"EurexTrade is a company registered in 2004 in Panama. It’s owned by three other companies, Ireland & Overseas Acquisitions Ltd, Milltown Corporate Services Ltd and Inhold Ltd.If you've invested money in EurexTrade, do you really want it to stay there? I'm not sure if you'll get much back from them but you need to start trying to recover your money today.

It’s the first two companies that are most interesting. In 2007 these two companies, both of which are registered in the British Virgin Islands, were involved in chartering a ship that travelled from Eastern Europe to Mombasa in Kenya. There’s nothing particularly wrong with that except that the cargo appears to have been weapons destined for rebels in South Sudan who were then under an international arms embargo. Let me put this simply. The people behind EurexTrade appear to be gun-runners.

They’re also career Ponzi scheme operators. The same two companies were behind a defunct Ponzi scheme called Rockford Funding that the US Securities and Exchange Commission claimed had stolen over $10 million from “investors” and transferred to banks in Latvia. They’ve also been involved in shady dealing with oil rigs and pharmaceuticals. Are these the sort of people you’d want to trust with your life savings? I think not."

Consumer Watchdog is a (fiercely) independent consumer rights and advocacy organisation campaigning on behalf of the consumers of Botswana, helping them to know their rights and to stand up against abuse. Contact us at consumerwatchdog@bes.bw or find us on Facebook by searching for Consumer Watchdog Botswana. Everything we do for the consumers of Botswana has always been and always will be entirely free.

Sunday, 25 November 2012

EurexTrade - who they really are

This is a sneak preview of what will appear in Mmegi this coming Friday. In case you had any doubts that EurexTrade is a scam, read this.

Action?

Is it worth taking action when you think something’s wrong or should you just put up with it?

I spend a lot of my time working with customers’ complaints and examples of abuse and I confess there are bad times when I wonder whether it’s worth it. There seems such an enormous community of abusers all of whom think it’s OK to lie, cheat and steal from people. They think it’s OK to make people sign contracts that they’ve written specifically to confuse people into parting with their money. They think that it’s OK to tell lies to exploit people.

Holiday clubs, let’s start with them. Let’s talk about the holiday clubs that offer you fantastic opportunities to have exotic breaks in exotic places but turn out to offer you precious little other than a lifetime contract that they won’t let you terminate. Often the breaks you want are at the wrong time, the place and with the wrong conditions. More importantly they don’t let you change your mind after the first few days. If you want to cancel the whole deal after a couple of years of having no holidays they’ll just say no. Even if you just change bank accounts and prevent them stealing your money they’ll still insist you’re committed and will send lawyers after you and make sure your credit history is ruined. They’ll also instruct second-rate lawyers to threaten any consumer rights bodies who dare to warn the public not to sign lifetime contracts like theirs.

Multi-level marketing schemes, network marketing schemes or perhaps more simply pyramid-structured schemes that actually have products, they frustrate me as well. I find it hard to see how people can deny one particular fact. The figures produced by the major MLM schemes, the figures they’re forced to publish by law in certain countries, show that virtually nobody who becomes a distributor makes any money from it.

For instance, Herbalife’s figures, once you’ve done the maths they’ve neglected to do, are perfectly simple to understand. According to their income disclosure statement for 2011, Herbalife "Supervisors" (33% of all distributors) in the USA had average annual "earnings compensation" of $475 (about P3,500) That’s less than P300 per month. Note that this is earnings, not profit, it’s before they paid their phone bill, internet fees and transport and accommodation costs. Note as well that these are the figures for the USA, a country with considerably higher average than ours.

When you drill down a little further into their figures you discover some more fascinating facts. For instance, the top 6% of their US “leaders” earned 89% of all the compensation paid out. Herbalife's "supervisors", who constitute 33% of the pyramid, shared the remaining 11% of the compensation. No compensation data was provided for the 60% of distributors who don't get to "supervisor" level so it’s probably safe to assume they earned nothing. Or less.

In short, unless you can work your way to the top of the pile in a MLM business, you’re screwed. The worse news is that there aren’t any vacancies at the top of the pile, they’re already occupied by people who got there a LONG time before you and they certainly don’t want to give up that 89% of the money they’re getting. You’re not going to get your hands on it.

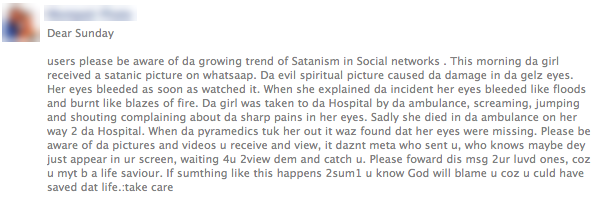

Sometimes I even find some consumers irritating. I saw a post on Facebook a few days ago that urged “users please be aware of da growing trend of Satanism in Social networks”.

The anonymous author told the story of a young girl who saw “a satanic picture” online. He went on:

But those are the bad moments. I soon get over them when I hear of a consumer who stood up for his or her rights and ending up getting fair treatment and some respect. Or when I hear the latest story of NBFIRA and their secret underground cavern where they imprison and torture unrepentant (and unregistered) loan sharks. Or when I hear of a store fixing a customer’s problem without any great hassle, leaving their customer happier and more loyal than if the problem had never occurred.

Most of all I feel optimistic when I hear of consumers who say that they simply refused to passively accept unfairness or abuse and decide that they need to take action to fight back. Like we all should.

I spend a lot of my time working with customers’ complaints and examples of abuse and I confess there are bad times when I wonder whether it’s worth it. There seems such an enormous community of abusers all of whom think it’s OK to lie, cheat and steal from people. They think it’s OK to make people sign contracts that they’ve written specifically to confuse people into parting with their money. They think that it’s OK to tell lies to exploit people.

Holiday clubs, let’s start with them. Let’s talk about the holiday clubs that offer you fantastic opportunities to have exotic breaks in exotic places but turn out to offer you precious little other than a lifetime contract that they won’t let you terminate. Often the breaks you want are at the wrong time, the place and with the wrong conditions. More importantly they don’t let you change your mind after the first few days. If you want to cancel the whole deal after a couple of years of having no holidays they’ll just say no. Even if you just change bank accounts and prevent them stealing your money they’ll still insist you’re committed and will send lawyers after you and make sure your credit history is ruined. They’ll also instruct second-rate lawyers to threaten any consumer rights bodies who dare to warn the public not to sign lifetime contracts like theirs.

Multi-level marketing schemes, network marketing schemes or perhaps more simply pyramid-structured schemes that actually have products, they frustrate me as well. I find it hard to see how people can deny one particular fact. The figures produced by the major MLM schemes, the figures they’re forced to publish by law in certain countries, show that virtually nobody who becomes a distributor makes any money from it.

For instance, Herbalife’s figures, once you’ve done the maths they’ve neglected to do, are perfectly simple to understand. According to their income disclosure statement for 2011, Herbalife "Supervisors" (33% of all distributors) in the USA had average annual "earnings compensation" of $475 (about P3,500) That’s less than P300 per month. Note that this is earnings, not profit, it’s before they paid their phone bill, internet fees and transport and accommodation costs. Note as well that these are the figures for the USA, a country with considerably higher average than ours.

When you drill down a little further into their figures you discover some more fascinating facts. For instance, the top 6% of their US “leaders” earned 89% of all the compensation paid out. Herbalife's "supervisors", who constitute 33% of the pyramid, shared the remaining 11% of the compensation. No compensation data was provided for the 60% of distributors who don't get to "supervisor" level so it’s probably safe to assume they earned nothing. Or less.

In short, unless you can work your way to the top of the pile in a MLM business, you’re screwed. The worse news is that there aren’t any vacancies at the top of the pile, they’re already occupied by people who got there a LONG time before you and they certainly don’t want to give up that 89% of the money they’re getting. You’re not going to get your hands on it.

Sometimes I even find some consumers irritating. I saw a post on Facebook a few days ago that urged “users please be aware of da growing trend of Satanism in Social networks”.

The anonymous author told the story of a young girl who saw “a satanic picture” online. He went on:

“Da evil spiritual picture caused da damage in da gelz eyes. Her eyes bleeded as soon as watched it. When she explained da incident her eyes bleeded like floods and burnt like blazes of fire.”He said that when she reached hospital her eyeballs had disappeared. This, of course, is a work of fiction. It’s a deception, a deceit, a shameless and horrible lie made up by someone selling something, presumably his rabble-rousing, miracle religious crusade. For money of course. Once I took some deep breaths and calmed down I asked whether there was any evidence that any of this was true. This is what I was told:

“hey ths thins du happn! u dnt hav to find whthr its tru or nt”Roughly translated he was saying that we don’t need to establish whether things are true or not in order to believe them. Yet again I was tempted to give up. That level of idiocy is astonishing and that style of typing is also criminal. Are there really people out there as catastrophically stupid as this?

But those are the bad moments. I soon get over them when I hear of a consumer who stood up for his or her rights and ending up getting fair treatment and some respect. Or when I hear the latest story of NBFIRA and their secret underground cavern where they imprison and torture unrepentant (and unregistered) loan sharks. Or when I hear of a store fixing a customer’s problem without any great hassle, leaving their customer happier and more loyal than if the problem had never occurred.

Most of all I feel optimistic when I hear of consumers who say that they simply refused to passively accept unfairness or abuse and decide that they need to take action to fight back. Like we all should.

The Voice - Consumer's Voice

Dear Consumer’s Voice #1

I received an email offering me loans from a company called Nature Loans. They say they offer loans from R10,000 to R10,000,000. Can this be real?

No, this is a scam. The clues are fairly simple to spot.

Firstly there’s the obvious one. Lenders don’t email total strangers offering them vast amounts of money. It’s just not the way the financial services sector works.

Then there are the traditional clues. Real companies don’t use just free email addresses and cellphone numbers as their primary contacts. Real companies have their own domain, and use email addresses like richard@company.com and landline numbers. Real companies have reasonably good spelling and grammar. “Nature Loans” breaks all of these rules.

Real companies don’t make extraordinary claims. They certainly don’t claim that they can lend you up to R10 million at an interest rate of a mere 3% like these crooks do.

Finally, companies that claim to be companies in South Africa are actually registered as companies in South Africa. Nature Loans is NOT registered as a company in South Africa.

This is an advance fee scam. At some point before you receive your fictional loan they’ll demand you pay them some fee they’ve invented, inevitably by Western Union. That’s what they’re after, just that money. If by any chance you pay them they’ll do their very best to drag more and more money out of you until you finally realize it’s a scam.

I suggest that you delete the email or, if you’re feeling more daring, send them the rudest reply you can think of. Remember that scammers don’t deserve courtesy!

Dear Consumer’s Voice #2

“What is the main purpose of an insurance when taking a loan from a bank? [A question from our Facebook group.]

A number of members of the group responded but the most comprehensive answer came from a banking expert. She said:

As our expert says, it’s not always an option. Many companies require you to pay for insurance when you take a loan or buy something on credit. I can understand that when you buy a house but I’m less keen when it comes to buying things like furniture. In that case you really should buy your own household insurance instead of the policy the store demands you take out. It will be vastly cheaper.

Celebrations

Following our appeal last week we’ve had several celebrations of people who deliver excellent service. Viral from Autoworld at Rail Park Mall was celebrated “for going above and beyond” and Michael from their Main branch is “brilliant at his job, he is always smiling, friendly and gives you 110%”. Patience from Air Botswana was also celebrated on our Facebook Group.

We’ve also been told that Tharina at BMS Printers in Broadhurst Industrial is extremely helpful and efficient.

Please keep the celebrations coming. Let us know when you get service that really impresses you. We’ll celebrate them here in The Voice and we’ll also celebrate them with their MD or CEO. Maybe if we all start recognizing the service stars out there excellent service might spread?

I received an email offering me loans from a company called Nature Loans. They say they offer loans from R10,000 to R10,000,000. Can this be real?

No, this is a scam. The clues are fairly simple to spot.

Firstly there’s the obvious one. Lenders don’t email total strangers offering them vast amounts of money. It’s just not the way the financial services sector works.

Then there are the traditional clues. Real companies don’t use just free email addresses and cellphone numbers as their primary contacts. Real companies have their own domain, and use email addresses like richard@company.com and landline numbers. Real companies have reasonably good spelling and grammar. “Nature Loans” breaks all of these rules.

Real companies don’t make extraordinary claims. They certainly don’t claim that they can lend you up to R10 million at an interest rate of a mere 3% like these crooks do.

Finally, companies that claim to be companies in South Africa are actually registered as companies in South Africa. Nature Loans is NOT registered as a company in South Africa.

This is an advance fee scam. At some point before you receive your fictional loan they’ll demand you pay them some fee they’ve invented, inevitably by Western Union. That’s what they’re after, just that money. If by any chance you pay them they’ll do their very best to drag more and more money out of you until you finally realize it’s a scam.

I suggest that you delete the email or, if you’re feeling more daring, send them the rudest reply you can think of. Remember that scammers don’t deserve courtesy!

Dear Consumer’s Voice #2

“What is the main purpose of an insurance when taking a loan from a bank? [A question from our Facebook group.]

A number of members of the group responded but the most comprehensive answer came from a banking expert. She said:

“Insurance taken on a loan is called credit insurance. Its purpose is to insure the life of the customer so that the loan gets repaid in the event that the customer dies before it is repaid. It is for the benefit of the bank but the benefit to the customer is that it avoids a claim against the estate for the outstanding balance due. For example, on a home loan, the house could get repossessed if the debt has not been cleared.I’m a big believer in insurance. It can really protect you when disasters happen. While it might seem a lot of money when things are going well, it might save you from ruin when things go wrong. I’ll give a personal example. When I bought a second-hand car from a dealer a couple of years ago I bought an extended warranty on it for P3,000. That extended warranty has since paid me five times that amount when the car needed work. I’ve saved a small fortune.

Most loans have compulsory credit insurance.”

As our expert says, it’s not always an option. Many companies require you to pay for insurance when you take a loan or buy something on credit. I can understand that when you buy a house but I’m less keen when it comes to buying things like furniture. In that case you really should buy your own household insurance instead of the policy the store demands you take out. It will be vastly cheaper.

Celebrations

Following our appeal last week we’ve had several celebrations of people who deliver excellent service. Viral from Autoworld at Rail Park Mall was celebrated “for going above and beyond” and Michael from their Main branch is “brilliant at his job, he is always smiling, friendly and gives you 110%”. Patience from Air Botswana was also celebrated on our Facebook Group.

We’ve also been told that Tharina at BMS Printers in Broadhurst Industrial is extremely helpful and efficient.

Please keep the celebrations coming. Let us know when you get service that really impresses you. We’ll celebrate them here in The Voice and we’ll also celebrate them with their MD or CEO. Maybe if we all start recognizing the service stars out there excellent service might spread?

Saturday, 17 November 2012

How to get banned

A few years ago we were approached by a guy we knew who ran a restaurant. He asked for advice about an awkward situation he’d had. Had he done the right thing?

A customer arrived at his restaurant with a friend one weekend morning and they had ordered coffee and cake. Shortly afterwards she called the owner over and told him that she didn’t like the taste of the cake. Ignoring the fact that she had eaten almost all of it before deciding it wasn’t to her taste he apologized profusely and told her she wouldn’t have to pay for it. In fact she wouldn’t have to pay for her coffee either. She seemed happy and went away.

The following weekend she was back and guess what, exactly the same thing happened again. Having consumed almost all of a different cake she made exactly the same complaint. Although he was beginning to get a little cross he did the same thing again, apologized and reduced her bill to say sorry. Again she went away happy.

The next weekend the same thing happened yet again. This time he was a bit more assertive. His patience had worn thin and he politely told her that as his cakes clearly weren’t to her taste maybe she should think of eating elsewhere in future. For the third and final time he cancelled her bill and wished her farewell.

She came back the following weekend. This time he refused to serve her. He reminded her of the previous occasions when she had suffered cake she claimed not to like and that he’d suggested she select a different restaurant in future. She was stunned. Only when he made it clear to her that she wasn’t going to be served at his restaurant again did she understand. She’d been banned. Eventually she left, muttering and promising to wreak vengeance upon the restaurant and it’s owner for the rudeness she’d experienced.

Was he correct to do this? Had he abused her rights? Had he done something wrong?

Of course not. Don’t you agree? He was perfectly within his rights to ban her. She was clearly enjoying getting a free meal and while it was OK perhaps the first time she was now going too far. She was costing him money, time, food and peace of mind.

It’s often forgotten that service isn’t a fundamental human right. Being able to buy cake from a restaurant isn’t like the right to life, to vote or to freedom of speech. You have a right to buy things but you have no right to demand that any particular person or supplier sells you things. This lady’s right was to buy coffee and cake but she had no right to demand that a particular restaurant sell it to her, particularly given her conduct.

Of course he had to do so as courteously as possible, but he had a right to decline to serve her in future. Her right to free cake had expired.

More recently I heard of another restaurant that banned some customers. This time it wasn’t a demand for free cake, it was slightly more serious. The details aren’t entirely clear, or even that important, but a meeting over coffee (maybe caffeine is the common link?) ended up with one customer’s laptop being seized by another, a lot of subsequent shouting and one of them ending up on his back on the floor outside the restaurant. The Police were eventually involved.

The private problem that these people had with each other isn’t the issue. The issue is whether the restaurant manager was then right to do what he next did. He banned everyone involved from his restaurant, saying such behavior was unacceptable in his restaurant, he had other customers to consider as well as the interests of his staff.

This caused some outrage from the banned customers. The problem rapidly changed from fighting customers to the conduct of the manager. But surely that’s a distraction? I think the situation is perfectly simple. If you and a friend have a fight in my house I’m perfectly entitled to throw you both out and tell you never to come here again. If two of our customers come to my office and start a fight I’m within my rights to kick them out as well. I don’t see any difference with the restaurant situation. The restaurant is private property in the same way that my house and office are private property, the conduct of the customers was dangerous and threatening and I, for one, don’t want to be in a restaurant where things like this are allowed to happen, do you?

One brief update. I heard later that one of the customers was in the habit of visiting the restaurant early in the morning, ordering one coffee, sitting there occupying a four-person table and using their free wireless network to run his business for several hours without ordering anything else. That’s just rude.

I spend a lot of my time criticizing suppliers and stores but it’s not just them that can be in the wrong. Sometimes it’s customers as well who can be wrong. Some customers are unreasonable, just like some store managers can be unreasonable. Sometimes it’s the customer who’s a real jerk.

Sometimes it’s the customer who seems to be asking for trouble by demonstrating a level of naivete that is staggering. Like the person I heard of yesterday who had just given P400,000 to the Eurextrade Ponzi scheme scam. Sometime I think there are people who shouldn’t be allowed out of their house with their mother.

So I urge you to be a reasonable customer. Treat people offering you products and services with the respect they deserve and offer them the courtesy you would like them to offer you. It’s not a miracle cure but it can only make life easier for you and I guarantee you’ll get better service as a result. You might also avoid being banned.

A customer arrived at his restaurant with a friend one weekend morning and they had ordered coffee and cake. Shortly afterwards she called the owner over and told him that she didn’t like the taste of the cake. Ignoring the fact that she had eaten almost all of it before deciding it wasn’t to her taste he apologized profusely and told her she wouldn’t have to pay for it. In fact she wouldn’t have to pay for her coffee either. She seemed happy and went away.

The following weekend she was back and guess what, exactly the same thing happened again. Having consumed almost all of a different cake she made exactly the same complaint. Although he was beginning to get a little cross he did the same thing again, apologized and reduced her bill to say sorry. Again she went away happy.

The next weekend the same thing happened yet again. This time he was a bit more assertive. His patience had worn thin and he politely told her that as his cakes clearly weren’t to her taste maybe she should think of eating elsewhere in future. For the third and final time he cancelled her bill and wished her farewell.

She came back the following weekend. This time he refused to serve her. He reminded her of the previous occasions when she had suffered cake she claimed not to like and that he’d suggested she select a different restaurant in future. She was stunned. Only when he made it clear to her that she wasn’t going to be served at his restaurant again did she understand. She’d been banned. Eventually she left, muttering and promising to wreak vengeance upon the restaurant and it’s owner for the rudeness she’d experienced.

Was he correct to do this? Had he abused her rights? Had he done something wrong?

Of course not. Don’t you agree? He was perfectly within his rights to ban her. She was clearly enjoying getting a free meal and while it was OK perhaps the first time she was now going too far. She was costing him money, time, food and peace of mind.

It’s often forgotten that service isn’t a fundamental human right. Being able to buy cake from a restaurant isn’t like the right to life, to vote or to freedom of speech. You have a right to buy things but you have no right to demand that any particular person or supplier sells you things. This lady’s right was to buy coffee and cake but she had no right to demand that a particular restaurant sell it to her, particularly given her conduct.

Of course he had to do so as courteously as possible, but he had a right to decline to serve her in future. Her right to free cake had expired.

More recently I heard of another restaurant that banned some customers. This time it wasn’t a demand for free cake, it was slightly more serious. The details aren’t entirely clear, or even that important, but a meeting over coffee (maybe caffeine is the common link?) ended up with one customer’s laptop being seized by another, a lot of subsequent shouting and one of them ending up on his back on the floor outside the restaurant. The Police were eventually involved.

The private problem that these people had with each other isn’t the issue. The issue is whether the restaurant manager was then right to do what he next did. He banned everyone involved from his restaurant, saying such behavior was unacceptable in his restaurant, he had other customers to consider as well as the interests of his staff.

This caused some outrage from the banned customers. The problem rapidly changed from fighting customers to the conduct of the manager. But surely that’s a distraction? I think the situation is perfectly simple. If you and a friend have a fight in my house I’m perfectly entitled to throw you both out and tell you never to come here again. If two of our customers come to my office and start a fight I’m within my rights to kick them out as well. I don’t see any difference with the restaurant situation. The restaurant is private property in the same way that my house and office are private property, the conduct of the customers was dangerous and threatening and I, for one, don’t want to be in a restaurant where things like this are allowed to happen, do you?

One brief update. I heard later that one of the customers was in the habit of visiting the restaurant early in the morning, ordering one coffee, sitting there occupying a four-person table and using their free wireless network to run his business for several hours without ordering anything else. That’s just rude.

I spend a lot of my time criticizing suppliers and stores but it’s not just them that can be in the wrong. Sometimes it’s customers as well who can be wrong. Some customers are unreasonable, just like some store managers can be unreasonable. Sometimes it’s the customer who’s a real jerk.

Sometimes it’s the customer who seems to be asking for trouble by demonstrating a level of naivete that is staggering. Like the person I heard of yesterday who had just given P400,000 to the Eurextrade Ponzi scheme scam. Sometime I think there are people who shouldn’t be allowed out of their house with their mother.

So I urge you to be a reasonable customer. Treat people offering you products and services with the respect they deserve and offer them the courtesy you would like them to offer you. It’s not a miracle cure but it can only make life easier for you and I guarantee you’ll get better service as a result. You might also avoid being banned.

Friday, 16 November 2012

The Voice - Consumer's Voice

Dear Consumer’s Voice #1

I bought a laptop from Game in F/town some time back in February through credit/lay bye terms. I then lost my receipt and the laptop crashed in September. I took it to them for repair on the 17th September and they told me they can’t help me if I don’t have the receipt because they are not sure the product is theirs. We argued a lot since I knew they have a copy of my details in their system.

We then agreed that they will fix it for me and I pay the charge and I agreed to that. Right now my concern is that they haven’t given me my laptop back. I gave them my serial no and asked them to check in their system and they told me they cant find anything including my credit details. I contacted the person who made the sale and he confirmed making the sale but the manager still says he can’t help mi because I don’t have proof of purchase. Please help!

I admit I was a bit confused by the mix-up this customer was in. Game took his laptop for repair but then wouldn’t return it because he didn’t have proof of purchase?

Rather than waste any time I got in touch with Game and asked them to take a look. Within moments I got an email from their Head Office in South Africa asking for more details. It turns out there had been a problem recording your details in some computer system somewhere, which is why the store was a bit confused.

This was quickly sorted out and I got the following message from the customer two days after his original complaint:

Scam update

Despite being scumbags scammers aren’t stupid. Another thing about scammers is that they evolve. Although there are still some traditional “419” or “advance fee” scams going around the scammers have moved on to other ideas. They’ve tried recruitment scams when they claim to offer you a fantastic job in a far-flung country, so long as you pay them up-front for a fee. They’ve also tried conference scams, where you’re invited to attend some exciting conference in an exotic location, all expenses paid, EXCEPT one. It’s usually the cost of a hotel room but that’s’ what the scam is ALL about. That’s the money they want.

More recently they’ve invested a lot of time in technology and run so-called “phishing” scams where they attract you to a web page that look exactly like your bank’s online banking web page.

The latest trend I’ve seen is the business complaint issue. An email arrives beginning like this one:

Please don’t be alarmed if you receive such an email, just delete it and please DO NOT open any attachments or click on any links, in emails from a strangers.

A request

Who’s given you excellent service recently? Who really WOWed you? Who deserves a pat on the back?

Please let us know when you get service that really impresses you. We’ll celebrate them here in The Voice and we’ll also celebrate them with their MD or CEO. Maybe if we all start recognizing the service stars that we know are out there excellent service might spread?

I bought a laptop from Game in F/town some time back in February through credit/lay bye terms. I then lost my receipt and the laptop crashed in September. I took it to them for repair on the 17th September and they told me they can’t help me if I don’t have the receipt because they are not sure the product is theirs. We argued a lot since I knew they have a copy of my details in their system.

We then agreed that they will fix it for me and I pay the charge and I agreed to that. Right now my concern is that they haven’t given me my laptop back. I gave them my serial no and asked them to check in their system and they told me they cant find anything including my credit details. I contacted the person who made the sale and he confirmed making the sale but the manager still says he can’t help mi because I don’t have proof of purchase. Please help!

I admit I was a bit confused by the mix-up this customer was in. Game took his laptop for repair but then wouldn’t return it because he didn’t have proof of purchase?

Rather than waste any time I got in touch with Game and asked them to take a look. Within moments I got an email from their Head Office in South Africa asking for more details. It turns out there had been a problem recording your details in some computer system somewhere, which is why the store was a bit confused.

This was quickly sorted out and I got the following message from the customer two days after his original complaint:

“I want to take this time to say thanks to the Consumer Watchdog team. It’s a good work you doing guys. I have been compensated at Game Stores and got a new laptop. Thanks again without you we consumers are nothing. Big up to you guys.”It’s very kind of you to say that. All Game needed was a gentle reminder and they fixed things swiftly, efficiently and made you a very happy man. I’m not advertising them but every time we’ve sent problems like this to them in recent years they’ve sorted things out very quickly. All a decent company needs, when they’ve slipped up, is a gentle nudge and they’ll fix it. Good for them.

Scam update

Despite being scumbags scammers aren’t stupid. Another thing about scammers is that they evolve. Although there are still some traditional “419” or “advance fee” scams going around the scammers have moved on to other ideas. They’ve tried recruitment scams when they claim to offer you a fantastic job in a far-flung country, so long as you pay them up-front for a fee. They’ve also tried conference scams, where you’re invited to attend some exciting conference in an exotic location, all expenses paid, EXCEPT one. It’s usually the cost of a hotel room but that’s’ what the scam is ALL about. That’s the money they want.

More recently they’ve invested a lot of time in technology and run so-called “phishing” scams where they attract you to a web page that look exactly like your bank’s online banking web page.

The latest trend I’ve seen is the business complaint issue. An email arrives beginning like this one:

“The Better Business Bureau has received the above-referenced complaint from one of your customers regarding their dealings with you.”In the following email, which you can imagine must seem rather alarming, there was an attachment that would have launched a piece of “malware”, which Wikipedia defines as “software used or created to disrupt computer operation, gather sensitive information, or gain access to private computer systems”.

Please don’t be alarmed if you receive such an email, just delete it and please DO NOT open any attachments or click on any links, in emails from a strangers.

A request

Who’s given you excellent service recently? Who really WOWed you? Who deserves a pat on the back?

Please let us know when you get service that really impresses you. We’ll celebrate them here in The Voice and we’ll also celebrate them with their MD or CEO. Maybe if we all start recognizing the service stars that we know are out there excellent service might spread?

Monday, 12 November 2012

Corllins "University" are thieves and liars

Corllins "University" is not a real university. It's nothing more than a web site owned by the “Organization for Global Learning Education”, a scam started by a crook called Salem Kureshi in Pakistan. He operates a number of so-called universities calling themselves Belford, Northern Port, Panworld, Headway, Ashwood, Rochville, MUST, OLWA, McFord and Corllins.

Corllins have a Facebook group that includes a number of "Tips for Online Learning success" (in slightly imperfect English) such as:

Which is curious.

Here's a picture of the students studying for a Health Care MBA at the Vanderbilt University Medical Center in the USA.

What a coincidence.

So they're photo thieves and liars as well as pedlars of fake qualifications. Are we surprised?

Corllins have a Facebook group that includes a number of "Tips for Online Learning success" (in slightly imperfect English) such as:

"Tip # 3 – Get into study routine. Plan time out of your normal routine for study and to keep your concentration up, allow time for healthy snacks and breaks.once your study schedule is right, your online course will be a breeze."They also include pictures of some of their successes. Like this one, which they say is of their "School of Medicine":

Which is curious.

Here's a picture of the students studying for a Health Care MBA at the Vanderbilt University Medical Center in the USA.

What a coincidence.

So they're photo thieves and liars as well as pedlars of fake qualifications. Are we surprised?

Friday, 9 November 2012

You hate call centers

Do you like calling a call center? Who would you rather call a bank’s call center or one of its branches? Or would you rather visit a branch in person?

More and more organisations are using call centers as their main contact point for their customers. Cellphone network providers, banks, insurance companies and parastatals have all started to make us call them rather than calling their branches and offices.

In principle there’s nothing wrong with it. In principle, a call center staffed by highly trained, knowledgeable and likeable people could deliver excellent service. In principle.

But what do consumers think about this? Has anyone ever asked them?

They have now.

We did. We hit the streets last week and asked just over 200 normal people what they thought about call centers, whether they preferred them to calling specific branches or whether they preferred to pop into a branch when they had a question.

The 200 people we questioned seemed like a fairly normal group. They were an equal mix of men and women and had an average age of just over 30. We questioned them at a major shopping center so we can assume they were the sort of people who go shopping, spend some money and travel a bit. They were just like you and me. I think their feelings were probably representative of the general population.

The 200 people we questioned seemed like a fairly normal group. They were an equal mix of men and women and had an average age of just over 30. We questioned them at a major shopping center so we can assume they were the sort of people who go shopping, spend some money and travel a bit. They were just like you and me. I think their feelings were probably representative of the general population.

20% of them thought the service they got from call centers was either good or excellent. 46% thought it was either bad or terrible. This compared to 50% who thought the service in branches was good or better, 20% who thought it was bad or terrible. You could say that the general feeling was that call centers were less than half as good as branches.

So why didn’t people like them? What was their complaint? That’s simple. It wasn’t that call center staff were discourteous or unfriendly. There were no problems with their product knowledge or ability to help. There was one reason above all others that made people dislike calling call centers.

So why didn’t people like them? What was their complaint? That’s simple. It wasn’t that call center staff were discourteous or unfriendly. There were no problems with their product knowledge or ability to help. There was one reason above all others that made people dislike calling call centers.

Speed.

65% of the people we questioned said that call centers were too slow to answer their call. 40% of them said there were times when they couldn’t get through at all.

Anyone who’s called certain call centers will know this. I once drove my kids to school and one of them called his cellphone network provider’s call center with a question. We left home at 6:20am and when I dropped him at school 45 minutes later he was still on hold. I’ve heard of people who’ve waited for more than an hour to get an answer. I called a call center last week to ask which network provider I should roam with when I’m next overseas. I called three times and eventually gave up because each time I got through and asked my question I was then cut off. I know I’m not the only person with this experience.

As a result of this I’m not surprised by the responses we got to the last question we asked. How would you prefer to speak to a supplier? By calling their call center, calling your local branch or by visiting in person?

A mere 13% said they prefer the call center. The rest were equally divided between calling or visiting a branch. I think that’s a good indication of how poorly perceived call centers are. 87% of people would rather avoid them. 43% of consumers would rather waste their time travelling to a branch, queuing in person and then, after they’ve been served, travelling back to their home or office rather than go through the struggle of waiting in an electronic queue to get an answer. That’s a poor state of affairs.

So why is it so bad? Why do people wait so long to get through, assuming that they’re not cut off beforehand? The answer is simple.

The companies you deal with are desperate to save money. Having your own call center, or hiring an external company to do it for you, is an expensive business. By far the most expensive element is staffing, the people who actually sit there answering your call and the first temptation for a company that wants to save money is to cut back on the staffing levels they have in their call center.

I know of a major company that has an outsourced call center. Within the last year they’ve cut back on the number of people answering their call center phone number by 40% in order to save costs. With fewer people to answer the phone the ones that are left must work much faster when they speak to customers and the time before being answered is going to get much, much longer. That’s exactly what’s happened. My source says that callers are now waiting longer than ever before they get an answer. Presumably a huge proportion of then don’t even make it because they’ve got lives to lead and simply give up.

There’s nothing inherently wrong with call centers. In principle they can give decent service. In principle they can be the quickest way to get the service you need. In principle they can be the very best way to keep a company’s customers informed and happy. In principle.

In practice it’s different. Some companies think they can save money by using call centers but all that really does is leave their customer unhappy, frustrated and likely to switch to the competition.

More and more organisations are using call centers as their main contact point for their customers. Cellphone network providers, banks, insurance companies and parastatals have all started to make us call them rather than calling their branches and offices.

In principle there’s nothing wrong with it. In principle, a call center staffed by highly trained, knowledgeable and likeable people could deliver excellent service. In principle.

But what do consumers think about this? Has anyone ever asked them?

They have now.

We did. We hit the streets last week and asked just over 200 normal people what they thought about call centers, whether they preferred them to calling specific branches or whether they preferred to pop into a branch when they had a question.

The 200 people we questioned seemed like a fairly normal group. They were an equal mix of men and women and had an average age of just over 30. We questioned them at a major shopping center so we can assume they were the sort of people who go shopping, spend some money and travel a bit. They were just like you and me. I think their feelings were probably representative of the general population.

The 200 people we questioned seemed like a fairly normal group. They were an equal mix of men and women and had an average age of just over 30. We questioned them at a major shopping center so we can assume they were the sort of people who go shopping, spend some money and travel a bit. They were just like you and me. I think their feelings were probably representative of the general population.20% of them thought the service they got from call centers was either good or excellent. 46% thought it was either bad or terrible. This compared to 50% who thought the service in branches was good or better, 20% who thought it was bad or terrible. You could say that the general feeling was that call centers were less than half as good as branches.

So why didn’t people like them? What was their complaint? That’s simple. It wasn’t that call center staff were discourteous or unfriendly. There were no problems with their product knowledge or ability to help. There was one reason above all others that made people dislike calling call centers.

So why didn’t people like them? What was their complaint? That’s simple. It wasn’t that call center staff were discourteous or unfriendly. There were no problems with their product knowledge or ability to help. There was one reason above all others that made people dislike calling call centers.Speed.

65% of the people we questioned said that call centers were too slow to answer their call. 40% of them said there were times when they couldn’t get through at all.

Anyone who’s called certain call centers will know this. I once drove my kids to school and one of them called his cellphone network provider’s call center with a question. We left home at 6:20am and when I dropped him at school 45 minutes later he was still on hold. I’ve heard of people who’ve waited for more than an hour to get an answer. I called a call center last week to ask which network provider I should roam with when I’m next overseas. I called three times and eventually gave up because each time I got through and asked my question I was then cut off. I know I’m not the only person with this experience.

As a result of this I’m not surprised by the responses we got to the last question we asked. How would you prefer to speak to a supplier? By calling their call center, calling your local branch or by visiting in person?

A mere 13% said they prefer the call center. The rest were equally divided between calling or visiting a branch. I think that’s a good indication of how poorly perceived call centers are. 87% of people would rather avoid them. 43% of consumers would rather waste their time travelling to a branch, queuing in person and then, after they’ve been served, travelling back to their home or office rather than go through the struggle of waiting in an electronic queue to get an answer. That’s a poor state of affairs.

So why is it so bad? Why do people wait so long to get through, assuming that they’re not cut off beforehand? The answer is simple.

The companies you deal with are desperate to save money. Having your own call center, or hiring an external company to do it for you, is an expensive business. By far the most expensive element is staffing, the people who actually sit there answering your call and the first temptation for a company that wants to save money is to cut back on the staffing levels they have in their call center.

I know of a major company that has an outsourced call center. Within the last year they’ve cut back on the number of people answering their call center phone number by 40% in order to save costs. With fewer people to answer the phone the ones that are left must work much faster when they speak to customers and the time before being answered is going to get much, much longer. That’s exactly what’s happened. My source says that callers are now waiting longer than ever before they get an answer. Presumably a huge proportion of then don’t even make it because they’ve got lives to lead and simply give up.

There’s nothing inherently wrong with call centers. In principle they can give decent service. In principle they can be the quickest way to get the service you need. In principle they can be the very best way to keep a company’s customers informed and happy. In principle.

In practice it’s different. Some companies think they can save money by using call centers but all that really does is leave their customer unhappy, frustrated and likely to switch to the competition.

The Voice - Consumer's Voice

Dear Consumer’s Voice #1

Last year I got interested in doing Bachelor of Social Work online. I met one university called Corllins University and talked to them. In the process they asked me to pay a certain fee to earn a degree through what they called Prior Learning Experience. I thought it was like our Mature Entry of the UB here. I did pay that.

Just when I thought I would be starting to study they told me that they converted my years of experience into the degree qualification and that I would be done. I became skeptical about the way they did things and was never comfortable with the process. Unfortunately I had paid. In no time they sent me the certificate written Bachelor of Social Work. I feared using this certificate.

In yet a short space of time I received another message that I should return the certificate to them to certify and authenticate it and they said that will be done by the US Department of Education. They asked for another amount.

I didn’t pay the amount, I am now asking if this is genuine or what and how can you help me find out if its not a scam?

I’m afraid you’ve been scammed. Corllins “University” is not a real university. It’s actually nothing more than a web site and an office somewhere in the Middle East that sends out fake certificates in return for cash. It has no lecturers, no buildings and no genuine accreditation.

In fact Corllins is part of a group of fake university web sites that appear to be run from Pakistan. A company called the “Organization for Global Learning Education”, started by a crook called Salem Kureshi operates a number of so-called universities calling themselves Belford, Northern Port, Panworld, Headway, Ashwood, Rochville, MUST, OLWA, McFord and Corllins. All of these are fakes.

At no point with Corllins does anyone need to sit exams, submit coursework, be assessed or do any of the things that real universities and colleges require. All you need to do is pay them and you get a fake degree. Nevertheless they sell people fake degrees in subjects like Nursing, Accounting and Education.

Unfortunately there’s not a lot you can do. You certainly can’t use this fake qualification to get a job or a promotion, that would be fraud and if you were to be discovered you’d be fired and possibly prosecuted. What you’ve bought from these crooks could get you a prison sentence if you ever used it.

Sorry I can’t be more helpful.

Dear Consumer’s Voice #2

I bought a NOKIA C7 touch screen for P3,000 on 21 December with a 12 months warranty. At the beginning of the year the phone started giving me problems as it will just freeze. When someone calls the screen goes blank and you wont know who is calling. The touch buttons will just freeze when you are typing a message. I took the phone back to them but the problem continued. There was never a month my phone would not go to them for fixing. It spent the whole of June at their shop and they kept telling me all sorts of stories.

After I collected the phone in July it worked for a week and the same problems continued. I could not take it back to them as I was out of town so last week I took the phone back to be fixed and went to collect it later on that day only to find the very same problems and applications being removed. Now I am using an incomplete phone which I bought for P3000. I told the shop owner last week about removed applications but he told me that buying a cellphone does not mean I bought the whole shop. My warranty is supposed to end on 21 December 2012, I dont know if I will still be able to use this phone with all its problems. Please I would like you to help me sort this problem out.

I think you should write them a letter listing all the problems you've had, give them all the dates and details and explain that they sold you a phone that is "not of merchantable quality as required by Section 13 (1) (a) of the Consumer Protection Regulations 2001". Make it clear that you no longer have confidence that they can repair it and that you expect an alternative solution within 7 days.

Also make it clear that you have alerted Consumer Watchdog and that we can offer them a free mention in The Voice if they don’t cooperate!

Last year I got interested in doing Bachelor of Social Work online. I met one university called Corllins University and talked to them. In the process they asked me to pay a certain fee to earn a degree through what they called Prior Learning Experience. I thought it was like our Mature Entry of the UB here. I did pay that.

Just when I thought I would be starting to study they told me that they converted my years of experience into the degree qualification and that I would be done. I became skeptical about the way they did things and was never comfortable with the process. Unfortunately I had paid. In no time they sent me the certificate written Bachelor of Social Work. I feared using this certificate.

In yet a short space of time I received another message that I should return the certificate to them to certify and authenticate it and they said that will be done by the US Department of Education. They asked for another amount.

I didn’t pay the amount, I am now asking if this is genuine or what and how can you help me find out if its not a scam?

I’m afraid you’ve been scammed. Corllins “University” is not a real university. It’s actually nothing more than a web site and an office somewhere in the Middle East that sends out fake certificates in return for cash. It has no lecturers, no buildings and no genuine accreditation.

In fact Corllins is part of a group of fake university web sites that appear to be run from Pakistan. A company called the “Organization for Global Learning Education”, started by a crook called Salem Kureshi operates a number of so-called universities calling themselves Belford, Northern Port, Panworld, Headway, Ashwood, Rochville, MUST, OLWA, McFord and Corllins. All of these are fakes.

At no point with Corllins does anyone need to sit exams, submit coursework, be assessed or do any of the things that real universities and colleges require. All you need to do is pay them and you get a fake degree. Nevertheless they sell people fake degrees in subjects like Nursing, Accounting and Education.

Unfortunately there’s not a lot you can do. You certainly can’t use this fake qualification to get a job or a promotion, that would be fraud and if you were to be discovered you’d be fired and possibly prosecuted. What you’ve bought from these crooks could get you a prison sentence if you ever used it.

Sorry I can’t be more helpful.

Dear Consumer’s Voice #2

I bought a NOKIA C7 touch screen for P3,000 on 21 December with a 12 months warranty. At the beginning of the year the phone started giving me problems as it will just freeze. When someone calls the screen goes blank and you wont know who is calling. The touch buttons will just freeze when you are typing a message. I took the phone back to them but the problem continued. There was never a month my phone would not go to them for fixing. It spent the whole of June at their shop and they kept telling me all sorts of stories.

After I collected the phone in July it worked for a week and the same problems continued. I could not take it back to them as I was out of town so last week I took the phone back to be fixed and went to collect it later on that day only to find the very same problems and applications being removed. Now I am using an incomplete phone which I bought for P3000. I told the shop owner last week about removed applications but he told me that buying a cellphone does not mean I bought the whole shop. My warranty is supposed to end on 21 December 2012, I dont know if I will still be able to use this phone with all its problems. Please I would like you to help me sort this problem out.

I think you should write them a letter listing all the problems you've had, give them all the dates and details and explain that they sold you a phone that is "not of merchantable quality as required by Section 13 (1) (a) of the Consumer Protection Regulations 2001". Make it clear that you no longer have confidence that they can repair it and that you expect an alternative solution within 7 days.

Also make it clear that you have alerted Consumer Watchdog and that we can offer them a free mention in The Voice if they don’t cooperate!

Wednesday, 7 November 2012

Has a scammer been using Google Translate?

The most awful opening email in an advance fee scam I've seen in a long time. Why don't you email "Interpol" and tell them what you think of them?

INTERNATIONAL POLICE(INTERPOL)Your attentionWe will by this message for you informed that during an investigation conducted on all scam them email is found in the list.Therefore we urge you that you have been a victim of scam like all the other and also we remind you that we are the ICPO (International Criminal Police Organization) has the largest police body, Interpol to assist law enforcement agencies in each of its 187 member countries to fight against all forms of transnational crime.Guided by four basic functions, provides high-tech Interpol's technical and operational support infrastructure to enable forces to police around the world to meet the growing challenges of crime in the 21st century.The general Secretariat has Cotonou in Benin, is operational 24 hours a day, seven days a week, providing a central point of contact for national central Bureau (NCB) in all countries to get assistance or information about cross-border investigations.All NCBs are connected to each other and the general Secretariat to I - 24 / 7, secure INTERPOL global communication system police, which also allows law enforcement officers of the law directly to check a series of vital police databases.INTERPOL has a system of color-coded international notices locate, stop or provide warnings about fugitives and other criminals. In 2009 alone, cooperation between INTERPOL member countries has led to more than 5,200 arrests around the world and this world meeting so we decided meter under arrest all the criminals on the net and your agreement and your help.It means that you must we helped a meter hand on his scam artists of very high rank.In what that you need as soon as possible put you in contact with them so that we can take them hand and getting them paid all this crime and all your money you will be reimbursed by the Government of this country or you have been scammed, and take that you are in contact with them you must keep us informed of any action and any financial actionFor not offended your marital status we of ask your agreement if possibleA faith agreement please contacts the following address:Statement to the press by the Secretary General of INTERPOL,Mr Kouton BernardEmail: interpolpolice405@yahoo.frTEL + 22998517200AGENCY INTERPOL BENIN

Saturday, 3 November 2012

Evidence

According to convincing estimates I recently read, there are at least 3 billion cellphones in the world that include cameras. In fact that figure is from a couple of years ago so the number can only be bigger by now. It’s safe to assume that at least half the world’s population own a phone with a camera.

Then there’s Botswana. In a number of ways we’re exceptional and cellphone use is no exception. A report by the World Bank published just a few months ago and reported in Mmegi showed that for every 100 people in Botswana there were 144 mobile phone subscriptions. That placed us third in the world in the cellphone use league table ahead of industrialised countries like Germany (140), the UK (130), the USA (106) and Japan (95).

Of course that doesn’t mean we’re more advanced, more economically viable or stronger, I suspect it’s more to do with our geography. All of those other countries have a history of massive investment in landlines, we don’t. With our small population and huge size, getting landlines to everyone is never going to be possible.

I don’t live far out of Gaborone but even my “landline” from BTC is actually a cellphone pretending to be a conventional phone. My home and office internet connections are both wireless. Our geography makes us a largely wireless country.

Back to those cellphones. I can’t find any figures about how many of those 144 cellphones per 100 people have cameras but let’s guess it’s a half? I reckon that suggests a million cameras in consumer’s pockets every day of the week.

Do you have any idea how powerful that makes us?

Those cameras give consumers a remarkable strength. Evidence.

How many of us have been in situations when we wish we could prove something from the past? That our car DIDN’T have that dent before we gave it to the garage? That the cellphone WASN”T scratched before the company took it for repairs? That you COULD remember the serial number of the stolen computer?

Last week we got an email from a frustrated consumer who had bought a fancy LCD screen from a local store in 2010. Later that year his house was burgled and the screen was stolen. The police advised him to check his local police stations regularly to see if the screen appeared and luckily some time later he found a screen exactly the same as his in a collection of recovered property. All the police needed to allow him to take the screen home was proof that this particular screen was his. Could he provide a record of the serial number from when he bought it?

No, he couldn’t. He went back to the store but they couldn’t help him either. The irony is that he was disadvantaged by buying the screen for cash. The store only kept serial numbers of items that had been bought on credit, their insurance policy demanded that. They’ve since changed their system and now record serial numbers on all customer receipts but our reader was one of the unlucky ones who bought before the store changed their system.

However even if he had kept his receipt that might not have helped. We’ve heard from a number of readers who keep all their receipts unfailingly but when they need to retrieve one a couple of years later they find that the receipt has completely faded and no trace of the text can be seen. This is because more and more stores are using thermal printers at their points of sale. While these printers are quicker, cheaper and more convenient the receipts they produce aren’t permanent.

However even if he had kept his receipt that might not have helped. We’ve heard from a number of readers who keep all their receipts unfailingly but when they need to retrieve one a couple of years later they find that the receipt has completely faded and no trace of the text can be seen. This is because more and more stores are using thermal printers at their points of sale. While these printers are quicker, cheaper and more convenient the receipts they produce aren’t permanent.

Is this an evil conspiracy by retailers to deprive us of our rights? No. it’s just a cock-up but it does leave you and me in an awkward situation, not being able to provide proof of purchase when needed. The answer is your cellphone.

We need to start taking pictures of everything. Take pictures of receipts before they fade. Take pictures of the serial number on the box. Take pictures of ANY problems you see with things you buy. DO it immediately, don’t wait.

We need to start taking pictures of everything. Take pictures of receipts before they fade. Take pictures of the serial number on the box. Take pictures of ANY problems you see with things you buy. DO it immediately, don’t wait.

Just as importantly take pictures of anything you think might be useful. Before you take your car for a service take a few snaps of it’s condition. Before you leave your rented house or office for the last time take some pictures to prove that it was in a good condition. When you move into a new rented property take pictures on the very first day of any problems, cracked windows, missing door handles, dangerous electrical sockets. Whenever you’re involved in an accident take pictures of everything, most importantly the registration numbers of other vehicles involved, any damage caused to your or other vehicles and, if you can do it discreetly, all the drivers and passengers involved.

Of course all of this is useless if you then lose your phone. I don’t know of any cellphone with a camera that doesn’t allow you to transfer pictures to a computer as a backup. Make sure you do this as often as possible. If you don’t have a computer yourself, find a friend who does and buy them lunch to thank them for lending you some disc space.

These days there’s no excuse for not doing this. I bet everyone reading this newspaper has a cellphone with a camera built in, why not use it to protect your consumer rights as well as taking pictures of your kids, partner and whatever naughtiness you’re getting up to?

Then there’s Botswana. In a number of ways we’re exceptional and cellphone use is no exception. A report by the World Bank published just a few months ago and reported in Mmegi showed that for every 100 people in Botswana there were 144 mobile phone subscriptions. That placed us third in the world in the cellphone use league table ahead of industrialised countries like Germany (140), the UK (130), the USA (106) and Japan (95).

Of course that doesn’t mean we’re more advanced, more economically viable or stronger, I suspect it’s more to do with our geography. All of those other countries have a history of massive investment in landlines, we don’t. With our small population and huge size, getting landlines to everyone is never going to be possible.

I don’t live far out of Gaborone but even my “landline” from BTC is actually a cellphone pretending to be a conventional phone. My home and office internet connections are both wireless. Our geography makes us a largely wireless country.

Back to those cellphones. I can’t find any figures about how many of those 144 cellphones per 100 people have cameras but let’s guess it’s a half? I reckon that suggests a million cameras in consumer’s pockets every day of the week.

Do you have any idea how powerful that makes us?

Those cameras give consumers a remarkable strength. Evidence.

How many of us have been in situations when we wish we could prove something from the past? That our car DIDN’T have that dent before we gave it to the garage? That the cellphone WASN”T scratched before the company took it for repairs? That you COULD remember the serial number of the stolen computer?

Last week we got an email from a frustrated consumer who had bought a fancy LCD screen from a local store in 2010. Later that year his house was burgled and the screen was stolen. The police advised him to check his local police stations regularly to see if the screen appeared and luckily some time later he found a screen exactly the same as his in a collection of recovered property. All the police needed to allow him to take the screen home was proof that this particular screen was his. Could he provide a record of the serial number from when he bought it?

No, he couldn’t. He went back to the store but they couldn’t help him either. The irony is that he was disadvantaged by buying the screen for cash. The store only kept serial numbers of items that had been bought on credit, their insurance policy demanded that. They’ve since changed their system and now record serial numbers on all customer receipts but our reader was one of the unlucky ones who bought before the store changed their system.

However even if he had kept his receipt that might not have helped. We’ve heard from a number of readers who keep all their receipts unfailingly but when they need to retrieve one a couple of years later they find that the receipt has completely faded and no trace of the text can be seen. This is because more and more stores are using thermal printers at their points of sale. While these printers are quicker, cheaper and more convenient the receipts they produce aren’t permanent.

However even if he had kept his receipt that might not have helped. We’ve heard from a number of readers who keep all their receipts unfailingly but when they need to retrieve one a couple of years later they find that the receipt has completely faded and no trace of the text can be seen. This is because more and more stores are using thermal printers at their points of sale. While these printers are quicker, cheaper and more convenient the receipts they produce aren’t permanent.Is this an evil conspiracy by retailers to deprive us of our rights? No. it’s just a cock-up but it does leave you and me in an awkward situation, not being able to provide proof of purchase when needed. The answer is your cellphone.

We need to start taking pictures of everything. Take pictures of receipts before they fade. Take pictures of the serial number on the box. Take pictures of ANY problems you see with things you buy. DO it immediately, don’t wait.

We need to start taking pictures of everything. Take pictures of receipts before they fade. Take pictures of the serial number on the box. Take pictures of ANY problems you see with things you buy. DO it immediately, don’t wait.Just as importantly take pictures of anything you think might be useful. Before you take your car for a service take a few snaps of it’s condition. Before you leave your rented house or office for the last time take some pictures to prove that it was in a good condition. When you move into a new rented property take pictures on the very first day of any problems, cracked windows, missing door handles, dangerous electrical sockets. Whenever you’re involved in an accident take pictures of everything, most importantly the registration numbers of other vehicles involved, any damage caused to your or other vehicles and, if you can do it discreetly, all the drivers and passengers involved.

Of course all of this is useless if you then lose your phone. I don’t know of any cellphone with a camera that doesn’t allow you to transfer pictures to a computer as a backup. Make sure you do this as often as possible. If you don’t have a computer yourself, find a friend who does and buy them lunch to thank them for lending you some disc space.

These days there’s no excuse for not doing this. I bet everyone reading this newspaper has a cellphone with a camera built in, why not use it to protect your consumer rights as well as taking pictures of your kids, partner and whatever naughtiness you’re getting up to?

The Voice - Consumer's Voice

Dear Consumer’s Voice #1

I purchased an LCD screen from a store for cash in 2010 and it got stolen the same year. I reported the matter to the police. I was advised to make periodic checks at any police station for recovered stolen goods and during my checks some time last year I found a set exactly like mine and the police requested me to bring my receipts together with my delivery invoices which I did.

Upon presenting these documents to the police we found that the receipts did not have the serial number on them this resulted in me not being able to lay claim to the set. I would like some professional advice on how I can make them take responsibility for that error on their part.

My question is can I get legal recourse or how do you advise me?

Firstly I don’t think legal action is anything you should consider in this situation. I can’t see that the store is in any way responsible for your misfortune. Yes, in an ideal world they would be able to supply you with the serial number but I can understand that they might not be able to.

I contacted the store and asked for their response to your situation. Ironically the problem is made worse because you bought the screen for cash. If you’d bought it on credit they would have kept the serial number in their records as part of the product insurance scheme they make you take out. Cash sales don’t offer that “insurance” (which is largely for their benefit, not yours). Since 2011 they’ve been keeping the serial numbers for cash sales as well but not in 2010 when you bought your screen.

I can understand your frustration but I can’t see how it’s the store’s fault. Do you have any other records of the purchase? Did you keep the original packaging? I’m certain that, like the rest of us, you don’t keep all the boxes for every purchase but it IS worth cutting out and keeping the bits that show the serial numbers. It’s also worth taking pictures with your phone of the serial numbers in case they get lost.

It might be worth going back to the Police and explaining your predicament and seeing if there is another creative solution to your problem? Sorry I can’t be of more help.

Dear Consumer’s Voice #2

I opened an account at a store in 2008 but before the end of the year I was retrenched because of recession. The store told me to bring the retrenchment letter, notification of possible retrenchment, ID, and Account Card so that my account can be closed. In 2009 the store told me that they misplaced my documents and asked me to bring them again.

In 2010 they asked me to submit the same particulars again because they did not have them which I did

A few months later I got a call to say I should come and claim some money but because I wasn’t working I did not go.

When I lost my job my account had P1,200 as balance but recently when I wanted to open an account I was told I have a pending credit of more than P2,000 with them. The store manager told me that there is nothing he can do to help me.

With your experience on such issues what do you think I should do?

I think you should start shouting and screaming at them. OK, maybe not. Write a letter to the store manager demanding a full statement of your account from the time of your retrenchment to today. You should remind them that they have twice lost your documents and that you are extremely disappointed with the level of service you’ve received from them. You might want to point out to them that they are required by Section 15 (1) (a) of the Consumer Protection Regulations to deliver services “with reasonable care and skill”. They have clearly failed to do so.

I suggest you give them 7 days to sort things out or you’ll take whatever measures you feel are appropriate.

Let me know how they respond?

I purchased an LCD screen from a store for cash in 2010 and it got stolen the same year. I reported the matter to the police. I was advised to make periodic checks at any police station for recovered stolen goods and during my checks some time last year I found a set exactly like mine and the police requested me to bring my receipts together with my delivery invoices which I did.

Upon presenting these documents to the police we found that the receipts did not have the serial number on them this resulted in me not being able to lay claim to the set. I would like some professional advice on how I can make them take responsibility for that error on their part.

My question is can I get legal recourse or how do you advise me?

Firstly I don’t think legal action is anything you should consider in this situation. I can’t see that the store is in any way responsible for your misfortune. Yes, in an ideal world they would be able to supply you with the serial number but I can understand that they might not be able to.

I contacted the store and asked for their response to your situation. Ironically the problem is made worse because you bought the screen for cash. If you’d bought it on credit they would have kept the serial number in their records as part of the product insurance scheme they make you take out. Cash sales don’t offer that “insurance” (which is largely for their benefit, not yours). Since 2011 they’ve been keeping the serial numbers for cash sales as well but not in 2010 when you bought your screen.

I can understand your frustration but I can’t see how it’s the store’s fault. Do you have any other records of the purchase? Did you keep the original packaging? I’m certain that, like the rest of us, you don’t keep all the boxes for every purchase but it IS worth cutting out and keeping the bits that show the serial numbers. It’s also worth taking pictures with your phone of the serial numbers in case they get lost.

It might be worth going back to the Police and explaining your predicament and seeing if there is another creative solution to your problem? Sorry I can’t be of more help.

Dear Consumer’s Voice #2

I opened an account at a store in 2008 but before the end of the year I was retrenched because of recession. The store told me to bring the retrenchment letter, notification of possible retrenchment, ID, and Account Card so that my account can be closed. In 2009 the store told me that they misplaced my documents and asked me to bring them again.

In 2010 they asked me to submit the same particulars again because they did not have them which I did

A few months later I got a call to say I should come and claim some money but because I wasn’t working I did not go.

When I lost my job my account had P1,200 as balance but recently when I wanted to open an account I was told I have a pending credit of more than P2,000 with them. The store manager told me that there is nothing he can do to help me.

With your experience on such issues what do you think I should do?