Who can spot the problem with this advertisement from HomeChoice?

Do you need a clue?

Consumer Watchdog is a (fiercely) independent consumer rights and advocacy organisation campaigning on behalf of the consumers of Botswana, helping them to know their rights and to stand up against abuse. Contact us at consumerwatchdog@bes.bw or find us on Facebook by searching for Consumer Watchdog Botswana. Everything we do for the consumers of Botswana has always been and always will be entirely free.

Sunday, 27 October 2013

Forever Living - yet another pyramid structured MLM

Forever Living, an Arizona-based Multi-Level Marketing company that sells aloe and bee products has made at least one person exceptionally rich. It's founder, Rex Maughan, is reputed to be worth at least $600 million.

Forever Living, an Arizona-based Multi-Level Marketing company that sells aloe and bee products has made at least one person exceptionally rich. It's founder, Rex Maughan, is reputed to be worth at least $600 million.Shall we overlook the inconvenient truth that there is precisely no evidence that aloe offers ANY health benefits?

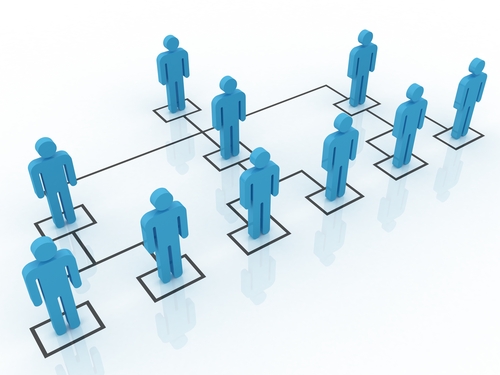

Their web site contains an image that accurately describes their business model.

Do I really need to go any further?

I can't find any earnings disclosure statements like Amway and Herbalife are forced to publish so I think it's safe to assume the chance of getting rich through Forever Living is about as unlikely as it is with them.

What phishing looks like

I received an email today as follows. Although it claimed to be from "fax" it was actually from an email address apparently in the Czech Republic.

The link in the email (the "Click here to proceed" bit) was to "http://keupdate.cwsurf.de/" which appears to be in Germany. Once I clicked the link the very helpful people from Google intervened with the following warning:

But I was reckless and pressed the "Ignore Warning" button. This is what came up next:

Let's ignore that sentence:

Remember that they wouldn't be doing this if there weren't people out there gullible enough to fall for it. They do it because it works.

The link in the email (the "Click here to proceed" bit) was to "http://keupdate.cwsurf.de/" which appears to be in Germany. Once I clicked the link the very helpful people from Google intervened with the following warning:

But I was reckless and pressed the "Ignore Warning" button. This is what came up next:

Let's ignore that sentence:

"Once your card is supposed be protected confirmed the threats is online fraud."All they're asking for is your personal details (you'll notice that this is focussed on our American friends, asking for their Social Security number) and everything they need to go on a spending spree at your expense. They even ask for your credit limit and current balance so they know how much they can steal from you.

Remember that they wouldn't be doing this if there weren't people out there gullible enough to fall for it. They do it because it works.

Saturday, 26 October 2013

Dear Minister (an open letter to the Minister of Trade and Industry)

Dear Minister

We can be justifiably proud of our consumer protection legislation. It’s well written, fairly comprehensive and, above all, easy to understand.

The Consumer Protection Act, the Control of Goods Act, the Food Control Act, the Public Health Regulations, the various laws relating to banking, copyright, labelling and the creation of NBFIRA have all given us powerful tools with which to protect ourselves.

Much of the credit for this must go to the Attorney General’s Chambers for drafting such laws and regulations but credit must also be given to your Ministry for understanding how best to protect the consumers of Botswana.

However, despite all of these protections there are nevertheless gaps in our current legislative framework.

The first is obvious. With a few honourable exceptions we don’t see sufficient enforcement of these laws. Of course this doesn’t mean that enforcement isn’t actually happening, I mean that it isn’t being SEEN to happen.

All newspaper readers will be familiar with the occasional notices from NBFIRA warning the public about the rules that various industries must abide by, rulings on certain companies or even general warnings about scams and companies with dubious business practices. They’ll probably have seen similar notices from BOTA about suspicious “colleges”. More recently they will also have seen some remarkably detailed rulings from DCEC on their investigations, even naming certain individuals who have been discovered to have engaged in corrupt practices.

This is what the public want and what they deserve: to see enforcement being done.

Unfortunately we don’t see nearly enough from the other enforcement agencies, in particular from the Consumer Protection Unit within your Ministry. I know that they do much valuable work but I think we deserve to SEE them doing this work. We deserve to see reports on their activities in the press. Not only would this assure us that they are fulfilling their mandate but it would also educate us, the people who fund their activities, much further on our rights and obligations as consumers.

The Consumer Protection Regulations are a powerful tool but they are beginning to show their age and there are gaps in their coverage that I believe need to be filled.

In particular we need protection against the massive upsurge in recent years of business and investment opportunities that clearly make false promises about the income and profits that can be made. For instance the Eurextrade Ponzi scheme that collapsed in February this year was targeted specifically at Botswana and was aggressively marketed within the country by its local representatives. They claimed that the scheme could offer “up to 2.9% daily” which is clearly nonsensical but we know of many people who lost their entire savings to this scam. Slightly less malign are the multi-level or network marketing schemes that offer a false opportunity to make money from the recruitment of multiple levels of people beneath each recruit. The evidence that these promises are false can be seen in the figures these companies are forced to publish in other countries, showing that only a very tiny minority of recruits make any profits at all and the vast majority make a loss.

I propose an addition to the Consumer Protection Regulations in the list of “acts of unfair business practice” along the following lines:

Cooling off periods are an essential protection for consumers. Some might argue that consumers who make rash decisions should pay the price but there are many situations when they are pressurized and manipulated by sales people into taking unwise decisions. I believe they need an opportunity to change their minds.

Suppliers will argue that cooling off periods will inconvenience them and will cost them money recovering their goods, but we can protect them from that. The cost of the return can be taken from the deposit the customer gave the store when they signed the agreement.

Some countries, such as South Africa, provide limited cooling off periods but only for direct selling, not when the consumer initiated the purchase. Other countries provide such periods in a wider range of circumstances. This is an area where we are lagging behind and I think we need to be a step ahead. I propose the following as a starting point:

As always, Consumer Watchdog remains at your disposal.

We can be justifiably proud of our consumer protection legislation. It’s well written, fairly comprehensive and, above all, easy to understand.

The Consumer Protection Act, the Control of Goods Act, the Food Control Act, the Public Health Regulations, the various laws relating to banking, copyright, labelling and the creation of NBFIRA have all given us powerful tools with which to protect ourselves.

Much of the credit for this must go to the Attorney General’s Chambers for drafting such laws and regulations but credit must also be given to your Ministry for understanding how best to protect the consumers of Botswana.

However, despite all of these protections there are nevertheless gaps in our current legislative framework.

The first is obvious. With a few honourable exceptions we don’t see sufficient enforcement of these laws. Of course this doesn’t mean that enforcement isn’t actually happening, I mean that it isn’t being SEEN to happen.

All newspaper readers will be familiar with the occasional notices from NBFIRA warning the public about the rules that various industries must abide by, rulings on certain companies or even general warnings about scams and companies with dubious business practices. They’ll probably have seen similar notices from BOTA about suspicious “colleges”. More recently they will also have seen some remarkably detailed rulings from DCEC on their investigations, even naming certain individuals who have been discovered to have engaged in corrupt practices.

This is what the public want and what they deserve: to see enforcement being done.

Unfortunately we don’t see nearly enough from the other enforcement agencies, in particular from the Consumer Protection Unit within your Ministry. I know that they do much valuable work but I think we deserve to SEE them doing this work. We deserve to see reports on their activities in the press. Not only would this assure us that they are fulfilling their mandate but it would also educate us, the people who fund their activities, much further on our rights and obligations as consumers.

The Consumer Protection Regulations are a powerful tool but they are beginning to show their age and there are gaps in their coverage that I believe need to be filled.

In particular we need protection against the massive upsurge in recent years of business and investment opportunities that clearly make false promises about the income and profits that can be made. For instance the Eurextrade Ponzi scheme that collapsed in February this year was targeted specifically at Botswana and was aggressively marketed within the country by its local representatives. They claimed that the scheme could offer “up to 2.9% daily” which is clearly nonsensical but we know of many people who lost their entire savings to this scam. Slightly less malign are the multi-level or network marketing schemes that offer a false opportunity to make money from the recruitment of multiple levels of people beneath each recruit. The evidence that these promises are false can be seen in the figures these companies are forced to publish in other countries, showing that only a very tiny minority of recruits make any profits at all and the vast majority make a loss.

I propose an addition to the Consumer Protection Regulations in the list of “acts of unfair business practice” along the following lines:

“advertising business or employment opportunities with claims of income or profits that cannot be readily substantiated“Finally I think there is an urgent need to include a couple of protections that have been overlooked: “cooling off” periods and an absolute right to clarity in contracts.

Cooling off periods are an essential protection for consumers. Some might argue that consumers who make rash decisions should pay the price but there are many situations when they are pressurized and manipulated by sales people into taking unwise decisions. I believe they need an opportunity to change their minds.

Suppliers will argue that cooling off periods will inconvenience them and will cost them money recovering their goods, but we can protect them from that. The cost of the return can be taken from the deposit the customer gave the store when they signed the agreement.

Some countries, such as South Africa, provide limited cooling off periods but only for direct selling, not when the consumer initiated the purchase. Other countries provide such periods in a wider range of circumstances. This is an area where we are lagging behind and I think we need to be a step ahead. I propose the following as a starting point:

“Any agreement relating to a sale of goods on any form of deferred payment shall contain a statement explaining that the customer may cancel the agreement in writing within 5 days of signature of that agreement. Any penalties applied by the supplier as a result of the cancellation may not exceed the amount of any deposit made when the agreement was signed.”We also need to insist that stores, particularly those who sell on credit or hire purchase are much, much clearer about the content of their contracts and what will happen if the customer experiences problems repaying. We hear regularly from consumers who genuinely seemed not to understand how their agreements worked and who often end up impoverished as a result. I suggest the following:

"It shall be an unfair business practice for any supplier who offers products or services for sale by way of any form of deferred payment not to clearly and completely explain to customers, in writing and before the customer signs any agreement, the details of the agreement, the penalties that might be applied and obligations incurred in the event of default of payment, and the remedies available to the customer in the event of failure by the supplier to deliver the products or service in any way."We require only very small changes to our existing legal framework in order to offer our neighbours, friends and family the protections they deserve.

As always, Consumer Watchdog remains at your disposal.

The Voice - Consumer's Voice

Dear Consumer’s Voice #1

Last year in May two fraudulent cheques amounting to P19,050 were cashed on my account. At the time of the P9,400 the first withdrawal I immediately called the bank when I received the SMS message and spoke to a supervisor inquiring about the withdrawal. I was told that the cheque was less then P10,000 and they did not need to call me and the persons cashing said they have done work on the farm for me. When I hung up the phone a second SMS for P9,650 came through.

I immediately went to the bank and made a case at the police station as the persons Omang and name were not familiar to me. I have demanded from the bank to see the surveillance footage which I was denied without a court order.

I later found that my cheque book had been stolen from my car but did not realise it was stolen until the message came through. Also there was 10 cheque number difference from the last cheque that I wrote and I have give cash cheques so it should have been odd to them anyway cashing such big amounts just a few minutes apart

The police managed to get a court order just to be told that the video footage is not available anymore. CID have a warrant of arrest out but have closed the case since they were not assisted by the bank with the investigation I have submitted a final letter on 25 June 2013 and the police report demanding my refund and up to now I am being promised every week and hear different stories without a resolution. Can anybody help me and tell me what is my options?

I suggest that you ask the bank for copies of the cheques and examine the signatures. If it’s clearly not yours then the bank is liable as they’re meant to honour the payment only if they have a reasonable belief that the cheque was really signed by you. However if they had good cause to think you’d signed them then the situation might be more difficult.

Did the bank explain why the video footage was missing? That sounds like a failure of basic standards to me. Did they say if all of the videos were missing or just the one that filmed them stealing your money? Maybe they have footage of the crooks entering or leaving the bank? It’s worth asking.

We’ll get in touch with your bank and see if they can’t try a little harder to help you.

Dear Consumer’s Voice #2

I mistakenly paid money into someone's account on 1st of August. I got a statement from the bank showing this transaction. At first the person denied it saying the account was closed. Only when I informed him that the bank confirmed that he withdrew the money did he admit to it. I have been trying to meet with this person in order to recover my money.

The guy is still avoiding me like a plague. I feel the bank should contact him to get his side of the story if they don't believe me instead of asking me to bring him in.

Isn't there anything the bank can do to assist?

I’m really sorry for your trouble, it must be very frustrating. We’ve heard of such things happening many times before and I’m still surprised that the banks don’t take more care to prevent them happening. It seems that banks only use the account number you give them to process a payment and they don’t double check using the account holder’s name. That seems strange to me. Maybe the banks should take a bit more care and help us prevent making easy mistakes?

I called the guy in question, the one who received your money by mistake, and he also gave me various excuses. However he did acknowledge that the money was yours and that he would need to make a plan to repay you. If you ever need a witness to corroborate I’m happy to be there in court.

Meanwhile we’ll get in touch with the bank and see if they can’t just reverse the transaction.

Last year in May two fraudulent cheques amounting to P19,050 were cashed on my account. At the time of the P9,400 the first withdrawal I immediately called the bank when I received the SMS message and spoke to a supervisor inquiring about the withdrawal. I was told that the cheque was less then P10,000 and they did not need to call me and the persons cashing said they have done work on the farm for me. When I hung up the phone a second SMS for P9,650 came through.

I immediately went to the bank and made a case at the police station as the persons Omang and name were not familiar to me. I have demanded from the bank to see the surveillance footage which I was denied without a court order.

I later found that my cheque book had been stolen from my car but did not realise it was stolen until the message came through. Also there was 10 cheque number difference from the last cheque that I wrote and I have give cash cheques so it should have been odd to them anyway cashing such big amounts just a few minutes apart

The police managed to get a court order just to be told that the video footage is not available anymore. CID have a warrant of arrest out but have closed the case since they were not assisted by the bank with the investigation I have submitted a final letter on 25 June 2013 and the police report demanding my refund and up to now I am being promised every week and hear different stories without a resolution. Can anybody help me and tell me what is my options?

I suggest that you ask the bank for copies of the cheques and examine the signatures. If it’s clearly not yours then the bank is liable as they’re meant to honour the payment only if they have a reasonable belief that the cheque was really signed by you. However if they had good cause to think you’d signed them then the situation might be more difficult.

Did the bank explain why the video footage was missing? That sounds like a failure of basic standards to me. Did they say if all of the videos were missing or just the one that filmed them stealing your money? Maybe they have footage of the crooks entering or leaving the bank? It’s worth asking.

We’ll get in touch with your bank and see if they can’t try a little harder to help you.

Dear Consumer’s Voice #2

I mistakenly paid money into someone's account on 1st of August. I got a statement from the bank showing this transaction. At first the person denied it saying the account was closed. Only when I informed him that the bank confirmed that he withdrew the money did he admit to it. I have been trying to meet with this person in order to recover my money.

The guy is still avoiding me like a plague. I feel the bank should contact him to get his side of the story if they don't believe me instead of asking me to bring him in.

Isn't there anything the bank can do to assist?

I’m really sorry for your trouble, it must be very frustrating. We’ve heard of such things happening many times before and I’m still surprised that the banks don’t take more care to prevent them happening. It seems that banks only use the account number you give them to process a payment and they don’t double check using the account holder’s name. That seems strange to me. Maybe the banks should take a bit more care and help us prevent making easy mistakes?

I called the guy in question, the one who received your money by mistake, and he also gave me various excuses. However he did acknowledge that the money was yours and that he would need to make a plan to repay you. If you ever need a witness to corroborate I’m happy to be there in court.

Meanwhile we’ll get in touch with the bank and see if they can’t just reverse the transaction.

Wednesday, 23 October 2013

Protect yourself from the next big data breach - Windows Secrets

Some technical advice on personal data security from Windows Secrets. Some of it's specific to the USA but it's nevertheless worth reading.

Protect yourself from the next big data breach

By Fred Langa on October 17, 2013

"Huge online attacks, such as the recent Adobe break-in, bring to mind a pressing question: What should we do if our credit-card data or sign-in credentials are stolen?

Plus, what steps will help minimize future exposures when large corporate sites are cracked — as they no doubt will be — by malicious hackers and cyber thieves?"

Friday, 18 October 2013

The Rules

First Rule of Business. Never lie to a customer because you WILL eventually be found out.

Second Rule of Business. Never have sex with a customer because it will all go wrong and you’ll both be FIRED.

Third Rule of Business. Never say rude things to your customers about your competitors because it makes you look like an IDIOT.

Those were the rules I was taught when I joined a company I worked for many years ago. I admit that the order of these rule did vary slightly, but that depended on who had just transgressed and was about to be fired. Nevertheless they were strictly enforced, for good reason.

You can probably understand the first two rules easily enough, they’re just common sense but it’s surprising how often people in business forget the last one. They seem to think that it’s acceptable to compete with other companies by saying rude things about them, by questioning the quality of their products, their staff or the services they offer. The truth is very different. Saying overtly bad things about other companies just makes you look cheap and sneaky, rather than someone who’s proud of their own company and its offerings.

You also run the risk of angering your competitors and how are they likely to react? They’re probably going to stoop down to your level and start criticising your stuff as well. You’ll have shot yourself in the foot.

You might have seen the recent story of the hotel DJ who is no longer a hotel DJ? This all started when various visitors to the Absolut Bar at the Lansmore Hotel in Gaborone complained that the bar serves drinks in plastic “glasses”. Wine is served there in firm plastic containers, beer and other drinks in cheap, soft, flimsy plastic cups, which doesn’t seem to fit with their luxury, stylish image. The hotel’s justification is safety. Their bar has a swimming pool next to it and they don’t want people dropping glasses and people stepping on the broken glass.

My response (if anyone asked me) would be simple. Employ a cleaner with broom and a mop. Besides, this isn’t the sort of pool I think people are going to be swimming in very often, it’s more the sort of place where people will be doing their best to be trendy and sophisticated on a warm evening, not somewhere where families go for a leisurely lunch and swim.

That however isn’t the big issue. The problem emerged when their resident DJ posted a comment on Facebook giving his feelings about the plastic cup issue. He said this:

Unfortunately for the DJ, even though he later deleted his comment (presumably after he saw the reaction from other Facebook users) many people had already taken a copy of what he said. It was too late to hide it.

The management of the Lansmore were also furious. Clearly they understood that rule about never criticising your competition and certainly never insulting them and their customers. The response from the Lansmore’s General Manager was swift. You can read his full statement on our blog and Facebook group but it included:

This is admittedly an extreme example where someone not only criticised a competitor but they’ve actually gone out of their way to insult both them and their customers but luckily the hotel responded suitably. The DJ, in case you’re wondering, has been suspended and his contract “is under review”. That’s what happens when you break the basic rules of business: you pay a hefty price. Your reputation, the loyalty of your customers, the respect of others in your industry and, worst of all, your profits might all get a shaking.

Second Rule of Business. Never have sex with a customer because it will all go wrong and you’ll both be FIRED.

Third Rule of Business. Never say rude things to your customers about your competitors because it makes you look like an IDIOT.

Those were the rules I was taught when I joined a company I worked for many years ago. I admit that the order of these rule did vary slightly, but that depended on who had just transgressed and was about to be fired. Nevertheless they were strictly enforced, for good reason.

You can probably understand the first two rules easily enough, they’re just common sense but it’s surprising how often people in business forget the last one. They seem to think that it’s acceptable to compete with other companies by saying rude things about them, by questioning the quality of their products, their staff or the services they offer. The truth is very different. Saying overtly bad things about other companies just makes you look cheap and sneaky, rather than someone who’s proud of their own company and its offerings.

You also run the risk of angering your competitors and how are they likely to react? They’re probably going to stoop down to your level and start criticising your stuff as well. You’ll have shot yourself in the foot.

You might have seen the recent story of the hotel DJ who is no longer a hotel DJ? This all started when various visitors to the Absolut Bar at the Lansmore Hotel in Gaborone complained that the bar serves drinks in plastic “glasses”. Wine is served there in firm plastic containers, beer and other drinks in cheap, soft, flimsy plastic cups, which doesn’t seem to fit with their luxury, stylish image. The hotel’s justification is safety. Their bar has a swimming pool next to it and they don’t want people dropping glasses and people stepping on the broken glass.

My response (if anyone asked me) would be simple. Employ a cleaner with broom and a mop. Besides, this isn’t the sort of pool I think people are going to be swimming in very often, it’s more the sort of place where people will be doing their best to be trendy and sophisticated on a warm evening, not somewhere where families go for a leisurely lunch and swim.

That however isn’t the big issue. The problem emerged when their resident DJ posted a comment on Facebook giving his feelings about the plastic cup issue. He said this:

“As part of Absolut I would like to say we have had all the complaints about this. For the last time, we use them because of the pool. And everyone who complains about this at some point during their stay knocks over there drink. Yes, our drinks are expensive cause we don't want cheap people like Gabs Sun, all the hookers and everything. We cater to a classy crowd and if you don't like it then don't come. We have plenty of business (drinkers) without you. And [name removed] all our glasses/cups/tumblers, silverware, plates, ash trays, etc, are cleaned multiple times during the day and night, we make sure of that. Lastly, please don't come to management and tell us how you've been to SA or elsewhere and they have this and that and you "know better". Our head management team have over 20 years experience in the hotel and entertainment industry, working and managing hotels, restaurants, clubs, etc. in places as the UK, Dubai, Russia, USA, SA, and many more.”You can imagine that storm that this caused. His arrogance, insults against another hotel and its customers and his claims to cater only to a “classy crowd” were too much to bear and not just for Facebook users.

Unfortunately for the DJ, even though he later deleted his comment (presumably after he saw the reaction from other Facebook users) many people had already taken a copy of what he said. It was too late to hide it.

The management of the Lansmore were also furious. Clearly they understood that rule about never criticising your competition and certainly never insulting them and their customers. The response from the Lansmore’s General Manager was swift. You can read his full statement on our blog and Facebook group but it included:

“The comments he made on Facebook were hugely misguided; they were also wrongThat was a mature response. State your regret, distance yourself from the person defaming your competition and make it clear that, in public at least, they’re to be respected. That’s how grown-ups behave.

...

these are not the opinions or values of the hotel or its Management

...

I sincerely apologise for any offence caused by comments made to both our valued patrons and to our fellow industry professionals at Gaborone Sun, whom we hold in high regard. We are saddened by the thought of any of our patrons and fellow professionals displeased by us in anyway and any inconvenience is highly regretted.”

This is admittedly an extreme example where someone not only criticised a competitor but they’ve actually gone out of their way to insult both them and their customers but luckily the hotel responded suitably. The DJ, in case you’re wondering, has been suspended and his contract “is under review”. That’s what happens when you break the basic rules of business: you pay a hefty price. Your reputation, the loyalty of your customers, the respect of others in your industry and, worst of all, your profits might all get a shaking.

The Voice - Consumer's Voice

Dear Consumer’s Voice #1

I want to ask for assistance concerning a transaction which was done on my account.

Some times a man from South Africa as a consultant for Hotel Express International contacted me to extent that I end up giving him my card number. Yesterday, a transaction of amount of P2496.60 was made without my authorization. The agreement was that, it can only be made after my authorization. I tried to contact my bank to see if they can not block it, unfortunately I was told that they can not.

We’ve heard from several people in the last couple of weeks and many others in the past who’ve had exactly the same experience as you and who were also victims of this selling approach.

First things first. Hotel Express International is a legitimate company selling a perfectly legitimate service. Their scheme offers 50% discounts on hotel stays and other vacation experiences. In return for your annual membership fee you get a card that offers you these discounts when you check in. However it’s not quite as simple as that sounds. Firstly not all hotels offer these discounts and those that do only have limited rooms available so it’s perfectly possible that a hotel will say refuse to offer you the discount. Also the 50% discount is from the hotel’s “rack rate” which is the often artificially inflated price a hotel will quote, solely so they can offer “discounts”.

There’s also the fact that I don’t see why anyone should need to pay for a discounted hotel stay when hotels often give these discounts away for free. One of my colleagues recently stayed in a hotel in Francistown for almost half the normal price just by booking the room online rather than by phone. We often stay in hotels in South Africa with similar discounts using Bid2Stay where you are allowed to offer that hotel chain what you would like to pay. Again you can usually get up to 40% off the normal rate and you don’t have to pay anything to get the discounts.

More importantly there seems to be a problem with the way Hotel Express International sell their membership scheme.

We’ve heard many times from consumers who have been “cold called” by them and who have been asked for their credit or debit card details, to “check your eligibility”, or to check “if you’re eligible for Gold membership”. If asked, they assure you that they won’t actually charge you but within minutes of giving out their card number and hanging up the phone, their cellphone beeps and they see they’ve charged the full amount, anything from about P1,600 up to P3,500.

The lessons are simple. Please don’t EVER give out your card numbers to strangers over the phone whatever the promise you. Secondly don’t bother joining discount schemes when you can get the same discounts elsewhere for free. Why waste your money?

Dear Consumer’s Voice #2

I have a situation with Ultimate Wedding Expressions in Mahalapye. I hired their tent in March 2013 for my uncle’s wedding. I signed a contract in which it said that a “refundable security deposit of P300 should be paid also in advance which will be refunded after the goods have been returned in good shape. Any damage or loss will be recovered from this security deposit” and that the deposit “will be paid out within seven days after delivery of goods.”

I have contacted them to refund me countless times and she kept on telling me she was expecting payment from someone and she kept saying she will deposit the money in my account. It has been six months now and she keeps on coming up with excuses every week.

Your assistance will be highly appreciated.

I contacted the manager of the company and I’ve had just a series of excuses as well. At one point she offered to pay the P300 in two instalments, claiming to be “a bit low with cash” but when I asked her to put that in writing she went silent on me. I’ll keep applying some pressure but it might require a trip to the Small Claims Court to get this fixed. Some people might say it’s not worth it for a mere P300 but it’s the principle that counts, don’t you think? People who refuse to honour their debts should be made to do so.

Update: Despite her assurances she still hasn't repaid a thing. She now promises something next week. We'll believe it when we see it!

Further update: She's not happy at her company being named and now suggests that she won't refund the customer at all. For the sake of openness below are some of the text messages we've exchanged.

I want to ask for assistance concerning a transaction which was done on my account.

Some times a man from South Africa as a consultant for Hotel Express International contacted me to extent that I end up giving him my card number. Yesterday, a transaction of amount of P2496.60 was made without my authorization. The agreement was that, it can only be made after my authorization. I tried to contact my bank to see if they can not block it, unfortunately I was told that they can not.

We’ve heard from several people in the last couple of weeks and many others in the past who’ve had exactly the same experience as you and who were also victims of this selling approach.

First things first. Hotel Express International is a legitimate company selling a perfectly legitimate service. Their scheme offers 50% discounts on hotel stays and other vacation experiences. In return for your annual membership fee you get a card that offers you these discounts when you check in. However it’s not quite as simple as that sounds. Firstly not all hotels offer these discounts and those that do only have limited rooms available so it’s perfectly possible that a hotel will say refuse to offer you the discount. Also the 50% discount is from the hotel’s “rack rate” which is the often artificially inflated price a hotel will quote, solely so they can offer “discounts”.

There’s also the fact that I don’t see why anyone should need to pay for a discounted hotel stay when hotels often give these discounts away for free. One of my colleagues recently stayed in a hotel in Francistown for almost half the normal price just by booking the room online rather than by phone. We often stay in hotels in South Africa with similar discounts using Bid2Stay where you are allowed to offer that hotel chain what you would like to pay. Again you can usually get up to 40% off the normal rate and you don’t have to pay anything to get the discounts.

More importantly there seems to be a problem with the way Hotel Express International sell their membership scheme.

We’ve heard many times from consumers who have been “cold called” by them and who have been asked for their credit or debit card details, to “check your eligibility”, or to check “if you’re eligible for Gold membership”. If asked, they assure you that they won’t actually charge you but within minutes of giving out their card number and hanging up the phone, their cellphone beeps and they see they’ve charged the full amount, anything from about P1,600 up to P3,500.

The lessons are simple. Please don’t EVER give out your card numbers to strangers over the phone whatever the promise you. Secondly don’t bother joining discount schemes when you can get the same discounts elsewhere for free. Why waste your money?

Dear Consumer’s Voice #2

I have a situation with Ultimate Wedding Expressions in Mahalapye. I hired their tent in March 2013 for my uncle’s wedding. I signed a contract in which it said that a “refundable security deposit of P300 should be paid also in advance which will be refunded after the goods have been returned in good shape. Any damage or loss will be recovered from this security deposit” and that the deposit “will be paid out within seven days after delivery of goods.”

I have contacted them to refund me countless times and she kept on telling me she was expecting payment from someone and she kept saying she will deposit the money in my account. It has been six months now and she keeps on coming up with excuses every week.

Your assistance will be highly appreciated.

I contacted the manager of the company and I’ve had just a series of excuses as well. At one point she offered to pay the P300 in two instalments, claiming to be “a bit low with cash” but when I asked her to put that in writing she went silent on me. I’ll keep applying some pressure but it might require a trip to the Small Claims Court to get this fixed. Some people might say it’s not worth it for a mere P300 but it’s the principle that counts, don’t you think? People who refuse to honour their debts should be made to do so.

Update: Despite her assurances she still hasn't repaid a thing. She now promises something next week. We'll believe it when we see it!

Further update: She's not happy at her company being named and now suggests that she won't refund the customer at all. For the sake of openness below are some of the text messages we've exchanged.

Saturday, 12 October 2013

The MLM fallacy

I really dislike Multi-Level Marketing (MLM) schemes. I also really dislike their cousins who call themselves Network Marketing schemes or Affiliate marketing schemes. Actually they’re not cousins, they’re just clones, they’re all basically the same thing, all selling the same false promises.

I’ve been approached by a handful of people over the years, usually people I don’t know very well but have met socially or through business, who me phone out of the blue saying that there’s something important they need to discuss with me. Knowing that it’s probably not going to be compliments on my good looks or irresistible charms, I’ve listened patiently. I now know that as soon as they use the word “opportunity” that they’re trying to recruit me into a MLM scheme like Amway or Herbalife. That’s when the conversation ends.

The trouble with the MLM industry is that it simply doesn’t do what it suggests. Despite all the aggressive marketing suggesting that these systems offer you the chance to make a fortune, it’s simply not true. And the evidence for this comes, ironically, from the industry itself.

Amway are required in the UK to publish an annual earnings disclosure statement outlining how much (or how little) their "Retail Consultants" make from their businesses. It’s important to know that they don’t publish this information because they want to, they do it because they’ve been forced to by the authorities in the UK as part of a deal that allowed them to continue trading if they started following some rules.

The figures they published (pdf download) for the year from October 2010 to September 2011 show that the average "Customer Volume Rebate" paid to their 16,287 Retail Consultants was, wait for it, a massive £41. About P450. In an entire year.

It's important to note that this is an average. The highest amount paid was £556 and the lowest was £20. It's even more important to understand that this wasn’t their profit, it was just their income and it takes no account of the costs needed to generate that income. That average figure of £41 was before they deducted the cost of their phone, internet connection, power, stationery, petrol, coffee, transport, booking hotel meeting rooms and anti-depressants.

It’s similar with the other great international MLM, Herbalife.

According to their Herbalife’s income disclosure statement (pdf download) for 2011, their "Supervisors" (a third of all distributors) in the USA had average annual "earnings compensation" of $475 (about P3,500) That’s less than P300 per month. Again, note that this is earnings, not profit, it’s before they paid their bills. Note as well that these are the figures for the USA, a country with considerably higher average than ours.

When you drill down a little further into their figures you discover some more fascinating facts. For instance, the top 6% of their US “leaders” earned 89% of all the compensation that was paid out. Herbalife's "supervisors", who constitute 33% of the pyramid, shared the remaining 11% of the compensation. No compensation data was provided for the 60% of distributors who don't get to "supervisor" level so it’s probably safe to assume they earned nothing. Or more likely they earned less than nothing, making an overall loss.

I think it’s fair to assume that if the biggest and most successful MLM schemes actually make most of their recruits poorer than when they joined then you can hardly expect better from all the new ones that are cropping up all over the place.

More importantly, the whole industry is based on a series of lies. Even most of the very few “successful” people involved aren’t actually making money.

The New York Post recently reported (thanks to my friend Kasey Chang for the lead) that one of Herbalife’s apparently most successful salespeople, Michael Burton, had to concede defeat. Having allegedly turned himself from an overweight slob into a muscular hunk using Herbalife’s products he then rose through the pyramid to become, so he claimed, one of their most successful advocates. Having once claimed to earn over $25,000 every month (an annual income of over P2½ million per year) he recently had to declare himself bankrupt. In fact, rather than being fabulously wealthy, he owed over P60 million, including over P8 million in tax.

Although he claims that this is nothing to do with Herbalife I think we have a right to be very skeptical indeed. That’s because the other truth about MLM schemes is that they bear a remarkable similarity to religious cults. Critical thinking within them is forbidden and relationships with outsiders, people not also involved or who refuse to be recruited, are distinctly frowned upon.

I recently read a moving account by an anonymous man whose partner was a “Regional Director” in a MLM scheme and his account of the money she repeatedly lost and her descent from affluence to poverty is deeply saddening. Her refusal to see the reality staring her in the face was eventually tragic. What he describes about her behaviour is very close to what we see in the less reputable evangelical churches. Adoration of the leadership, blind acceptance of empty promises, endless amounts of money being contributed for worthless tuition, expulsion of critics and the abandonment of family and friends who refuse to be recruited. Eventually she had lost so much money that they couldn’t make ends meet. He says:

“Finally, unable to gain her cooperation in formulating a household budget and rationalizing her business involvements, I reluctantly told her she would soon be faced with having to choose between me and her continued MLM involvement. Without hesitation, she replied that given that choice, she’d stay with MLM. Several months later, after she spent an afternoon exploring yet another MLM ‘business opportunity’, I left the partnership.”

The truth about MLMs is that they aren’t just a harmless way of buying some pots and pans, toiletries and useless health products. The truth is that the lucky recruits just lose a bit of money. The unlucky ones lose everything.

I’ve been approached by a handful of people over the years, usually people I don’t know very well but have met socially or through business, who me phone out of the blue saying that there’s something important they need to discuss with me. Knowing that it’s probably not going to be compliments on my good looks or irresistible charms, I’ve listened patiently. I now know that as soon as they use the word “opportunity” that they’re trying to recruit me into a MLM scheme like Amway or Herbalife. That’s when the conversation ends.

The trouble with the MLM industry is that it simply doesn’t do what it suggests. Despite all the aggressive marketing suggesting that these systems offer you the chance to make a fortune, it’s simply not true. And the evidence for this comes, ironically, from the industry itself.

Amway are required in the UK to publish an annual earnings disclosure statement outlining how much (or how little) their "Retail Consultants" make from their businesses. It’s important to know that they don’t publish this information because they want to, they do it because they’ve been forced to by the authorities in the UK as part of a deal that allowed them to continue trading if they started following some rules.

The figures they published (pdf download) for the year from October 2010 to September 2011 show that the average "Customer Volume Rebate" paid to their 16,287 Retail Consultants was, wait for it, a massive £41. About P450. In an entire year.

It's important to note that this is an average. The highest amount paid was £556 and the lowest was £20. It's even more important to understand that this wasn’t their profit, it was just their income and it takes no account of the costs needed to generate that income. That average figure of £41 was before they deducted the cost of their phone, internet connection, power, stationery, petrol, coffee, transport, booking hotel meeting rooms and anti-depressants.

It’s similar with the other great international MLM, Herbalife.

According to their Herbalife’s income disclosure statement (pdf download) for 2011, their "Supervisors" (a third of all distributors) in the USA had average annual "earnings compensation" of $475 (about P3,500) That’s less than P300 per month. Again, note that this is earnings, not profit, it’s before they paid their bills. Note as well that these are the figures for the USA, a country with considerably higher average than ours.

When you drill down a little further into their figures you discover some more fascinating facts. For instance, the top 6% of their US “leaders” earned 89% of all the compensation that was paid out. Herbalife's "supervisors", who constitute 33% of the pyramid, shared the remaining 11% of the compensation. No compensation data was provided for the 60% of distributors who don't get to "supervisor" level so it’s probably safe to assume they earned nothing. Or more likely they earned less than nothing, making an overall loss.

I think it’s fair to assume that if the biggest and most successful MLM schemes actually make most of their recruits poorer than when they joined then you can hardly expect better from all the new ones that are cropping up all over the place.

More importantly, the whole industry is based on a series of lies. Even most of the very few “successful” people involved aren’t actually making money.

The New York Post recently reported (thanks to my friend Kasey Chang for the lead) that one of Herbalife’s apparently most successful salespeople, Michael Burton, had to concede defeat. Having allegedly turned himself from an overweight slob into a muscular hunk using Herbalife’s products he then rose through the pyramid to become, so he claimed, one of their most successful advocates. Having once claimed to earn over $25,000 every month (an annual income of over P2½ million per year) he recently had to declare himself bankrupt. In fact, rather than being fabulously wealthy, he owed over P60 million, including over P8 million in tax.

Although he claims that this is nothing to do with Herbalife I think we have a right to be very skeptical indeed. That’s because the other truth about MLM schemes is that they bear a remarkable similarity to religious cults. Critical thinking within them is forbidden and relationships with outsiders, people not also involved or who refuse to be recruited, are distinctly frowned upon.

I recently read a moving account by an anonymous man whose partner was a “Regional Director” in a MLM scheme and his account of the money she repeatedly lost and her descent from affluence to poverty is deeply saddening. Her refusal to see the reality staring her in the face was eventually tragic. What he describes about her behaviour is very close to what we see in the less reputable evangelical churches. Adoration of the leadership, blind acceptance of empty promises, endless amounts of money being contributed for worthless tuition, expulsion of critics and the abandonment of family and friends who refuse to be recruited. Eventually she had lost so much money that they couldn’t make ends meet. He says:

“Finally, unable to gain her cooperation in formulating a household budget and rationalizing her business involvements, I reluctantly told her she would soon be faced with having to choose between me and her continued MLM involvement. Without hesitation, she replied that given that choice, she’d stay with MLM. Several months later, after she spent an afternoon exploring yet another MLM ‘business opportunity’, I left the partnership.”

The truth about MLMs is that they aren’t just a harmless way of buying some pots and pans, toiletries and useless health products. The truth is that the lucky recruits just lose a bit of money. The unlucky ones lose everything.

Friday, 11 October 2013

The Voice - Consumer's Voice

Dear Consumer’s Voice #1

I bought a BlackberryQ5 on 29th September at a value of P4,995 to replace my older Blackberry. When I got home I realised that the phone SIM card slot is too small and my SIM card does not fit in it so I decided to go back on 2nd October. I told them about this problem but I was told that nothing can be done to help me and I should go to Mascom to ask them to make a small SIM card for me. I told them that I have business information on the SIM card that I can’t afford to lose. I asked them to let me get another Blackberry in the shop that fits my current SIM card and they refused yet they never told me that the Q5 will need a small SIM card.

Please help!

It’s probably true that the store should have told you that the Blackberry Q5 takes the new Micro SIM card, not the larger SIM card that we’ve been used to in the past. However many phone manufacturers, including Apple, Samsung and Blackberry have switched to the smaller ones in recent years.

I understand your problem though. All the contacts, calendar items and whatever else you have on your SIM card are valuable and you don’t want to lose them. I can think of a couple of solutions that might work for you.

One solution is very simple. You might just need a pair of scissors. The Micro SIM card is in fact identical to a conventional SIM card but with just the extra plastic removed. The gold bit that holds all the data is exactly the same. When I converted to a Micro SIM card I downloaded a template from the web that showed exactly how to cut the excess plastic off and I got busy with the scissors. You have to be very careful but it’s really as simple as that.

Perhaps a better option would be simply to transfer your existing data to a new SIM card. I asked some people who know more than me about Blackberrys and they all recommend a free Blackberry service called Blackberry Protect. According to Blackberry this allows you to “Back up data from your BlackBerry smartphone (including Contacts and Calendar; Memos and Tasks; Browser Bookmarks and Text Messages)” and to “Restore your data to a new BlackBerry smartphone, or simply switch from one BlackBerry smartphone to another”.

That sounds the best option to me. All you need is a WiFi connection and a Blackberry ID that you can get for free online. Good luck!

Dear Consumer’s Voice #2

My wife has got an MTN line which she bought when she was in South Africa, she is keeping the line roaming while she is here in Botswana, now on 30/09/2013 she received an sms from no+ 27725004956 that she had won R250,000 in Rica promotion 2013 ref no 2200KP and to contact Asanda on +27733826485 for the claim. When she phoned that Asanda she was told that she had really won that amount then was told to send bank account details or postal address. She sent postal details and Asanda replied with no+ 27791559927 that "you are required to pay R1 650 before courier will deliver the cheque to ur door step. Call Kevin on 0218369355". When she phoned Kevin he told her that there are in Cape Town and should send money before cheque expires on 05/10/2013. So can u research for me if these guys are genuine or not. Thanks in advance.

This is certainly a scam, there's absolutely no doubt about it.

Here are some of the clues. Firstly you can't win a prize in a competition that you didn't enter. It’s never happened and it never will. Secondly, like almost all scammers they are using cellphone numbers although remarkably this one gives a landline number in Cape Town, a number that no longer works. Then there’s the fact that many other people have reported this scam. Finally there’s that fee they demand from you in order to get your “prize”. That’s what it’s all about. It's basically just an advance fee scam. If you pay them that money they’ll keep on inventing new reasons to ask you for money. They’ll only stop when you either run out of money or finally realise you’ve been scammed.

Please don't send any money, you'll never see it again.

I bought a BlackberryQ5 on 29th September at a value of P4,995 to replace my older Blackberry. When I got home I realised that the phone SIM card slot is too small and my SIM card does not fit in it so I decided to go back on 2nd October. I told them about this problem but I was told that nothing can be done to help me and I should go to Mascom to ask them to make a small SIM card for me. I told them that I have business information on the SIM card that I can’t afford to lose. I asked them to let me get another Blackberry in the shop that fits my current SIM card and they refused yet they never told me that the Q5 will need a small SIM card.

Please help!

It’s probably true that the store should have told you that the Blackberry Q5 takes the new Micro SIM card, not the larger SIM card that we’ve been used to in the past. However many phone manufacturers, including Apple, Samsung and Blackberry have switched to the smaller ones in recent years.

I understand your problem though. All the contacts, calendar items and whatever else you have on your SIM card are valuable and you don’t want to lose them. I can think of a couple of solutions that might work for you.

One solution is very simple. You might just need a pair of scissors. The Micro SIM card is in fact identical to a conventional SIM card but with just the extra plastic removed. The gold bit that holds all the data is exactly the same. When I converted to a Micro SIM card I downloaded a template from the web that showed exactly how to cut the excess plastic off and I got busy with the scissors. You have to be very careful but it’s really as simple as that.

Perhaps a better option would be simply to transfer your existing data to a new SIM card. I asked some people who know more than me about Blackberrys and they all recommend a free Blackberry service called Blackberry Protect. According to Blackberry this allows you to “Back up data from your BlackBerry smartphone (including Contacts and Calendar; Memos and Tasks; Browser Bookmarks and Text Messages)” and to “Restore your data to a new BlackBerry smartphone, or simply switch from one BlackBerry smartphone to another”.

That sounds the best option to me. All you need is a WiFi connection and a Blackberry ID that you can get for free online. Good luck!

Dear Consumer’s Voice #2

My wife has got an MTN line which she bought when she was in South Africa, she is keeping the line roaming while she is here in Botswana, now on 30/09/2013 she received an sms from no+ 27725004956 that she had won R250,000 in Rica promotion 2013 ref no 2200KP and to contact Asanda on +27733826485 for the claim. When she phoned that Asanda she was told that she had really won that amount then was told to send bank account details or postal address. She sent postal details and Asanda replied with no+ 27791559927 that "you are required to pay R1 650 before courier will deliver the cheque to ur door step. Call Kevin on 0218369355". When she phoned Kevin he told her that there are in Cape Town and should send money before cheque expires on 05/10/2013. So can u research for me if these guys are genuine or not. Thanks in advance.

This is certainly a scam, there's absolutely no doubt about it.

Here are some of the clues. Firstly you can't win a prize in a competition that you didn't enter. It’s never happened and it never will. Secondly, like almost all scammers they are using cellphone numbers although remarkably this one gives a landline number in Cape Town, a number that no longer works. Then there’s the fact that many other people have reported this scam. Finally there’s that fee they demand from you in order to get your “prize”. That’s what it’s all about. It's basically just an advance fee scam. If you pay them that money they’ll keep on inventing new reasons to ask you for money. They’ll only stop when you either run out of money or finally realise you’ve been scammed.

Please don't send any money, you'll never see it again.

Tuesday, 8 October 2013

A storm in a plastic cup?

In case you missed it.

Yesterday we received two complaints about the new trendy Absolut Bar on top of the Lansmore Hotel in Gaborone. They weren't about the drinks, the service or the atmosphere but were mainly about the use of plastic cups to serve the drinks. Customers had been told that this was for safety reasons as there's a swimming pool there and they don't want broken glass everywhere.

Then the resident DJ entered to discussion as follows:

Shortly afterwards he removed the comments but not before a number of people had copied them and reposted them, including in our Facebook group, followed by some very clear expressions of outrage.

Some hours later he posted the following apology:

That's when the fun started. To begin with there were reports of online intimidation but I don't know who from. Then some relatively mild comments, including the first one on our Facebook group, were "reported" to Facebook and the posters suspended from Facebook for 12 hours. Again, I don't know who did that.

I'd spoken to the Lansmore Hotel General Manager early on and he was, I don't think I'm betraying any confidences, furious at the situation. His hotel's reputation was being badly undermined.

Within a couple of hours out came this press release.

Problem solved?

Yesterday we received two complaints about the new trendy Absolut Bar on top of the Lansmore Hotel in Gaborone. They weren't about the drinks, the service or the atmosphere but were mainly about the use of plastic cups to serve the drinks. Customers had been told that this was for safety reasons as there's a swimming pool there and they don't want broken glass everywhere.

Then the resident DJ entered to discussion as follows:

"As part of Absolut I would like to say we have had all the complaints about this. For the last time, we use them because of the pool. And everyone who complains about this at some point during their stay knocks over there drink. Yes, our drinks are expensive cause we don't want cheap people like Gabs Sun, all the hookers and everything. We cater to a classy crowd and if you don't like it then don't come. We have plenty of business (drinkers) without you. And [name removed] all our glasses/cups/tumblers, silverware, plates, ash trays, etc, are cleaned multiple times during the day and night, we make sure of that. Lastly, please don't come to management and tell us how you've been to SA or elsewhere and they have this and that and you "know better". Our head management team have over 20 years experience in the hotel and entertainment industry, working and managing hotels, restaurants, clubs, etc. in places as the UK, Dubai, Russia, USA, SA, and many more."You can imagine the reaction. People were furious at his arrogance and condescending attitude, in particular to his slur about the patrons of the Gaborone Sun Hotel. The more charitable of us just assumed he'd been drinking.

Shortly afterwards he removed the comments but not before a number of people had copied them and reposted them, including in our Facebook group, followed by some very clear expressions of outrage.

Some hours later he posted the following apology:

"I must offer my sincere apologies for my thoughtless post. It was posted after a long night. I must stress that I in no way represent the management of Lansmore being as I am a contractor for them. The opinions I shared, however misguided, were my own and do not match in anyway those of the people who run Lansmore. Their style is inclusive and hospitable, only wanting a happy, content group of people in the business wherever that may be. Please accept my apologies. The hotel management too has taken extreme exception to my post."Unfortunately some just thought that the last sentence meant "I've been ordered to apologise".

That's when the fun started. To begin with there were reports of online intimidation but I don't know who from. Then some relatively mild comments, including the first one on our Facebook group, were "reported" to Facebook and the posters suspended from Facebook for 12 hours. Again, I don't know who did that.

I'd spoken to the Lansmore Hotel General Manager early on and he was, I don't think I'm betraying any confidences, furious at the situation. His hotel's reputation was being badly undermined.

Within a couple of hours out came this press release.

"8th October 2013Good recovery. I still have some "issues" with the plastic cup thing but this is a mature response to the problem. It's clear, direct and decisive, it's also apologetic and conciliatory. Nicely done. That's how you deal with a PR problem. You take it on the chin, you stiffen your backbone, apologise decently and offer an assurance that it won't happen again.

STATEMENT FOR IMMEDIATE RELEASE

It has been brought to our attention that certain comments were made via a number of Facebook platforms as though on the behalf of Lansmore Masa Square and/or its Management. The comments made by Devon Tyler Workman are unfounded and which are in no way representative of or shared by Lansmore.

Devon is a contractor hired in his professional capacity as a DJ and does not serve in a managerial role or as spokesperson of any form. The comments he made on Facebook were hugely misguided; they were also wrong. Absolut Gaborone at Lansmore was conceived out of a desire to offer the people in Gaborone, on indeed visiting Gaborone, somewhere different to enjoy social time in unique surroundings, providing all of our guests and patrons with an enjoyable and relaxed environment. Introduced as a safety measure which we take very seriously, the issue of the plastic glasses has not escaped us. We truly value the feedback and are already exploring ways in which glass could be used whilst at the same time avoiding accidental breakage of glass and potential harm to our guests, particularly in the swimming pool.

Let me reassure you, these are not the opinions or values of the hotel or its Management. We have already begun to address the matter internally and Mr Workman’s contract with Lansmore Masa Square is under review. On behalf of the entire Lansmore team, I sincerely apologise for any offence caused by comments made to both our valued patrons and to our fellow industry professionals at Gaborone Sun, whom we hold in high regard. We are saddened by the thought of any of our patrons and fellow professionals displeased by us in anyway and any inconvenience is highly regretted.

Lansmore Masa Square welcomes and encourages all feedback on how we can continue to work further to ensure only the best experience for all of our guests and patrons.

Rupert Elliott

General Manager

Lansmore Masa Square"

Problem solved?

Friday, 4 October 2013

Get Rich Quick?

Is it possible to get rich quickly?

I can think of several ways to get rich quickly. Rob a bank, set up a pyramid or Ponzi scheme or start dealing drugs. They’ll all make you some money very quickly. Of course the link between all of these things is that you’ll almost certainly end up either in a prison cell or a coffin quite soon afterwards so they’re probably not the best choices.

You could also set up a Get Rich Quick Scheme. There’s certainly no shortage of inspiration. Just visit Facebook and you’ll very quickly find a huge number of them popping up in various groups making some remarkable promises. I saw these in just a few minutes.

In fact that’s the real truth. These schemes don’t make money by selling products or services, the only real source of income is the recruitment of other people. There is, of course, no scheme in the world in which you can earn “$ 2K - $ 5K per week” by working “two hours per day”. It’s nothing more than a lie and a scam to get you to cough up money.

It’s the same with forex trading schemes like XForex whose marketers make ridiculous and fictitious claims like “Mr.Baruti From Botswana Has Made $5024 From EUR/USD Trading Last Month! It Is So Easy To Make A Second Income! Take Your First Step In To a Wealthier Future!”

This is all lies. Only the tiniest proportion of individuals make any money from forex trading. The only winners from the forex business are the enormous companies with billions to gamble and the companies that try and persuade you that you can do the same. Everyone else loses.

It’s the same with the companies that say they’ll train you on how to make fortunes from stock market trading. You’ll remember Stock Market Direct who a few years ran a business in Gaborone offering exactly these “services”. They collapsed when the money ran dry and their leader, the mythical “Tony Samuels” skipped the country with millions of “investors” money, never to be seen again. I say mythical because although there was a human being in a shiny suit running the business he certainly wasn’t called Tony Samuels, his identity was as fake as the profits his company promised.

Last week my favourite regulator, NBFIRA, issued a public warning about another company operating along the same lines, this time called “Go Direct Stock Market Investment (Botswana) (Pty) Ltd” (GDSMI). NBFIRA’s warning said that they had investigated GDSMI and reported that: “GDSMI has not been registered, licensed, approved and or endorsed by NBFIRA to operate” and that they warned the public that “GDSMI is not licensed by NBFIRA to take any funds on behalf of the clients.

They concluded by advising the public “to undertake its own due diligence before investing with any Non-Bank Financial Institution” like GDSMI and to contact NBFIRA before making any investment decisions.

Wise words. To their credit NBFIRA were one of the few entities warning people about the Eurextrade Ponzi scheme but that didn’t stop many, many people losing fortunes in that scam. I’ve heard of endless people investing what little they had and losing it all and of other more affluent victims who cashed in savings and pension schemes, even some who sold property to hand it over to Eurextrade. Just last week I heard about a victim who “sold two houses and a Range Rover” and gave it all to the criminals who are no doubt now sitting on a yacht somewhere laughing at their gullible victims.

I think we all know that there are no genuine Get Rick Quick Schemes, don’t we? Unless you inherit wealth, or you discover oil in your back yard, the only way to make some money in life is using hard work, imagination and persistence. People who promise you an “opportunity” to become wealthy with very little work are either liars, thieves or insane. Or any combination of those three things.

So if you see such an advertisement on Facebook or elsewhere please report it to Facebook as spam and pass straight on. Then you can join the rest of us who are trying to make money the old-fashioned and proven way.

I can think of several ways to get rich quickly. Rob a bank, set up a pyramid or Ponzi scheme or start dealing drugs. They’ll all make you some money very quickly. Of course the link between all of these things is that you’ll almost certainly end up either in a prison cell or a coffin quite soon afterwards so they’re probably not the best choices.

You could also set up a Get Rich Quick Scheme. There’s certainly no shortage of inspiration. Just visit Facebook and you’ll very quickly find a huge number of them popping up in various groups making some remarkable promises. I saw these in just a few minutes.

“Learn how to generate income worldwide. Do you know that cellphone can be the way of income? Yes, it is. using the new mobile phone system you can earn $5,000 weekly and it is available worldwide. 100% money back guarantee. 100% safe. 100% secure”Here’s a suggestion about what you should do whenever you read claims like these. Ask yourself a simple question. How does the person posting the message gain from telling you about this scheme? Surely if he or she has discovered a wonderful way of making money they should just use the scheme themselves? Why do they want to recruit other people into the scheme? Is it perhaps because the way to make money from the scheme is actually about recruitment rather than products?

“Let's Have a Passive Income. Many members receive thausands dollar per month. Only just $50 potentially receive passive income up to $8,847 per month. Earn Up To $8191 Without Having to refer a single person. In two hours per day you are able to earn $ 2K - $ 5K per week. Remember, everyone who joins will make money!”

“I discovered a programme which claimed to generate a passive income with no risk and very little work.... Yeah, right! Rather sceptically I tried it and the results took me by surprise. They were telling the truth. When I saw the system actually working, I knew I’d found something special.”

In fact that’s the real truth. These schemes don’t make money by selling products or services, the only real source of income is the recruitment of other people. There is, of course, no scheme in the world in which you can earn “$ 2K - $ 5K per week” by working “two hours per day”. It’s nothing more than a lie and a scam to get you to cough up money.

It’s the same with forex trading schemes like XForex whose marketers make ridiculous and fictitious claims like “Mr.Baruti From Botswana Has Made $5024 From EUR/USD Trading Last Month! It Is So Easy To Make A Second Income! Take Your First Step In To a Wealthier Future!”

This is all lies. Only the tiniest proportion of individuals make any money from forex trading. The only winners from the forex business are the enormous companies with billions to gamble and the companies that try and persuade you that you can do the same. Everyone else loses.

It’s the same with the companies that say they’ll train you on how to make fortunes from stock market trading. You’ll remember Stock Market Direct who a few years ran a business in Gaborone offering exactly these “services”. They collapsed when the money ran dry and their leader, the mythical “Tony Samuels” skipped the country with millions of “investors” money, never to be seen again. I say mythical because although there was a human being in a shiny suit running the business he certainly wasn’t called Tony Samuels, his identity was as fake as the profits his company promised.

Last week my favourite regulator, NBFIRA, issued a public warning about another company operating along the same lines, this time called “Go Direct Stock Market Investment (Botswana) (Pty) Ltd” (GDSMI). NBFIRA’s warning said that they had investigated GDSMI and reported that: “GDSMI has not been registered, licensed, approved and or endorsed by NBFIRA to operate” and that they warned the public that “GDSMI is not licensed by NBFIRA to take any funds on behalf of the clients.

They concluded by advising the public “to undertake its own due diligence before investing with any Non-Bank Financial Institution” like GDSMI and to contact NBFIRA before making any investment decisions.

Wise words. To their credit NBFIRA were one of the few entities warning people about the Eurextrade Ponzi scheme but that didn’t stop many, many people losing fortunes in that scam. I’ve heard of endless people investing what little they had and losing it all and of other more affluent victims who cashed in savings and pension schemes, even some who sold property to hand it over to Eurextrade. Just last week I heard about a victim who “sold two houses and a Range Rover” and gave it all to the criminals who are no doubt now sitting on a yacht somewhere laughing at their gullible victims.

I think we all know that there are no genuine Get Rick Quick Schemes, don’t we? Unless you inherit wealth, or you discover oil in your back yard, the only way to make some money in life is using hard work, imagination and persistence. People who promise you an “opportunity” to become wealthy with very little work are either liars, thieves or insane. Or any combination of those three things.

So if you see such an advertisement on Facebook or elsewhere please report it to Facebook as spam and pass straight on. Then you can join the rest of us who are trying to make money the old-fashioned and proven way.

The Voice - Consumer's Voice

Dear Consumer’s Voice #1

I registered with a University to do my Degree, 2 weeks after registering, I got hired, and decided, to leave school and start working due to the high level of unemployment, I decided that working now will be better than going to school. So I went back to the university to ask them to release me but they refused saying that I have to pay them P12500, because I have breached a contract with them, so I'm wondering which contract have I breached because the only thing I did was register my name on their course list other than I didn't sign anything, since I was going to be on government sponsorship even the memorandum of agreement at DTEF I haven't signed.

I really need advice on what to do on this situation its really stressing!

You might be one of the few people lucky enough to escape from a situation like this. If it’s true that you never actually signed a contract, either with the university or DTEF, then you might just get away with it. I suggest that you write to the university explaining that you never had any written agreement with them and that you don’t see how any money is owed to them.

However you need to understand that you’re very lucky. It’s only because the university made a serious mistake in not getting you to sign a contract that you’ve got away with it. If they’d been more sensible you would have been committed. Some might think that you’re morally committed anyway. You gave them an assurance and two weeks later you changed your mind. They now have lost a lot of income because you wouldn’t honour your commitments.

The simple truth is that an agreement is binding. If you sign a contract, whether it’s a lease for a house, a loan agreement with a bank or a credit agreement with a furniture store (ignoring that you need you head examined if you sign that last one) then you have to stick to it, no matter how much you might later regret it.

Consider yourself very lucky!

Dear Consumer’s Voice #2

Good day. People I need your help. I have bought 2 loads of river sand on the 7th this month and was promised to be delivered on 9th this month. The supplier did not honour his promise so I called him and he told me he is in Gabs to buy a spare part and will deliver the following day. That didn’t happen and I called him back he told me the truck is on its way to deliver as we speak but the day went by without any delivery. The next morning I called him and he cuts off my call and switch off his phone. After a day he delivers one truck and when I call to ask about the second load he cuts off and switches off his phones, Up to now all I have is just one load and his invoice. What should I do? He is in Mahalapye and I’m in Gabs.

Yet another person who doesn’t keep his promises. Didn’t their Mums ever teach them the difference between right and wrong, about keeping their word?