You don’t have a right to completely free speech. No, honestly, you don’t.

Oliver Wendell Holmes, an American Supreme Court judge once said in a ruling that the “most stringent protection of free speech would not protect a man falsely shouting fire in a theatre and causing a panic”. In other words there are certain things you can’t say. Our freedom of speech is limited. You’re not allowed to shout fire in a theatre if there isn’t actually a fire. We’re simply not allowed to say things that will cause panic or that may cause death, injury or civil disturbance.

Holmes went on to say that the decision is “whether the words used are used in such circumstances and are of such a nature as to create a clear and present danger”.

I think we’re surrounded by the abuse of free speech every day. I think that some of this speech presents a clear and present danger to our wealth, and more importantly to our health.

A few days ago I saw a post on Facebook from someone called Paul who said:

He later claimed that his coconut oil and cream could aid with all sorts of things including heart health, “creating hormones, maintaining hormonal balance”, “cellular health”, “balanced cholesterol levels”, claimed that it “kills bacteria”, possesses “anti-carcinogenic” properties and protects “against infection from bacteria, viruses, yeast, fungi and parasites”. He continued to say that it “kills viruses that cause influenza, herpes, measles, hepatitis C and other viruses”.

Most offensively he claimed that:

I say “offensively” because there are few types of people I despise more than peddlers of cures for HIV infection and AIDS. They are lower morally than the creators of the Eurextrade Ponzi scheme, psychics and TV evangelists. They are the absolute lowest of the low.

Paul on Facebook is one of this group of low-down scumbags.

Let’s state the obvious in an obvious way. If even some of his claims about coconut oil were true then there would be people with Nobel Prizes for Medicine as a result. There would be people with Nobel Prizes for Peace as well. There would be accolades, knighthoods and medals in abundance. There would be faces on postage stamps, statues and wings of universities named after the discoverers. Most significantly pharmaceutical firms would be buying up the patents as well as purchasing every coconut in the world.

I must have missed all of these things.

Or maybe it’s all a staggeringly flagrant and audacious lie? Maybe Paul and his fellow liars are all lying liars?

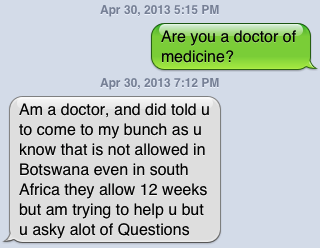

I think we should be doing more about people like Paul. I pointed out on Facebook that his “advertisements” are illegal in Botswana. Sections 396-399 of our Penal Code specifically outlaws advertising medicines and treatments for a variety of conditions, including cancer, heart disease and, by implication, HIV and AIDS. It’s simply illegal. Luckily his ridiculous comments were all very quickly removed, presumably because illegal claims aren’t popular on Facebook. But I’m sure he’ll be back again elsewhere very soon.

But who will enforce this law that protects us against people offering miracle cures? Technically it’s the Police. Someone would need to lodge a complaint and request the cops to investigate. But we all know that’s probably not going to happen, don’t we? We’ve all read stories of so-called traditional healers being arrested and even of a few who’ve been deported but not nearly enough.

What about the other group who threaten not our health but our wealth? The pyramid and Ponzi scheme scammers who steal so much of our money? The people behind Eurextrade, Three Link Connection and Oil of Asia. Who can deal with them?

The Bank of Botswana can play a role if they think that someone’s running an “illegal deposit-taking scheme” but the scammers get around this often by requiring the deposits to be made overseas.

Eurextrade and

Oil of Asia have bank accounts in far-away countries and the crooks from

Three Link Connection required their victims to cross the border and pay their money into banks in Zeerust. That makes it difficult to police.

To their great credit, our friends at

NBFIRA, the Non-Bank Financial Institutions Regulatory Authority, are doing their best. Even though it wasn’t technically their business they placed adverts in many of the local newspapers warning people against Eurextrade. With luck that warned some people and maybe they got out in time. Maybe.

NBFIRA’a example is a good one. They were concerned enough to get out and warn the public and they deserve great credit for that. It’s just a shame that other agencies, other Government departments aren’t doing the same. In fact it’s much more than a shame, it a danger, it’s a clear and present danger. People are shouting fire in a crowded theatre and the agencies empowered to stop people doing that are sitting idly by.

I know of one person whose health and wealth were both damaged by Eurextrade. He sold two houses and a car to raise the money to invest in the scheme. When he began to see stories that the scam had finally fallen apart he collapsed and ended up in hospital and as far as I know he’s still there. How many more people do we need to be damaged before the authorities take action to prevent rather than just apologise afterwards for their lack of action?

Correction. None of them have apologised yet. That’s their shame.