitchen Nightmares series on DSTV will know that this is not always the case. The scariest thing is that the horrors you see in that program are in restaurant kitchens when they new a premier chef was about to turn up with a film crew and show his program all over the world. If they couldn’t clean up the kitchen and get rid of the vermin and hygiene crimes then what’s it like in non-televised restaurants like ours?

The ONE thing that measures the success in a restaurant is the delivery of food that pleases the customers. Friendliness, courtesy, décor, location and atmosphere are all important but not as important as that one basic objective. It’s why a chain like Wimpy does well. Their food isn’t the most advanced, the most delicious or the most healthy, it’s just the most consistent. Of all the restaurants I know it’s the one I hear people complain about the least. We’ve probably all visited a Wimpy restaurant in various locations in Botswana, probably in South Africa as well. The only thing that ever varies is the accent of the waiter. Everything else is consistently identical.

I heard from someone else recently who had experienced a corporate failure. He wanted to buy a new SIM card so went to a store belonging to one of the major network providers, it doesn’t matter which one. Once he got to the front of the queue he politely asked for his SIM card only to be told: “We don’t have any”.

Cellphone network providers are not in the business of selling phones, their core business is selling people the ability to use their network. You can’t do that without a SIM card. Having no SIM cards is like the spicy chicken joint having no chicken. Just close shop and go home until you get some.

We had a complaint a couple of years ago from a reader who had recently bought something from a major furniture store. For whatever reason she returned it and they agreed to give her a refund. That was nice of them except for one small matter. They had no money.

They weren’t bankrupt, they hadn’t gone out of business, they still existed. They still had all that lovely money they made from selling cheap tat at exorbitant prices on credit. The store just didn’t have any cash and they couldn’t figure out a way to repay her. A store without money? Just like a spicy chicken joint with no chicken.

All of these cases are, I think, examples of a business failing its core mandate. Every organisation should surely spend some serious time trying to work out what its core business is. Then you need to invest everything you have in that aspect of your business or those things that directly support that core business. If you consider spending money on anything in your company, ask yourself first whether this will directly improve the quality of your core business, or at least help you support that core business. Improving the quality of customer care is great because that will help you improve the way in which you deliver spicy chicken, but even that isn’t as important as being able to cook spicy chicken when a customer wants some.

Next time you consider spending your company’s money on some ridiculous conference, a fake “only if you pay for it” excellence award or a shiny new “rebranding” exercise, consider instead spending it on your core business like chicken or SIM cards. It will be worth it and it’ll make your customers much happier and much more likely to give you their money!

The first one I ever thought of was about bars. I was a regular at a particular bar in Gaborone that was renowned for being a bit of a disgrace. They occasionally allowed some of their thirstier patrons to get out of control, the décor was shockingly bad and the service was often slow. However they always, without fail, got one thing right. The beer was always cold. That’s why we regulars were there al the time.

If a bar can’t do that, then surely nothing else can work properly. Serving cold beer is the fundamental purpose of a bar and if they can’t get that right then it’s not a functional bar.

The challenge of my theory is to find the core measurement in other organisations. What’s the ONE thing that judges whether your company is functional?

A few years ago we heard from a reader who had visited one of the major spicy chicken outlets in Gaborone. She’d gone there hungry for spicy chicken, one of those cravings we all sometimes get. But she was to be disappointed. The spicy chicken joint had no chicken. That presumably is a textbook case of a failed organisation. I know they probably had a delivery of chicken, their core product, shortly afterwards but I don’t think that’s a forgivable offence.

It’s probably easier in a conventional restaurant. Spicy chicken outlets serve, despite minor variations, just one product. Restaurants usually have a broad menu with a vast range of choices. It’s more acceptable to be told in a restaurant that they have no chicken today because you can always choose beef, fish or pork. There are alternatives.

What a restaurant has to do, the ONE thing they have to focus on cooking food hygienically. Anyone who’s watched the Ramsay’s Kitchen Nightmares series on DSTV will know that this is not always the case. The scariest thing is that the horrors you see in that program are in restaurant kitchens when they new a premier chef was about to turn up with a film crew and show his program all over the world. If they couldn’t clean up the kitchen and get rid of the vermin and hygiene crimes then what’s it like in non-televised restaurants like ours?

The ONE thing that measures the success in a restaurant is the delivery of food that pleases the customers. Friendliness, courtesy, décor, location and atmosphere are all important but not as important as that one basic objective. It’s why a chain like Wimpy does well. Their food isn’t the most advanced, the most delicious or the most healthy, it’s just the most consistent. Of all the restaurants I know it’s the one I hear people complain about the least. We’ve probably all visited a Wimpy restaurant in various locations in Botswana, probably in South Africa as well. The only thing that ever varies is the accent of the waiter. Everything else is consistently identical.

I heard from someone else recently who had experienced a corporate failure. He wanted to buy a new SIM card so went to a store belonging to one of the major network providers, it doesn’t matter which one. Once he got to the front of the queue he politely asked for his SIM card only to be told: “We don’t have any”.

Cellphone network providers are not in the business of selling phones, their core business is selling people the ability to use their network. You can’t do that without a SIM card. Having no SIM cards is like the spicy chicken joint having no chicken. Just close shop and go home until you get some.

We had a complaint a couple of years ago from a reader who had recently bought something from a major furniture store. For whatever reason she returned it and they agreed to give her a refund. That was nice of them except for one small matter. They had no money.

They weren’t bankrupt, they hadn’t gone out of business, they still existed. They still had all that lovely money they made from selling cheap tat at exorbitant prices on credit. The store just didn’t have any cash and they couldn’t figure out a way to repay her. A store without money? Just like a spicy chicken joint with no chicken.

All of these cases are, I think, examples of a business failing its core mandate. Every organisation should surely spend some serious time trying to work out what its core business is. Then you need to invest everything you have in that aspect of your business or those things that directly support that core business. If you consider spending money on anything in your company, ask yourself first whether this will directly improve the quality of your core business, or at least help you support that core business. Improving the quality of customer care is great because that will help you improve the way in which you deliver spicy chicken, but even that isn’t as important as being able to cook spicy chicken when a customer wants some.

Next time you consider spending your company’s money on some ridiculous conference, a fake “only if you pay for it” excellence award or a shiny new “rebranding” exercise, consider instead spending it on your core business like chicken or SIM cards. It will be worth it and it’ll make your customers much happier and much more likely to give you their money!

The Voice - Consumer's Voice

Dear Consumer’s Voice #1

I have a problem my friend who bought a car from overseas. That car is now stuck at Durban because the people he was dealing with took 5 weeks to deliver the export documents for him to clear the car.

Now he has to pay R21,000 for him to get his car. The dealers are now out of it yet they are the ones who brought it there and delayed till the car had to be paid so much for the warehouse at Durban. Please help.

This is a very good example of why I urge people NOT to buy cars from overseas. The risks are just too high. It’s bad enough buying an imported car when you see it with a dealer here in Botswana. Very often the local dealerships will refuse to service any imported cars because of the difficulty in finding the right parts and equipment necessary to service a car built for another market. They’re also suspicious of the history of many of these imported vehicles. One dealer told me that at least half of all the imported cars he was asked to service turned out to have been “clocked”, meaning their mileage had been reduced to increase the purchase price.

However at least people buying imported cars from dealers here had a chance to examine the vehicle and test-drive it before they spent their money. When you buy a car from a company overseas you have no guarantee whatsoever that the car you get will be what you want. I’ve heard of people paying for a car and a totally different model being delivered. I’ve also heard of stories just like yours when the vehicle is held up somewhere and the buyer is told to cough up more cash or abandon the car.

Your message isn’t perfectly clear about what the additional R21,000 is for. Is it just a storage fee until the papers arrived? If that’s the case I would expect the people who delayed the papers to pay. If you send me their details I’ll get in touch with them.

Meanwhile I urge every reader of The Voice NOT to buy cars this way. I know some people have had good experiences but the number with bad ones is enormous. It’s just too risky.

Dear Consumer’s Voice #2

I have been renting a house for the past 2 years. When I moved in I paid an up-front refundable deposit of P2,500. I signed a lease which has a clause that the deposit will be used for maintenance if need be when I leave the house. I moved out of the house in October after I gave a full months notice. Instead of getting my deposit back my landlord said he would give me back the money end of November. Now instead of giving me back my money he gave me receipts for the maintenance he claims was done on the house and P900 change. I feel this is unfair on my side because we never discussed about maintenance when I left the house.

Unfortunately your landlord is just doing what he’s entitled to do. The lease probably said that you had to leave the property in a decent condition and having repaired any damage you might have caused. Normally a tenant is also expected to repaint the property as well before leaving.

It’s very important that whenever you move into a property you should very carefully record the state of the place. Take pictures as well if possible and give your landlord a full list of all faults and repairs that are necessary. You should do exactly the same thing when you leave. That way there can be no arguments about who caused any damage.

Sorry I can’t be more helpful.

Celebrations

Benson at Orange Riverwalk store for being “polite, pleasant and helpful.” Our reader says that “Orange should get more staff like him!”

Another reader celebrated Ms Mauku at the South African High Commission for her “painstaking assistance” and “great service”.

Keep the celebrations coming in!

I have a problem my friend who bought a car from overseas. That car is now stuck at Durban because the people he was dealing with took 5 weeks to deliver the export documents for him to clear the car.

Now he has to pay R21,000 for him to get his car. The dealers are now out of it yet they are the ones who brought it there and delayed till the car had to be paid so much for the warehouse at Durban. Please help.

This is a very good example of why I urge people NOT to buy cars from overseas. The risks are just too high. It’s bad enough buying an imported car when you see it with a dealer here in Botswana. Very often the local dealerships will refuse to service any imported cars because of the difficulty in finding the right parts and equipment necessary to service a car built for another market. They’re also suspicious of the history of many of these imported vehicles. One dealer told me that at least half of all the imported cars he was asked to service turned out to have been “clocked”, meaning their mileage had been reduced to increase the purchase price.

However at least people buying imported cars from dealers here had a chance to examine the vehicle and test-drive it before they spent their money. When you buy a car from a company overseas you have no guarantee whatsoever that the car you get will be what you want. I’ve heard of people paying for a car and a totally different model being delivered. I’ve also heard of stories just like yours when the vehicle is held up somewhere and the buyer is told to cough up more cash or abandon the car.

Your message isn’t perfectly clear about what the additional R21,000 is for. Is it just a storage fee until the papers arrived? If that’s the case I would expect the people who delayed the papers to pay. If you send me their details I’ll get in touch with them.

Meanwhile I urge every reader of The Voice NOT to buy cars this way. I know some people have had good experiences but the number with bad ones is enormous. It’s just too risky.

Dear Consumer’s Voice #2

I have been renting a house for the past 2 years. When I moved in I paid an up-front refundable deposit of P2,500. I signed a lease which has a clause that the deposit will be used for maintenance if need be when I leave the house. I moved out of the house in October after I gave a full months notice. Instead of getting my deposit back my landlord said he would give me back the money end of November. Now instead of giving me back my money he gave me receipts for the maintenance he claims was done on the house and P900 change. I feel this is unfair on my side because we never discussed about maintenance when I left the house.

Unfortunately your landlord is just doing what he’s entitled to do. The lease probably said that you had to leave the property in a decent condition and having repaired any damage you might have caused. Normally a tenant is also expected to repaint the property as well before leaving.

It’s very important that whenever you move into a property you should very carefully record the state of the place. Take pictures as well if possible and give your landlord a full list of all faults and repairs that are necessary. You should do exactly the same thing when you leave. That way there can be no arguments about who caused any damage.

Sorry I can’t be more helpful.

Celebrations

Benson at Orange Riverwalk store for being “polite, pleasant and helpful.” Our reader says that “Orange should get more staff like him!”

Another reader celebrated Ms Mauku at the South African High Commission for her “painstaking assistance” and “great service”.

Keep the celebrations coming in!

Thursday, 13 December 2012

A Public Notice from NBFIRA - EurexTrade

The good people at NBFIRA are making their feelings known again. This time about High Yield Investment Programs (almost always Ponzi schemes) like EurexTrade. You may have seen their advert in the papers.

Their statement makes it clear that as a body registered and operating overseas NBFIRA have no power over them but that doesn't stop them warning people about scams, Ponzi schemes in particular.

The full text reads as follows:

Their statement makes it clear that as a body registered and operating overseas NBFIRA have no power over them but that doesn't stop them warning people about scams, Ponzi schemes in particular.

The full text reads as follows:

I like NBFIRA. They have backbone and a determination to get off their backsides and do what needs to be done."PUBLIC NOTICEThe purpose of this notice is to alert the general public of persons who are marketing “high-yield” and possibly illegal investment schemes which purport to offer ‘guaranteed’ and above average returns. Such investment programs are often the latest iteration of the classic Ponzi or pyramid investment scheme where unsuspecting ‘investors’ have lost significant amounts of money.

The NBFIRA is aware of an investment vehicle currently being sold in Botswana by persons representing a company by the name of EUREX TRADE LTD, wherein a number of citizens of Botswana have invested their personal savings.

The NBFIRA hereby states the following:

In view of the above, the public is hereby notified that investments in EurEx Trade are considered to have been completed strictly at the investor’s own risk and states that NBFIRA is not in a position to provide assistance to persons who have invested in the above mentioned entity.

- EurEx Trade Ltd, a company registered in Panama and is not domiciled or registered to conduct investment business within the Republic of Botswana.

- EurEx Trade Ltd does not fall within the regulatory purview of NBFIRA and has not been registered, licensed, approved and/or endorsed by NBFIRA to sell investment instruments locally.

- NBFIRA has not licensed any fund management companies nor their agents to sell EUREX Trade products in Botswana

- As EurEx Trade is conducting an offshore internet-based business only, NBFIRA has been unable to conduct an in-depth analysis or verification of the true nature of this business and consequently has multiple concerns regarding the financial credibility and conduct of business ethics of such an operation.

NBFIRA has noted with concern the recent rise in reported incidences of fraudulent financial schemes being promoted to the public and intends to regularly issue public notices in cases where the problem can be clearly identified. As a part of our financial literacy program, the Authority will shortly release an informative paper discussing the warning signs of Ponzi schemes and other financial scams though our website-www.nbfira.org.bw

Lastly, the public is advised to always seek professional advice from trained and licensed financial consultants as well as undertake its own due diligence in all investment decisions. The public should be aware and take heed of the well-known Latin axiom: Caveat Emptor—’let the buyer beware’; before investing personal savings.

Sincerely yours,

Mr. Melville Brown

ACTING CHIEF EXECUTIVE OFFICER"

Saturday, 8 December 2012

We’re surrounded by liars

We’re surrounded by liars.

I don’t mean the occasional “white lie” that many of us tell to get a quiet life. No, of course that doesn’t make you look fat. Yes, of course you were right in that argument. No, I wasn’t looking at the girl, honestly!

I’m talking about the real lies, the ones crafted deliberately to deceive people, and worse still, to steal their money. Even worse, the ones that endanger our health.

A week ago I was one of many people who received an email from a company which said:

Following the email was a link to the web site of the manufacturer of this “medicine”. It said that they “have good herbal therapy against diabetes, heart disease, arthritis, cancer, HIV/AIDS and stomach disease.” They claim that their capsules can make HIV “undetectable” in people who buy their products.

Where shall I begin?

Let’s start with the law. Sections 396-399 of the Penal Code state very clearly that it is illegal to publish “prohibited advertisements”. These are any advertisements in “any publication, whether written, printed or oral, or by any other method whatsoever” that offer to sell any medicine for a wide range of disorders including any STD, cancer, heart disease and so on. Clearly these people are breaking this law by advertising what they call their “medicine”.

Then there’s the little fact that what they are saying simply isn’t true. Of all the countries in the world we are best placed to say, based on vast quantities of evidence, that the only effective interventions for HIV/AIDS are anti-retroviral drugs. While we have many challenges left in reducing the rate of new infections, our family members, friends and colleagues infected with HIV are now living for decades longer than they used to, just because of ARVs. Anyone who denies this is deluded, dense or demonic.

There are no herbal remedies for HIV or AIDS, there simply aren’t. If there were, the big pharmaceutical companies would have bought them all, priced them at enormously high levels and would be selling them to us right now and making enormous profits. Those cynics who think big pharma companies have a reason to resist alternatives should reflect on two facts. Firstly, most “alternative” health remedies are not produced by hippie collectives in rain forests, but by exactly the same big companies who produce conventional medicines. Secondly these companies would love to find free, easy and mass-marketable new products instead of spending billions on developing new products in labs.

Given that there is absolutely no scientific evidence that a Chinese herbal concoction can make HIV “undetectable” we can safely assume that the producers are either liars or fools.

How much does this concoction cost? They explain the price in their email. They say you need to consume “four bottles in a month. Price: BWP560.00 per bottle”. In other words the poor fool that buys this useless crap has to pay P2,240 each month for the privilege.

I think it’s safe to say that the local distributors of this nonsense are breaking the law. But what about the other thing they claim in their email, that they are “authorised to supply herbal supplements by the Ministry of Health based in Gaborone, Botswana”. That seemed easy to check. I sent the email to the Ministry for their reactions. This is what they said. It’s perfectly clear.

They’re also the most dangerous sort of liars, the type that claims to have miracle solutions to difficult problems. As my friend in the Ministry warns, the danger is that someone will abandon their real medicines, the ones that really will probably now keep them alive long enough to see their grandchildren, and they’ll end up first poor and later dead. They’re dangerous liar and cheats.

I don’t mean the occasional “white lie” that many of us tell to get a quiet life. No, of course that doesn’t make you look fat. Yes, of course you were right in that argument. No, I wasn’t looking at the girl, honestly!

I’m talking about the real lies, the ones crafted deliberately to deceive people, and worse still, to steal their money. Even worse, the ones that endanger our health.

A week ago I was one of many people who received an email from a company which said:

“Hello. We are introducing our product the herbal medicine against HIV/AIDS called the Babao Relife Capsules made of top quality Chinese herbs from China. The medicine helps to boost the Immune System for HIV/AIDS patients. We are a Botswana Registered Company authorized to supply herbal supplements by the Ministry of Health based in Gaborone, Botswana.

Your health comes first, we are here to give you free advice on health matters including HIV/AIDS. Keep a healthy lifes style with our effective herbals.”

Following the email was a link to the web site of the manufacturer of this “medicine”. It said that they “have good herbal therapy against diabetes, heart disease, arthritis, cancer, HIV/AIDS and stomach disease.” They claim that their capsules can make HIV “undetectable” in people who buy their products.

Where shall I begin?

Let’s start with the law. Sections 396-399 of the Penal Code state very clearly that it is illegal to publish “prohibited advertisements”. These are any advertisements in “any publication, whether written, printed or oral, or by any other method whatsoever” that offer to sell any medicine for a wide range of disorders including any STD, cancer, heart disease and so on. Clearly these people are breaking this law by advertising what they call their “medicine”.

Then there’s the little fact that what they are saying simply isn’t true. Of all the countries in the world we are best placed to say, based on vast quantities of evidence, that the only effective interventions for HIV/AIDS are anti-retroviral drugs. While we have many challenges left in reducing the rate of new infections, our family members, friends and colleagues infected with HIV are now living for decades longer than they used to, just because of ARVs. Anyone who denies this is deluded, dense or demonic.

There are no herbal remedies for HIV or AIDS, there simply aren’t. If there were, the big pharmaceutical companies would have bought them all, priced them at enormously high levels and would be selling them to us right now and making enormous profits. Those cynics who think big pharma companies have a reason to resist alternatives should reflect on two facts. Firstly, most “alternative” health remedies are not produced by hippie collectives in rain forests, but by exactly the same big companies who produce conventional medicines. Secondly these companies would love to find free, easy and mass-marketable new products instead of spending billions on developing new products in labs.

Given that there is absolutely no scientific evidence that a Chinese herbal concoction can make HIV “undetectable” we can safely assume that the producers are either liars or fools.

How much does this concoction cost? They explain the price in their email. They say you need to consume “four bottles in a month. Price: BWP560.00 per bottle”. In other words the poor fool that buys this useless crap has to pay P2,240 each month for the privilege.

I think it’s safe to say that the local distributors of this nonsense are breaking the law. But what about the other thing they claim in their email, that they are “authorised to supply herbal supplements by the Ministry of Health based in Gaborone, Botswana”. That seemed easy to check. I sent the email to the Ministry for their reactions. This is what they said. It’s perfectly clear.

“The Ministry of Health has not authorized any company to supply herbal supplements.So the company selling these bogus products are lying. They’re lying about their products, their effects and their “authorisation” to sell them. They’re liars in almost every sense.

Currently there is no cure for HIV/AIDS. Even the retroviral drugs (ARVs) do not cure HIV/AIDS but suppresses the virus. The only thing that can be done to beat HIV/AIDS is behavior change and the Ministry currently has programs in place such as the Safe Male Circumcision (SMC) that aim at reducing the chances of getting HIV/AIDS.

It is regrettable that such claims may encourage patients to abandon their ART for something that is not true. This will encourage the development of resistance that may lead to high morbidity and mortality. The public is informed that all medicines, substances and solutions are regulated and registered by the Director of Health Services per the Drugs and Related Substance Act and as a Ministry we encourage the public to always buy medication from government regulated/supervised areas. These have a low chance of stocking ‘unregulated medication’.

As it stands, the claim has no substance and should be ignored.”

They’re also the most dangerous sort of liars, the type that claims to have miracle solutions to difficult problems. As my friend in the Ministry warns, the danger is that someone will abandon their real medicines, the ones that really will probably now keep them alive long enough to see their grandchildren, and they’ll end up first poor and later dead. They’re dangerous liar and cheats.

The Voice - Consumer's Voice

Dear Consumer’s Voice

I need to check the authenticity of a certain Regina Horley who claims to be a business investor who can give businesses loans to finance their businesses. A friend of mine got her connections from Linkedin network. She promised to lend him a whopping $10,000,000 to finance his business. Her address is 3630 Gatlin Dr, Rockledge FI, in Florida.

Thank you in advance.

This is certainly the beginning of a scam. It's simply NOT how loans operate. Total strangers on the internet do NOT lend people money and they certainly don’t lend millions of dollars to people they’ve never met.

Her LinkedIn profile is itself very dubious. It says she works for the Federal Reserve Board, but is a "Private Investor (General Financing)". The Federal Reserve Board isn't an organisation that lends money to people, it's just the Board of the Federal Reserve Bank in the USA.

There is no doubt that this is an "advance fee" scam. Before your friend gets the enormous "loan" (which of course doesn't exist) he'll be required to pay a fee in advance. That fee is what the whole scam is about. If he pays that first fee you can be sure that there will be another fee and then another until he runs out of money or realizes his mistake. It will be too late by then. The money will have gone forever. Nobody EVER gets refunds from scammers!

Please encourage your friend not to pursue this any further!

EurexTrade Update

I’ve lost count of the people who’ve contacted us in the last few months about a so-called investment scheme called EurexTrade. I’ve heard probably of dozens of people who have invested anything from P1,000 to P500,000 in this scheme. They’ve heard stories of people making enormous returns on their “investment” and of people becoming rich, or so they think.

The problem is that EurexTrade is a Ponzi scheme. Some of the investment you make when you join this scheme is paid directly to the people who joined before you. The people who join after you are paid some of your joining fee. There are no actual investments in a Ponzi scheme, it’s just “robbing Peter to pay Paul”. What’s more, the payments you receive are almost always just payments on a computer screen, you don’t actually get the cash in your hand. Even if you do get a small amount it will be tiny compared to the amount you gave them.

One curious thing is that this is a scheme focused largely on Botswana. Around a half of all the contacts they list on their web site have phone numbers starting with “+267”, even the ones for neighboring countries like Lesotho, Namibia, South Africa and Zimbabwe.

A little detective work comes up with some curious things. The companies who own EurexTrade which is itself based in Panama, are based in the British Virgin Islands, a renowned tax home for dodgy companies. These parent companies have a very checkered history. They’ve been involved in running guns to Sudan from Eastern Europe, appear to have been involved in various corrupt practices in Ukraine and were reported to have run a previous Ponzi scheme called Rockford Funding which, according to the US Securities and Exchange Commission stole over $100 million from it’s victims.

My recommendation is simple. If you’ve already given EurexTrade money do whatever you can to get it back. I’m not sure if you’ll manage to but at least try. If you’re considering handing over your money DO NOT DO THIS. Please, don’t.

Celebrations

Sergeant Dubula and Constables Moduke and Kgakaka from Old Naledi Police Station who were all “reassuring, helpful, comforting, efficient and knowledgeable” to the victim of a crime.

Keep the celebrations coming in!

I need to check the authenticity of a certain Regina Horley who claims to be a business investor who can give businesses loans to finance their businesses. A friend of mine got her connections from Linkedin network. She promised to lend him a whopping $10,000,000 to finance his business. Her address is 3630 Gatlin Dr, Rockledge FI, in Florida.

Thank you in advance.

This is certainly the beginning of a scam. It's simply NOT how loans operate. Total strangers on the internet do NOT lend people money and they certainly don’t lend millions of dollars to people they’ve never met.

Her LinkedIn profile is itself very dubious. It says she works for the Federal Reserve Board, but is a "Private Investor (General Financing)". The Federal Reserve Board isn't an organisation that lends money to people, it's just the Board of the Federal Reserve Bank in the USA.

There is no doubt that this is an "advance fee" scam. Before your friend gets the enormous "loan" (which of course doesn't exist) he'll be required to pay a fee in advance. That fee is what the whole scam is about. If he pays that first fee you can be sure that there will be another fee and then another until he runs out of money or realizes his mistake. It will be too late by then. The money will have gone forever. Nobody EVER gets refunds from scammers!

Please encourage your friend not to pursue this any further!

EurexTrade Update

I’ve lost count of the people who’ve contacted us in the last few months about a so-called investment scheme called EurexTrade. I’ve heard probably of dozens of people who have invested anything from P1,000 to P500,000 in this scheme. They’ve heard stories of people making enormous returns on their “investment” and of people becoming rich, or so they think.

The problem is that EurexTrade is a Ponzi scheme. Some of the investment you make when you join this scheme is paid directly to the people who joined before you. The people who join after you are paid some of your joining fee. There are no actual investments in a Ponzi scheme, it’s just “robbing Peter to pay Paul”. What’s more, the payments you receive are almost always just payments on a computer screen, you don’t actually get the cash in your hand. Even if you do get a small amount it will be tiny compared to the amount you gave them.

One curious thing is that this is a scheme focused largely on Botswana. Around a half of all the contacts they list on their web site have phone numbers starting with “+267”, even the ones for neighboring countries like Lesotho, Namibia, South Africa and Zimbabwe.

A little detective work comes up with some curious things. The companies who own EurexTrade which is itself based in Panama, are based in the British Virgin Islands, a renowned tax home for dodgy companies. These parent companies have a very checkered history. They’ve been involved in running guns to Sudan from Eastern Europe, appear to have been involved in various corrupt practices in Ukraine and were reported to have run a previous Ponzi scheme called Rockford Funding which, according to the US Securities and Exchange Commission stole over $100 million from it’s victims.

My recommendation is simple. If you’ve already given EurexTrade money do whatever you can to get it back. I’m not sure if you’ll manage to but at least try. If you’re considering handing over your money DO NOT DO THIS. Please, don’t.

Celebrations

Sergeant Dubula and Constables Moduke and Kgakaka from Old Naledi Police Station who were all “reassuring, helpful, comforting, efficient and knowledgeable” to the victim of a crime.

Keep the celebrations coming in!

Saturday, 1 December 2012

Organized crime

When most of us think of a scammer we probably think of a guy on his own in an Internet café in downtown Lagos, desperately trying to keep up with the emails he’s receiving from gullible fools who want some of his fictitious inheritance.

In fact it’s not as simple as that. Just as petty criminals often develop into larger criminals and any small-scale crime is soon incorporated into a larger organisation, scammers have been absorbed by the much bigger brother. Organised crime.

They may not yet match the Mafia, the South American drug cartels and the Oriental Tongs and Yakuza, but the West African scam crime organisations are becoming well organised. You see that from the way they adapt and evolve to exploit the latest trends and fashions. Originally they just focussed on the conventional “my late father left millions of dollars in a foreign bank account and I need your help getting it out” approach, but soon moved on to fake lotteries wins, fake job offers, the invitations to fake conferences and the fake romances with rich, good-looking people who fall desperately in love with total strangers they’ve only ever met on the internet. That’s a sign of a smart organisation reacting to consume pressure.

Instead of picturing that lone scammer in the Internet café, imagine instead a focus group of high-level scam leaders plotting their new strategy for stealing people’s money, using flipcharts, PowerPoint presentations and laser pointers. In fact just like any meeting in the boardroom of a bank.

Another scam that’s well organised is the whole fake universities industry. You may think that they’re all separate and distinct scams but a lot of them are actually part of the same family. A company called the “Organization for Global Learning Education”, which was created by a crook called Salem Kureshi operates from Pakistan. This organization includes a range of fake establishments, including the ones calling themselves Belford, Northern Port, Panworld, Headway, Corllins, Ashwood, Rochville, MUST, OLWA and McFord “universities”. All of them are nothing more than a credit card charging mechanism attached to a shipping address in the Middle East that sends fake certificates to the naïve or criminal people who’ve bought one of their fake degrees.

Like conventional scammers, this is no longer a small operation, it’s a major crime organization. Before you think it’s not relevant to you and me here in Botswana just take a look around. I suspect that if you work in any large organization you probably know someone, or you know someone who knows someone who’s bought a fake degree. I know I do. Yes, before you ask, the one I’ve met WAS fired from his job as a result of this. He’s lucky not to have been prosecuted for fraud because it IS a crime to obtain a financial benefit from a lie. Claiming to possess a degree when in fact it’s a fake is fraud.

Then there’s the more advanced, more intricate criminal operations. Ponzi schemes. A Ponzi scheme is actually very simple. You recruit people into your scheme promising them enormous financial returns but what actually happens is those returns come from the investments of later recruits. Your small return this month comes from the money I paid in when I joined. My return next month will come from the investment of the next victim. There is no actual investment in a Ponzi scheme, just a flow of money to one victim to a more recent one. It’s “robbing Peter to pay Paul”.

The biggest Ponzi scheme that affects us in Botswana at the moment calls itself EurexTrade. I’ve heard in the last week of several people who have “invested” over P100,000 in this scheme. One reader’s mother invested P500,000. I’ve also heard from reputable financial advisors and investment companies that their clients are cashing in their genuine investments to throw them away in this scheme. The amounts of money flowing towards this scheme are staggering.

Again though, this isn’t just a guy in an Internet café doing this. This is organized crime. In fact it’s particularly nasty organized crime.

EurexTrade is a company registered in 2004 in Panama. It’s owned by three other companies, Ireland & Overseas Acquisitions Ltd, Milltown Corporate Services Ltd and Inhold Ltd.

It’s the first two companies that are most interesting. In 2007 these two companies, both of which are registered in the British Virgin Islands, were involved in chartering a ship that travelled from Eastern Europe to Mombasa in Kenya. There’s nothing particularly wrong with that except that the cargo appears to have been weapons destined for rebels in South Sudan who were then under an international arms embargo. Let me put this simply. The people behind EurexTrade appear to be gun-runners.

They’re also career Ponzi scheme operators. The same two companies were behind a defunct Ponzi scheme called Rockford Funding that the US Securities and Exchange Commission claimed had stolen over $10 million from “investors” and transferred to banks in Latvia. They’ve also been involved in shady dealing with oil rigs and pharmaceuticals. Are these the sort of people you’d want to trust with your life savings? I think not.

The lesson is simple, at least I think it is. If you want to help fund the illegal running of guns, extortion and corruption, then yes, you should give your money to EurexTrade, you really should. However, if you’re old-fashioned like me, you’ll probably prefer to put any money you save somewhere where it might actually make me some money, rather than make just criminals rich.

In fact it’s not as simple as that. Just as petty criminals often develop into larger criminals and any small-scale crime is soon incorporated into a larger organisation, scammers have been absorbed by the much bigger brother. Organised crime.

They may not yet match the Mafia, the South American drug cartels and the Oriental Tongs and Yakuza, but the West African scam crime organisations are becoming well organised. You see that from the way they adapt and evolve to exploit the latest trends and fashions. Originally they just focussed on the conventional “my late father left millions of dollars in a foreign bank account and I need your help getting it out” approach, but soon moved on to fake lotteries wins, fake job offers, the invitations to fake conferences and the fake romances with rich, good-looking people who fall desperately in love with total strangers they’ve only ever met on the internet. That’s a sign of a smart organisation reacting to consume pressure.

Instead of picturing that lone scammer in the Internet café, imagine instead a focus group of high-level scam leaders plotting their new strategy for stealing people’s money, using flipcharts, PowerPoint presentations and laser pointers. In fact just like any meeting in the boardroom of a bank.

Another scam that’s well organised is the whole fake universities industry. You may think that they’re all separate and distinct scams but a lot of them are actually part of the same family. A company called the “Organization for Global Learning Education”, which was created by a crook called Salem Kureshi operates from Pakistan. This organization includes a range of fake establishments, including the ones calling themselves Belford, Northern Port, Panworld, Headway, Corllins, Ashwood, Rochville, MUST, OLWA and McFord “universities”. All of them are nothing more than a credit card charging mechanism attached to a shipping address in the Middle East that sends fake certificates to the naïve or criminal people who’ve bought one of their fake degrees.

Like conventional scammers, this is no longer a small operation, it’s a major crime organization. Before you think it’s not relevant to you and me here in Botswana just take a look around. I suspect that if you work in any large organization you probably know someone, or you know someone who knows someone who’s bought a fake degree. I know I do. Yes, before you ask, the one I’ve met WAS fired from his job as a result of this. He’s lucky not to have been prosecuted for fraud because it IS a crime to obtain a financial benefit from a lie. Claiming to possess a degree when in fact it’s a fake is fraud.

Then there’s the more advanced, more intricate criminal operations. Ponzi schemes. A Ponzi scheme is actually very simple. You recruit people into your scheme promising them enormous financial returns but what actually happens is those returns come from the investments of later recruits. Your small return this month comes from the money I paid in when I joined. My return next month will come from the investment of the next victim. There is no actual investment in a Ponzi scheme, just a flow of money to one victim to a more recent one. It’s “robbing Peter to pay Paul”.

The biggest Ponzi scheme that affects us in Botswana at the moment calls itself EurexTrade. I’ve heard in the last week of several people who have “invested” over P100,000 in this scheme. One reader’s mother invested P500,000. I’ve also heard from reputable financial advisors and investment companies that their clients are cashing in their genuine investments to throw them away in this scheme. The amounts of money flowing towards this scheme are staggering.

Again though, this isn’t just a guy in an Internet café doing this. This is organized crime. In fact it’s particularly nasty organized crime.

EurexTrade is a company registered in 2004 in Panama. It’s owned by three other companies, Ireland & Overseas Acquisitions Ltd, Milltown Corporate Services Ltd and Inhold Ltd.

It’s the first two companies that are most interesting. In 2007 these two companies, both of which are registered in the British Virgin Islands, were involved in chartering a ship that travelled from Eastern Europe to Mombasa in Kenya. There’s nothing particularly wrong with that except that the cargo appears to have been weapons destined for rebels in South Sudan who were then under an international arms embargo. Let me put this simply. The people behind EurexTrade appear to be gun-runners.

They’re also career Ponzi scheme operators. The same two companies were behind a defunct Ponzi scheme called Rockford Funding that the US Securities and Exchange Commission claimed had stolen over $10 million from “investors” and transferred to banks in Latvia. They’ve also been involved in shady dealing with oil rigs and pharmaceuticals. Are these the sort of people you’d want to trust with your life savings? I think not.

The lesson is simple, at least I think it is. If you want to help fund the illegal running of guns, extortion and corruption, then yes, you should give your money to EurexTrade, you really should. However, if you’re old-fashioned like me, you’ll probably prefer to put any money you save somewhere where it might actually make me some money, rather than make just criminals rich.

The Voice - Consumer's Voice

Dear Consumer’s Voice #1

I bought a Blackberry 9810 at a store at Riverwalk on Tuesday the 20th November 2012. I was told that it doesn’t come with a memory card. Today one of my colleagues went to another branch on Old Lobatse Road and bought a Blackberry 9360. Surprisingly it came with a memory card. I then called the store on Old Lobatse Road to find out if they have Blackberry 9810 and if it comes with a memory card. They confirmed that yes they have it in stock and it comes with a memory card.

I was just wondering if it’s possible for one company with different branches operating differently. I haven’t confronted them yet because I wanted your advice. The funny thing is that I was told to take it to Old Lobatse Road store if I experience technical problems. I have already opened the packaging but the phone is still new. What do you suggest??

This is a tricky one. I did some very brief research about Blackberrys (I’m an iPhone sort of guy) and it seems that although many older Blackberrys came with memory cards, the more recent models do NOT. If you do get a free memory card with your phone then it’s probably a freebie from the store.

However I find it strange that two stores within the same company would differ but then perhaps that’s just the nature of the free market? I know which store I’d buy the phone from if I had the choice.

Probably the lesson is just to ask and to make a few phone calls before you hand over your cash. Maybe even tell Store B that Store A offers a free memory card see what Store B can offer to beat them?

Dear Consumer’s Voice #2

My laptop was stolen a few weeks ago, already someone has hacked my 3 email accounts tried 419 scams in my name to 200 of my contacts, causing Yahoo and Hotmail to block my accounts and Google to issue a warning. Any advice on locating the laptop or stopping the reputational and worse financial damage?

Some laptops with the right software can be traced when they connect to a network. For instance any Apple device with wireless capabilities that are linked to an iCloud account can be traced very easily to within a few meters, but only if you set this up first. It’s also possible to buy tracking software that you load on a Windows-based laptop that enables you to trace it if it’s stolen but you need to do that BEFORE it’s stolen. In your case it’s too late for that.

However there are other things you can try. If the thief accesses either your or his Gmail account and sends emails it might be possible to trace him using the IP address the laptop was given when it connected to a network. I’m no expert on this but it might be worth finding one who can help you. I’ll try and find such an expert for you but if one is reading this please get in touch to assist.

Update

A couple of weeks ago we had an email from a reader who had some problems with a cellphone he’d bought in December last year. Over several months he’d had several problems but the store had been reluctant to replace. The good news is that he got in touch recently to say that he’d been given a brand new replacement phone.

However he asked “there is still 1 thing that I am not happy about, they want to use the warranty of the phone I took back to them for the new phone which ends on the 21 of December 2012. They said I must bring the receipt so that they change the serial number and not the warranty which I refused. What steps should I take next?”

Although it seems strange I think this is probably reasonable. When he bought his phone in January he got a 1-year warranty which expires next month. Even though he was given a brand new phone the item he spent his money on was bought last December and the warranty was for a year from that date. Remember that the new phone was entirely free so I think he’s done fairly well. It’s highly unlikely that a brand new phone is going to fail in the next few months.

Celebrations

Boitumelo at Nandos in Palapye gave our reader “impeccable service”. Christo and his team at Wireless@Home / BBI also went out of their way to keep an existing customer happy, being described as “above and beyond” her expectations. Well done to all of them.

Keep the celebrations coming in!

I bought a Blackberry 9810 at a store at Riverwalk on Tuesday the 20th November 2012. I was told that it doesn’t come with a memory card. Today one of my colleagues went to another branch on Old Lobatse Road and bought a Blackberry 9360. Surprisingly it came with a memory card. I then called the store on Old Lobatse Road to find out if they have Blackberry 9810 and if it comes with a memory card. They confirmed that yes they have it in stock and it comes with a memory card.

I was just wondering if it’s possible for one company with different branches operating differently. I haven’t confronted them yet because I wanted your advice. The funny thing is that I was told to take it to Old Lobatse Road store if I experience technical problems. I have already opened the packaging but the phone is still new. What do you suggest??

This is a tricky one. I did some very brief research about Blackberrys (I’m an iPhone sort of guy) and it seems that although many older Blackberrys came with memory cards, the more recent models do NOT. If you do get a free memory card with your phone then it’s probably a freebie from the store.

However I find it strange that two stores within the same company would differ but then perhaps that’s just the nature of the free market? I know which store I’d buy the phone from if I had the choice.

Probably the lesson is just to ask and to make a few phone calls before you hand over your cash. Maybe even tell Store B that Store A offers a free memory card see what Store B can offer to beat them?

Dear Consumer’s Voice #2

My laptop was stolen a few weeks ago, already someone has hacked my 3 email accounts tried 419 scams in my name to 200 of my contacts, causing Yahoo and Hotmail to block my accounts and Google to issue a warning. Any advice on locating the laptop or stopping the reputational and worse financial damage?

Some laptops with the right software can be traced when they connect to a network. For instance any Apple device with wireless capabilities that are linked to an iCloud account can be traced very easily to within a few meters, but only if you set this up first. It’s also possible to buy tracking software that you load on a Windows-based laptop that enables you to trace it if it’s stolen but you need to do that BEFORE it’s stolen. In your case it’s too late for that.

However there are other things you can try. If the thief accesses either your or his Gmail account and sends emails it might be possible to trace him using the IP address the laptop was given when it connected to a network. I’m no expert on this but it might be worth finding one who can help you. I’ll try and find such an expert for you but if one is reading this please get in touch to assist.

Update

A couple of weeks ago we had an email from a reader who had some problems with a cellphone he’d bought in December last year. Over several months he’d had several problems but the store had been reluctant to replace. The good news is that he got in touch recently to say that he’d been given a brand new replacement phone.

However he asked “there is still 1 thing that I am not happy about, they want to use the warranty of the phone I took back to them for the new phone which ends on the 21 of December 2012. They said I must bring the receipt so that they change the serial number and not the warranty which I refused. What steps should I take next?”

Although it seems strange I think this is probably reasonable. When he bought his phone in January he got a 1-year warranty which expires next month. Even though he was given a brand new phone the item he spent his money on was bought last December and the warranty was for a year from that date. Remember that the new phone was entirely free so I think he’s done fairly well. It’s highly unlikely that a brand new phone is going to fail in the next few months.

Celebrations

Boitumelo at Nandos in Palapye gave our reader “impeccable service”. Christo and his team at Wireless@Home / BBI also went out of their way to keep an existing customer happy, being described as “above and beyond” her expectations. Well done to all of them.

Keep the celebrations coming in!

Sunday, 25 November 2012

EurexTrade - who they really are

This is a sneak preview of what will appear in Mmegi this coming Friday. In case you had any doubts that EurexTrade is a scam, read this.

"EurexTrade is a company registered in 2004 in Panama. It’s owned by three other companies, Ireland & Overseas Acquisitions Ltd, Milltown Corporate Services Ltd and Inhold Ltd.If you've invested money in EurexTrade, do you really want it to stay there? I'm not sure if you'll get much back from them but you need to start trying to recover your money today.

It’s the first two companies that are most interesting. In 2007 these two companies, both of which are registered in the British Virgin Islands, were involved in chartering a ship that travelled from Eastern Europe to Mombasa in Kenya. There’s nothing particularly wrong with that except that the cargo appears to have been weapons destined for rebels in South Sudan who were then under an international arms embargo. Let me put this simply. The people behind EurexTrade appear to be gun-runners.

They’re also career Ponzi scheme operators. The same two companies were behind a defunct Ponzi scheme called Rockford Funding that the US Securities and Exchange Commission claimed had stolen over $10 million from “investors” and transferred to banks in Latvia. They’ve also been involved in shady dealing with oil rigs and pharmaceuticals. Are these the sort of people you’d want to trust with your life savings? I think not."

Action?

Is it worth taking action when you think something’s wrong or should you just put up with it?

I spend a lot of my time working with customers’ complaints and examples of abuse and I confess there are bad times when I wonder whether it’s worth it. There seems such an enormous community of abusers all of whom think it’s OK to lie, cheat and steal from people. They think it’s OK to make people sign contracts that they’ve written specifically to confuse people into parting with their money. They think that it’s OK to tell lies to exploit people.

Holiday clubs, let’s start with them. Let’s talk about the holiday clubs that offer you fantastic opportunities to have exotic breaks in exotic places but turn out to offer you precious little other than a lifetime contract that they won’t let you terminate. Often the breaks you want are at the wrong time, the place and with the wrong conditions. More importantly they don’t let you change your mind after the first few days. If you want to cancel the whole deal after a couple of years of having no holidays they’ll just say no. Even if you just change bank accounts and prevent them stealing your money they’ll still insist you’re committed and will send lawyers after you and make sure your credit history is ruined. They’ll also instruct second-rate lawyers to threaten any consumer rights bodies who dare to warn the public not to sign lifetime contracts like theirs.

Multi-level marketing schemes, network marketing schemes or perhaps more simply pyramid-structured schemes that actually have products, they frustrate me as well. I find it hard to see how people can deny one particular fact. The figures produced by the major MLM schemes, the figures they’re forced to publish by law in certain countries, show that virtually nobody who becomes a distributor makes any money from it.

For instance, Herbalife’s figures, once you’ve done the maths they’ve neglected to do, are perfectly simple to understand. According to their income disclosure statement for 2011, Herbalife "Supervisors" (33% of all distributors) in the USA had average annual "earnings compensation" of $475 (about P3,500) That’s less than P300 per month. Note that this is earnings, not profit, it’s before they paid their phone bill, internet fees and transport and accommodation costs. Note as well that these are the figures for the USA, a country with considerably higher average than ours.

When you drill down a little further into their figures you discover some more fascinating facts. For instance, the top 6% of their US “leaders” earned 89% of all the compensation paid out. Herbalife's "supervisors", who constitute 33% of the pyramid, shared the remaining 11% of the compensation. No compensation data was provided for the 60% of distributors who don't get to "supervisor" level so it’s probably safe to assume they earned nothing. Or less.

In short, unless you can work your way to the top of the pile in a MLM business, you’re screwed. The worse news is that there aren’t any vacancies at the top of the pile, they’re already occupied by people who got there a LONG time before you and they certainly don’t want to give up that 89% of the money they’re getting. You’re not going to get your hands on it.

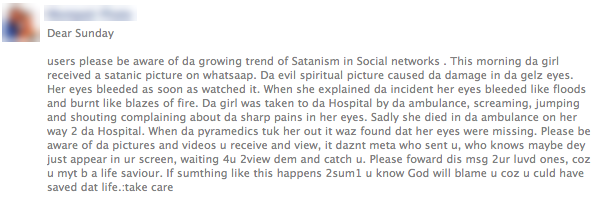

Sometimes I even find some consumers irritating. I saw a post on Facebook a few days ago that urged “users please be aware of da growing trend of Satanism in Social networks”.

The anonymous author told the story of a young girl who saw “a satanic picture” online. He went on:

But those are the bad moments. I soon get over them when I hear of a consumer who stood up for his or her rights and ending up getting fair treatment and some respect. Or when I hear the latest story of NBFIRA and their secret underground cavern where they imprison and torture unrepentant (and unregistered) loan sharks. Or when I hear of a store fixing a customer’s problem without any great hassle, leaving their customer happier and more loyal than if the problem had never occurred.

Most of all I feel optimistic when I hear of consumers who say that they simply refused to passively accept unfairness or abuse and decide that they need to take action to fight back. Like we all should.

I spend a lot of my time working with customers’ complaints and examples of abuse and I confess there are bad times when I wonder whether it’s worth it. There seems such an enormous community of abusers all of whom think it’s OK to lie, cheat and steal from people. They think it’s OK to make people sign contracts that they’ve written specifically to confuse people into parting with their money. They think that it’s OK to tell lies to exploit people.

Holiday clubs, let’s start with them. Let’s talk about the holiday clubs that offer you fantastic opportunities to have exotic breaks in exotic places but turn out to offer you precious little other than a lifetime contract that they won’t let you terminate. Often the breaks you want are at the wrong time, the place and with the wrong conditions. More importantly they don’t let you change your mind after the first few days. If you want to cancel the whole deal after a couple of years of having no holidays they’ll just say no. Even if you just change bank accounts and prevent them stealing your money they’ll still insist you’re committed and will send lawyers after you and make sure your credit history is ruined. They’ll also instruct second-rate lawyers to threaten any consumer rights bodies who dare to warn the public not to sign lifetime contracts like theirs.

Multi-level marketing schemes, network marketing schemes or perhaps more simply pyramid-structured schemes that actually have products, they frustrate me as well. I find it hard to see how people can deny one particular fact. The figures produced by the major MLM schemes, the figures they’re forced to publish by law in certain countries, show that virtually nobody who becomes a distributor makes any money from it.

For instance, Herbalife’s figures, once you’ve done the maths they’ve neglected to do, are perfectly simple to understand. According to their income disclosure statement for 2011, Herbalife "Supervisors" (33% of all distributors) in the USA had average annual "earnings compensation" of $475 (about P3,500) That’s less than P300 per month. Note that this is earnings, not profit, it’s before they paid their phone bill, internet fees and transport and accommodation costs. Note as well that these are the figures for the USA, a country with considerably higher average than ours.