Can they still repair it?

I have a problem here. I bought a printer and before the warranty elapsed it had a problem printing. I returned it and they said they fixed it. I took it but realised that its still doing the same. I returned it for the second time and they still failed for the second time. I returned it for the third time now they want to give me the same printer which I no longer trust as they failed to repair it two times.

I have been communicating with them but they are refusing to assist me. They want me to take the old one saying they have fixed it but they failed two times to fix it. I am calling them every day to talk to the manager and they always say he will call me back but he never does so. I talked to them this morning they said i should collect the old printer which failed so many times,

I call every day and they say the manager is in a meeting or not in and they will pass my message and get back to me but they never get back to me. Please help me.

The Consumer Protection Act was passed in 2018, four years ago, but it still surprises me that some stores have no understanding of what it says.

Section 16 of the Consumer Protection Act says that when a product develops a problem during the warranty period the dealer has a right to decide what they want to do, choosing from three options. They can offer you a repair, a replacement or a refund, the three Rs. Clearly any sensible supplier will choose the simplest and cheapest option for them which is to try and repair the problem. This store had the right to do that and you were right to give them that chance.

However, things change after that. The same section of the Act says that if a supplier repairs something and the same problem reoccurs within the next three months, they then have just two options. They can only replace the item or refund you. There's no second chance to repair it.

I emailed the company and their MD told me that his staff would immediately deal with the issue and contact you to confirm this.

Will I get my money back?

There is this guy he took money from me saying I'm funding his business of being a loan shark. He said he needed money to loan his customers which would come back with interest. He said the initial amount would have a 12.5% compound interest monthly for 6 months. The amount was P5,900 in total which was supposed to give me P11,800. But he only gave me P2,000 so I told him I just wanted my P3,900 since he couldn't manage. There's a dozen of us he didn't pay. I have bank transactions to prove the investment.

Now he blocked me I have no way of communicating.

This is going to be complicated. Very complicated.

Firstly, you're dealing with an industry that is heavily regulated. NBFIRA, the Non Bank Financial Institutions Regulatory Authority oversees the microlending industry and they have extremely strict rules about how micro-lenders are established and how they behave. I wonder whether this guy actually approached NBFIRA and got their advice or approval before setting up his company in such a strange way? I suspect he didn't. I checked and the company doesn't currently appear to be registered with NBFIRA.

I think you should approach NBFIRA and get their advice. As someone who invested in the company, you might need to get their opinions on your status as someone who is a stakeholder in a company that is possibly operating illegally.

I contacted the guy and he made a serious of excuses and claimed that the reason there's a delay is that he's the subject of a court case. He sent me pictures of court receipts which suggest that he's being truthful. However, I don't think that should be your concern.

In your position I would approach the Small Claims Court and see if you and the other people who lent him money can get an order against him for your money.

Consumer Watchdog is a (fiercely) independent consumer rights and advocacy organisation campaigning on behalf of the consumers of Botswana, helping them to know their rights and to stand up against abuse. Contact us at consumerwatchdog@bes.bw or find us on Facebook by searching for Consumer Watchdog Botswana. Everything we do for the consumers of Botswana has always been and always will be entirely free.

Saturday, 26 March 2022

Saturday, 19 March 2022

The Voice - Consumer's Voice

Do I get a refund?

Good day Richard, please help me. I opened a funeral policy with my bank in 2014 and they were always deducting from my account till last year (2021). In August they closed my policy because I was hit by Covid, (meaning no money) they just send me an SMS for the closing of the account, saying that they will call me, which they didn't do. Later I called them asking for refund and they refused.

Please help me thank you.

Unfortunately this isn't how funeral policies normally work.

Funeral plans, like all insurance policies, offer you protection against the effects of some bad event happening. You can get insurance against loss of property, fire damage to your house and contents, theft, car accidents, becoming ill or the ultimate disaster, the death of you or one of your loved ones.

In all cases, the principle is the same. You pay a monthly premium to the insurance company and if the dreaded event happens, the insurance company pays the bills.

A common confusion is about what happens if the terrible event the consumer has bought insurance against doesn't happen. What happens if your house doesn't burn down, your car isn't stolen, you don't become ill or you don't die. Don't you get the money back?

No, that doesn't normally happen. That's because the insurance policy wasn't a savings scheme where money accumulates, you were paying to be protected. Think of it like employing a security guard to protect your house. If you don't have a break-in, will the security company refund you? No, you bought protection against something and were lucky that that bad thing didn't happen. It's exactly the same with insurance.

The complication is that there are now some insurance policies, particularly life insurance policies that offer a 'cash back' facility where, if you didn't claim, after a number of years you get some or all of your instalments back. However, these policies are still fairly uncommon, and I've never heard of cash back being offered with a funeral plan.

A warning (again, following several requests)

I've been approached by several people on WhatsApp who suggested I can make large amounts of money from Yellow Card. I was also approached by a few on Facebook saying the same thing and I've turned down even more posts from people who wanted to post the same adverts in the Consumer Watchdog Facebook group.

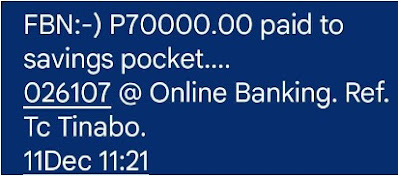

They all had three things in common. They all mentioned Yellow Card, they all promised that I could multiply my "investment" many times over in just a few days and they all included screenshots of payment notifications from FNB. However, all three of these claims were false.

Good day Richard, please help me. I opened a funeral policy with my bank in 2014 and they were always deducting from my account till last year (2021). In August they closed my policy because I was hit by Covid, (meaning no money) they just send me an SMS for the closing of the account, saying that they will call me, which they didn't do. Later I called them asking for refund and they refused.

Please help me thank you.

Unfortunately this isn't how funeral policies normally work.

Funeral plans, like all insurance policies, offer you protection against the effects of some bad event happening. You can get insurance against loss of property, fire damage to your house and contents, theft, car accidents, becoming ill or the ultimate disaster, the death of you or one of your loved ones.

In all cases, the principle is the same. You pay a monthly premium to the insurance company and if the dreaded event happens, the insurance company pays the bills.

A common confusion is about what happens if the terrible event the consumer has bought insurance against doesn't happen. What happens if your house doesn't burn down, your car isn't stolen, you don't become ill or you don't die. Don't you get the money back?

No, that doesn't normally happen. That's because the insurance policy wasn't a savings scheme where money accumulates, you were paying to be protected. Think of it like employing a security guard to protect your house. If you don't have a break-in, will the security company refund you? No, you bought protection against something and were lucky that that bad thing didn't happen. It's exactly the same with insurance.

The complication is that there are now some insurance policies, particularly life insurance policies that offer a 'cash back' facility where, if you didn't claim, after a number of years you get some or all of your instalments back. However, these policies are still fairly uncommon, and I've never heard of cash back being offered with a funeral plan.

A warning (again, following several requests)

I've been approached by several people on WhatsApp who suggested I can make large amounts of money from Yellow Card. I was also approached by a few on Facebook saying the same thing and I've turned down even more posts from people who wanted to post the same adverts in the Consumer Watchdog Facebook group.

They all had three things in common. They all mentioned Yellow Card, they all promised that I could multiply my "investment" many times over in just a few days and they all included screenshots of payment notifications from FNB. However, all three of these claims were false.

Firstly, it's nothing to do with Yellow Card, which is an exchange where you can buy and sell cryptocurrencies.

Secondly, there is no investment in the world that can multiply your money seven times in 3 days, as one of these people claimed. Thirdly, the FNB alerts were faked. One of them couldn't even get the letters F, N and B in the right order.

In my conversations with these scammers they all eventually confessed that they were associated with a range of web sites that made these offers and all of these sites were registered in just the last few months. They were also all reluctant to say where in fact they were based, most claiming they were in South Africa but often giving contact numbers in the USA. It was also interesting to see that the web sites were all almost identical. This is clearly an organised scam. Hilariously, one of these fake companies, Hot Trade FX, offered a Certificate of Incorporation from the USA that couldn't even spell the word "America" correctly.

Please I beg you, don't fall for scams like this. You'll never make a profit and I guarantee you'll lose any money you "invest". If you're ever in any doubt if something is a scam, you can always contact Consumer Watchdog for advice. And remember that anyone who invites you to join their money-making scheme wants to make money FROM you, not WITH you.

In my conversations with these scammers they all eventually confessed that they were associated with a range of web sites that made these offers and all of these sites were registered in just the last few months. They were also all reluctant to say where in fact they were based, most claiming they were in South Africa but often giving contact numbers in the USA. It was also interesting to see that the web sites were all almost identical. This is clearly an organised scam. Hilariously, one of these fake companies, Hot Trade FX, offered a Certificate of Incorporation from the USA that couldn't even spell the word "America" correctly.

Please I beg you, don't fall for scams like this. You'll never make a profit and I guarantee you'll lose any money you "invest". If you're ever in any doubt if something is a scam, you can always contact Consumer Watchdog for advice. And remember that anyone who invites you to join their money-making scheme wants to make money FROM you, not WITH you.

Sunday, 13 March 2022

The Voice - Consumer's Voice

Won't they fix it?

Here is my story. We have purchased two tombstones for family members from a supplier. We made full payment, unfortunately they made mistakes in the writing and they refuse to fix it. It's been two months already and we are preparing for the unveiling. First they said they have to take it back to South Africa and we said it's fine at their expense because they acknowledge that they made the mistake. Then they said no it can be fixed here after installing because it can be fixed by a tiler. Now they are refused to help us. May you kindly send them an email or if you can call them.

This is simply unacceptable.

This is simply unacceptable.

Do we really need to explain to these people what the law says? Is that necessary? Surely it's obvious that tombstones should have the names of the deceased spelled correctly? Do we even need laws to tell us something so simple?

But let's tell them about the law. Section 14 (1) of the Consumer Protection Act says that when a supplier offers services they must do so "in a manner and quality that consumers are reasonably entitled to expect". It goes on to say that if a supplier fails to do this, they must "remedy any defect in the quality of the services" or they can "refund the consumer a reasonable portion of the price paid". The same section of the Act says that any goods supplied must be "of a quality that consumers are reasonably entitled to expect".

Even though it shouldn't be necessary, I'll contact them and explain this to them and let's see if they want to incur the wrath of the law and face a fine of up to P100,000, a prison term of up to five years or even both. Or maybe they want to do the decent thing?

Must I pay so much?

I have pawned mi car and they borrowed me P7,000 with 30% interest. I paid interest rate last month being on January. In February I didn't have money to pay for the interest they took the car to their place but they are saying that the interest is still accumulating 1% of the whole amount daily.

Is this true or they trying to cheat on me?

The bad news is that this is all true. The terrible news is that it's even worse than this.

Yes, the contract you signed says that if you default, you "will be charged a penalty fee at an interest rate of 1%, compounded daily on the outstanding amount".

'Compounded' means that each day the previous day's penalty is included in the calculation of the interest. If, like you, a customer owes P7,000, the interest after 30 days won't be 30 x P70 = P2,100, it will be P2,435. That's on top of the P7,000 which they still owe. After 60 days, won't be 60 x P30 = P4,200, it be P5,717.

The only piece of goods news is that the so-called 'in duplum rule' says that the interest they charge at the time the debt is settled can't exceed the capital amount you still owe them, in this case P7,000.

However, it gets worse. The contract you signed also says that if the debt isn't settled within 30 days the car will be sold and whatever money they make from the sale will be deducted from the amount you owe. However, they say they'll also charge you "Legal Charges" "Repossession Charges" and "Marketing Charges" and who knows how much they might be? One thing is certain. Your debt will only get bigger and bigger the longer it is before you settle it.

The lesson? Please only consider pawning your goods as a last resort. It might seem convenient and an easy way to raise some temporary money but it can very easily go horribly wrong. You can easily end up a lot poorer than when you started.

Here is my story. We have purchased two tombstones for family members from a supplier. We made full payment, unfortunately they made mistakes in the writing and they refuse to fix it. It's been two months already and we are preparing for the unveiling. First they said they have to take it back to South Africa and we said it's fine at their expense because they acknowledge that they made the mistake. Then they said no it can be fixed here after installing because it can be fixed by a tiler. Now they are refused to help us. May you kindly send them an email or if you can call them.

This is simply unacceptable.

This is simply unacceptable.

Do we really need to explain to these people what the law says? Is that necessary? Surely it's obvious that tombstones should have the names of the deceased spelled correctly? Do we even need laws to tell us something so simple?

But let's tell them about the law. Section 14 (1) of the Consumer Protection Act says that when a supplier offers services they must do so "in a manner and quality that consumers are reasonably entitled to expect". It goes on to say that if a supplier fails to do this, they must "remedy any defect in the quality of the services" or they can "refund the consumer a reasonable portion of the price paid". The same section of the Act says that any goods supplied must be "of a quality that consumers are reasonably entitled to expect".

Even though it shouldn't be necessary, I'll contact them and explain this to them and let's see if they want to incur the wrath of the law and face a fine of up to P100,000, a prison term of up to five years or even both. Or maybe they want to do the decent thing?

Must I pay so much?

I have pawned mi car and they borrowed me P7,000 with 30% interest. I paid interest rate last month being on January. In February I didn't have money to pay for the interest they took the car to their place but they are saying that the interest is still accumulating 1% of the whole amount daily.

Is this true or they trying to cheat on me?

The bad news is that this is all true. The terrible news is that it's even worse than this.

Yes, the contract you signed says that if you default, you "will be charged a penalty fee at an interest rate of 1%, compounded daily on the outstanding amount".

'Compounded' means that each day the previous day's penalty is included in the calculation of the interest. If, like you, a customer owes P7,000, the interest after 30 days won't be 30 x P70 = P2,100, it will be P2,435. That's on top of the P7,000 which they still owe. After 60 days, won't be 60 x P30 = P4,200, it be P5,717.

The only piece of goods news is that the so-called 'in duplum rule' says that the interest they charge at the time the debt is settled can't exceed the capital amount you still owe them, in this case P7,000.

However, it gets worse. The contract you signed also says that if the debt isn't settled within 30 days the car will be sold and whatever money they make from the sale will be deducted from the amount you owe. However, they say they'll also charge you "Legal Charges" "Repossession Charges" and "Marketing Charges" and who knows how much they might be? One thing is certain. Your debt will only get bigger and bigger the longer it is before you settle it.

The lesson? Please only consider pawning your goods as a last resort. It might seem convenient and an easy way to raise some temporary money but it can very easily go horribly wrong. You can easily end up a lot poorer than when you started.

Saturday, 5 March 2022

The Voice - Consumer's Voice

Where's my refund?

I booked accommodation at a hotel in Maun this past December. This was for 3 nights. I was told that my reservation will only be approved after I pay for 1 night as it was a busy season. I then paid P600 and it got approved. On my day of being the 31st, I got a call early morning from a gentleman at their reception to confirm my arrival time. I told them I will leave Gabs as soon as I was done, so I will check in late. On my way there I called to let them know that I was on the way and this time I spoke to a lady who told me my booking has been cancelled. I asked her how since I paid a deposit and confirmed that I was coming. I had to come up with Plan B regarding accommodation.

They have been promising to refund me but to this day I keep getting the excuse that the Directors are in Namibia for a Holiday and later South Africa. I spoke to the Manager and she's been promising to push the directors to refund me. I no longer believe that she's taking my issue seriously as she's always coming up with excuses. When I call their reception they tell me she's around and in a meeting but when I call in her cell she tells me she's not at work and will get back to me. The reception staff is very sympathetic and are surprised that its almost 2 months later and I still haven't been refunded.

All I want is my refund.

Do you think this hotel has ever heard of "customer service"? Clearly not.

Do you think this hotel has ever heard of "customer service"? Clearly not.

This sort of behaviour is completely unacceptable and the authorities regulating tourism need to hear about this. I'm not suggesting that they need to be closed down or punished but they need to understand that, in a country increasingly reliant on tourism income, a hotel that treats a customer like this is undermining our national future.

I messaged the hotel management and asked them when they plan on refunding you. I hope it's soon if they want to avoid any unpleasant consequences.

Update. A refund was paid and the hotel have offered a free stay to say sorry.

Must I pay them?

I have a problem with a gym. They have not been deducting money from my account since June 2021. They only deducted in August but the payment was rejected and returned to my account and since then they were not deducting anything till November.

I was communicating with the Sales Manager and telling him that money wasn't deducted from my account and now in January they called telling me that I owe then. I went to the bank to ask for my bank statement to show that they are the ones that they have not been deducting and I called telling them that they are not deducting. The bank statements shows that all those months they have not been deducting money from my account now they want me to be accountable for their fault. I wasn't using the gym at all but my contract was still running.

Kindly advise me on this issue please.

This is probably a difficult issue. That's because when you set up a payment mechanism like this with your bank it doesn't mean you're no longer responsible for making the payments. The contract with the gym and your agreement with your bank will both say that it's still your job to make sure the payments are made if the bank or the gym screws things up. They can argue that if you knew the payments weren't being taken you should have found another way to pay them what you owed.

However, clearly this gym must take some responsibility. They obviously have a problem doing the simplest of things. An occasional mistake can be overlooked but to fail to take their payment for so long strikes me as incompetent. Surely their admin staff noticed they were short of money every month?

My suspicion is that you're probably responsible for the money you owe them but I also think that a reasonable company, run by reasonable people would be reasonable and would accept that they are partly to blame. Given that you didn't use their services during the period you weren't paying I think they should allow everyone to walk away without any money changing hands.

That would be the reasonable thing to do. It's just a shame that not all companies are reasonable. Let's see whether they are or not.

I booked accommodation at a hotel in Maun this past December. This was for 3 nights. I was told that my reservation will only be approved after I pay for 1 night as it was a busy season. I then paid P600 and it got approved. On my day of being the 31st, I got a call early morning from a gentleman at their reception to confirm my arrival time. I told them I will leave Gabs as soon as I was done, so I will check in late. On my way there I called to let them know that I was on the way and this time I spoke to a lady who told me my booking has been cancelled. I asked her how since I paid a deposit and confirmed that I was coming. I had to come up with Plan B regarding accommodation.

They have been promising to refund me but to this day I keep getting the excuse that the Directors are in Namibia for a Holiday and later South Africa. I spoke to the Manager and she's been promising to push the directors to refund me. I no longer believe that she's taking my issue seriously as she's always coming up with excuses. When I call their reception they tell me she's around and in a meeting but when I call in her cell she tells me she's not at work and will get back to me. The reception staff is very sympathetic and are surprised that its almost 2 months later and I still haven't been refunded.

All I want is my refund.

Do you think this hotel has ever heard of "customer service"? Clearly not.

Do you think this hotel has ever heard of "customer service"? Clearly not.This sort of behaviour is completely unacceptable and the authorities regulating tourism need to hear about this. I'm not suggesting that they need to be closed down or punished but they need to understand that, in a country increasingly reliant on tourism income, a hotel that treats a customer like this is undermining our national future.

I messaged the hotel management and asked them when they plan on refunding you. I hope it's soon if they want to avoid any unpleasant consequences.

Update. A refund was paid and the hotel have offered a free stay to say sorry.

Must I pay them?

I have a problem with a gym. They have not been deducting money from my account since June 2021. They only deducted in August but the payment was rejected and returned to my account and since then they were not deducting anything till November.

I was communicating with the Sales Manager and telling him that money wasn't deducted from my account and now in January they called telling me that I owe then. I went to the bank to ask for my bank statement to show that they are the ones that they have not been deducting and I called telling them that they are not deducting. The bank statements shows that all those months they have not been deducting money from my account now they want me to be accountable for their fault. I wasn't using the gym at all but my contract was still running.

Kindly advise me on this issue please.

This is probably a difficult issue. That's because when you set up a payment mechanism like this with your bank it doesn't mean you're no longer responsible for making the payments. The contract with the gym and your agreement with your bank will both say that it's still your job to make sure the payments are made if the bank or the gym screws things up. They can argue that if you knew the payments weren't being taken you should have found another way to pay them what you owed.

However, clearly this gym must take some responsibility. They obviously have a problem doing the simplest of things. An occasional mistake can be overlooked but to fail to take their payment for so long strikes me as incompetent. Surely their admin staff noticed they were short of money every month?

My suspicion is that you're probably responsible for the money you owe them but I also think that a reasonable company, run by reasonable people would be reasonable and would accept that they are partly to blame. Given that you didn't use their services during the period you weren't paying I think they should allow everyone to walk away without any money changing hands.

That would be the reasonable thing to do. It's just a shame that not all companies are reasonable. Let's see whether they are or not.

Subscribe to:

Comments (Atom)